During bull markets, everyone tends to flock to cryptocurrencies, as everything they purchase seems to rise, convincing them of their investment prowess. This herd mentality is driven by the visible gains of others or the revelations of one’s own profits, further fueling FOMO (Fear of Missing Out). However, this did not occur with cryptocurrencies in 2025, although they have not yet hit rock bottom.

var litespeed_vary=document.cookie.replace(/(?:(?:^|.*;\s*)_lscache_vary\s*\=\s*([^;]*).*$)|^.*$/,"");litespeed_vary||fetch("/wp-content/plugins/litespeed-cache/guest.vary.php",{method:"POST",cache:"no-cache",redirect:"follow"}).then(e=>e.json()).then(e=>{console.log(e),e.hasOwnProperty("reload")&&"yes"==e.reload&&(sessionStorage.setItem("litespeed_docref",document.referrer),window.location.reload(!0))});Cryptocurrencies Haven’t Hit Rock Bottom

Santiment is one of the largest on-chain data sources for cryptocurrencies, and its founder Maksim Balashevich is considered a leading authority on understanding and interpreting cycle data. According to him, cryptocurrencies have not seen their lowest point, meaning investors must prepare for the worst.

Maksim Balashevich mentioned in a recent broadcast that the market has not yet hit bottom, as the level of fear among investors is insufficient. For this scenario to change, Bitcoin (BTC)

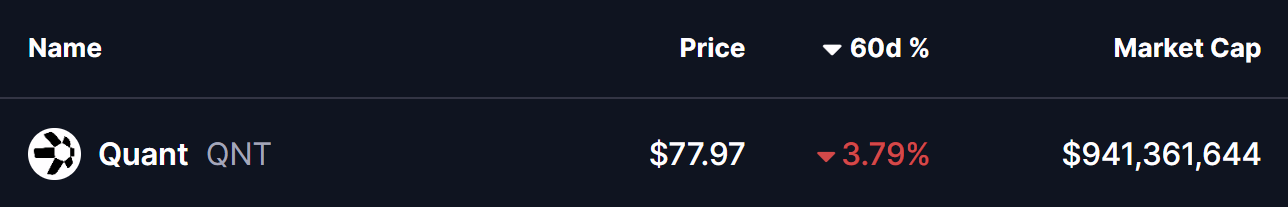

Balashevich views the drop to his target level as a “great opportunity” for investors, a possibility supported by events in January. Numerous adverse developments may pressure cryptocurrencies, accelerating sales that push BTC towards $75,000 amid heated debates around MNAV in cryptocurrency reserve companies.

Cryptocurrency Predictions for 2026

Maksim Balashevich remains hopeful for 2026, anticipating prices reaching $76,000. Conversely, Jurrien Timmer of Fidelity believes more is achievable, describing the coming year as a consolidation period. Timmer expects the price to potentially dip to $65,000, although significant inflation spikes might invalidate this view, as the Fed could hasten interest rate cuts, especially with Powell’s departure in May.

Bitwise’s Chief Investment Officer Matt Hougan is optimistic about 2026, predicting a year of growth, contrary to Timmer’s outlook. Historical data, however, forecasts a downturn for 2026, but if BTC stays above $88,000, as seen now, it may reinforce the current optimism. BTC has yet to establish deeper lows, and with aggressive selling in anticipation of the downturn in the last three months, investors remain on edge, expecting a crash.