Metaplanet Inc. offers ADRs on U.S. OTC market increasing investor access to Bitcoin-backed equity.

Metaplanet Inc., a Japanese Bitcoin treasury company, launched its sponsored Level I ADR program for U.S. OTC trading, allowing U.S. investors USD-denominated access to its Bitcoin-backed equity under ticker MPJPY.

The ADR launch may enhance Metaplanet’s reach to U.S. investors, boosting Bitcoin treasury strategies and potentially influencing BTC-related trading sentiment in traditional equity markets.

Metaplanet Inc., a Japan-based Bitcoin treasury company, has begun trading its American Depositary Receipts (ADRs) in the U.S. Over-the-Counter (OTC) market under the ticker MPJPY. This offers U.S. investors USD-denominated exposure to the firm.

The ADR program, sponsored and managed by Deutsche Bank, aims to provide wider access to Metaplanet’s Bitcoin-backed equity. The initiative underscores a strategic expansion into U.S. markets, facilitating USD investments into the company.

The launch of ADRs is expected to broaden Metaplanet’s investor base by attracting capital from U.S. institutions and individuals. This strategic move by Metaplanet aligns with its core business model of accumulating Bitcoin as a treasury reserve.

The introduction of this ADR program delivers an opportunity for American investors to engage with a company primarily focused on Bitcoin acquisition. This could lead to increased market interest and investments in Metaplanet’s equity.

Analysts suggest that Metaplanet’s approach mirrors trends seen in other Bitcoin-treasury public companies. The firm’s consistent accumulation of Bitcoin through equity markets potentially provides investors with a regulated proxy for Bitcoin exposure.

If Metaplanet’s Bitcoin-focused strategy succeeds in the U.S. markets, it could influence other non-U.S. companies to pursue similar ADR listings. Such strategic expansions are watched closely for their potential impacts on global cryptocurrency investment dynamics. As noted in a Business Wire release, “Metaplanet Inc. (OTC: MPJPY) is a Japanese Bitcoin treasury company that leverages Bitcoin as its core treasury reserve asset, employing capital market strategies to accumulate BTC through equity and fixed income offerings while building complementary Bitcoin-focused business lines.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

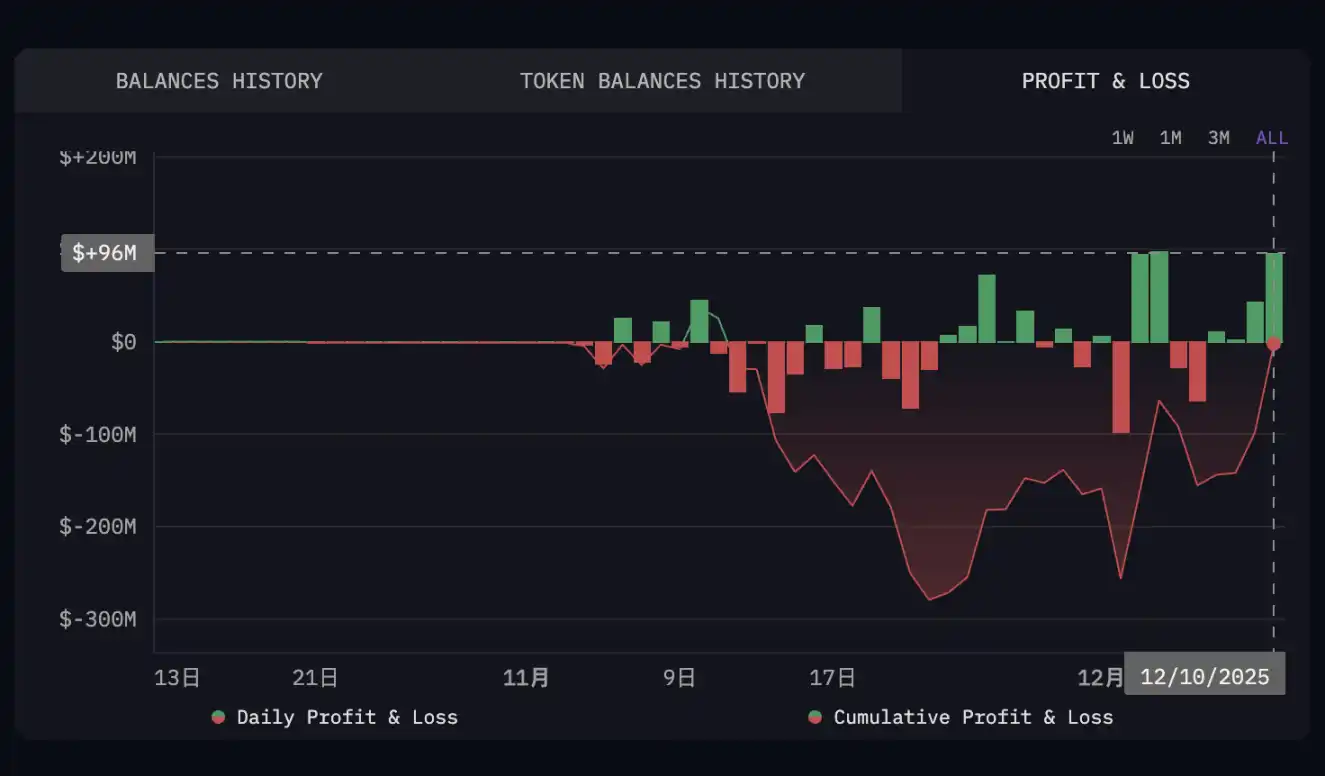

The 2025 Whale Tragedy: Mansion Kidnappings, Supply Chain Poisoning, and Hundreds of Millions Liquidated

Tether Data Expands QVAC Genesis II To 148 Billion AI Tokens

One year into the Trump administration: Transformations in the U.S. crypto industry

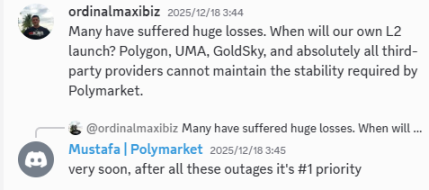

Polymarket coming of age: Farewell, Polygon