- Crypto staking may face unfair double taxation under IRS rules.

- Lawmakers demand tax clarity before 2026 regulations begin.

- Bipartisan pressure builds for crypto tax reform.

A group of U.S. lawmakers, led by Representative Mike Carey, is urging the IRS to revise its guidance on crypto staking taxation. The lawmakers are concerned about a possible “double taxation” scenario, where crypto holders might be taxed both when they receive staking rewards and again when they sell them.

Staking allows cryptocurrency holders to lock up their assets in blockchain networks in exchange for rewards. However, the current IRS stance may treat these rewards as immediate income—leading to confusion and financial setbacks for everyday crypto users.

Lawmakers Want Action Before 2026

The push for clarity comes ahead of major crypto tax reporting changes set to roll out in 2026, under the Infrastructure Investment and Jobs Act. Lawmakers argue that without updates to crypto staking tax rules, these changes could harm innovation and adoption.

Representative Carey stressed that treating staking rewards as taxable income upon receipt is unfair and inconsistent with how other forms of property are taxed. The letter to the IRS shows bipartisan concern, with lawmakers asking the agency to issue clear and fair guidance before these new rules are enforced.

The Call for Crypto Tax Reform Grows

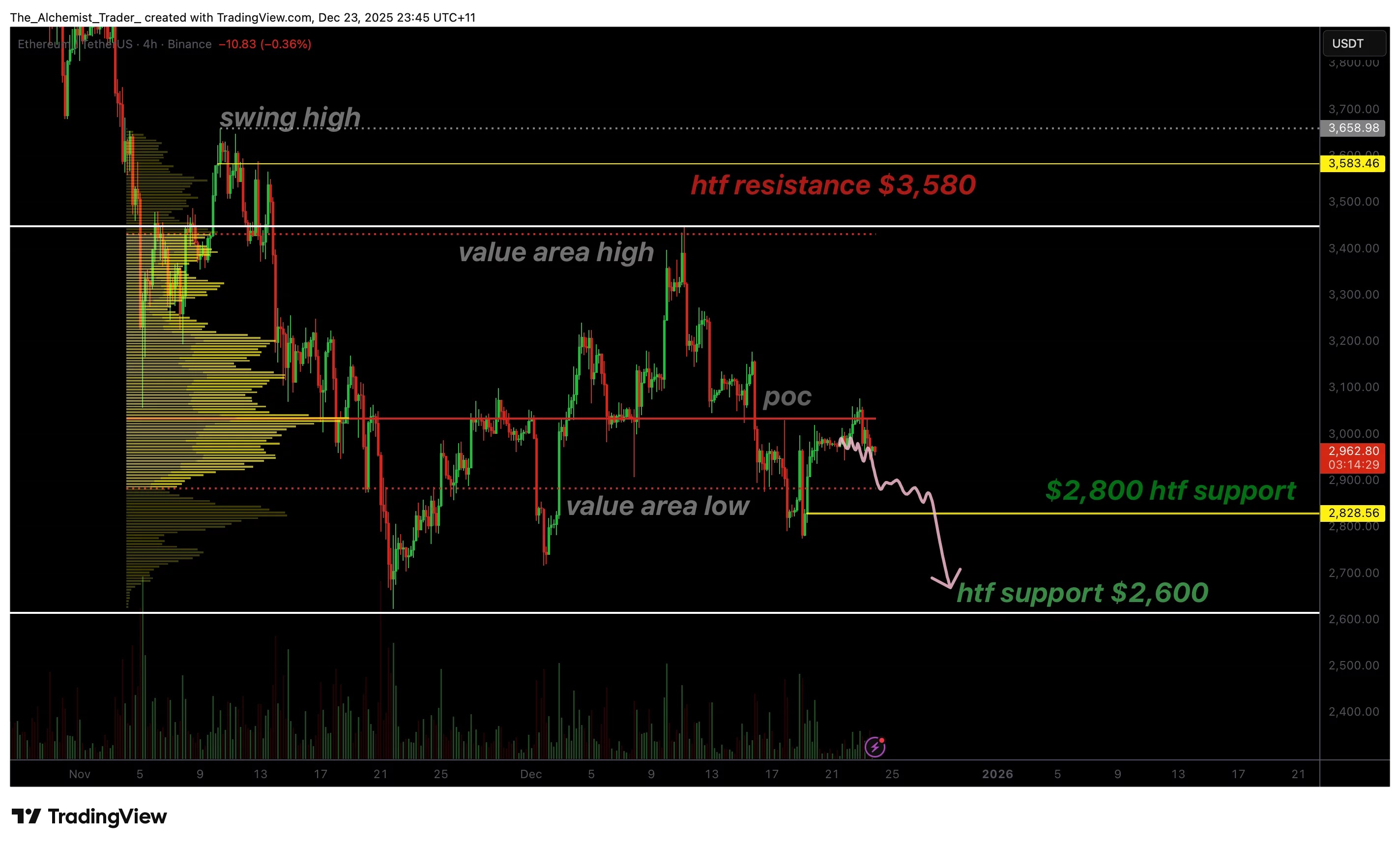

The crypto industry has long called for clear taxation policies, especially as networks like Ethereum adopt proof-of-stake models. Many advocates believe staking rewards should only be taxed when sold, not when earned, aligning with how other assets like stocks or property are handled.

Without reform, the U.S. risks pushing crypto innovation offshore. Lawmakers and industry leaders agree that a modern, fair tax framework is essential to keep the country competitive in the evolving world of digital finance.

Read Also :

- Bitmine Immersion (BMNR) Announces ETH Holdings Reach 4.066 Million Tokens, and Total Crypto and Total Cash Holdings of $13.2 Billion

- Ghana Legalizes Crypto With New VASP Bill

- Crypto Funds See $952M Exit in Weekly Outflows

- Bitcoin Network Activity Slows, Signaling Accumulation

- US Lawmakers Push IRS to Fix Crypto Staking Tax Rules