Macro uncertainty is accelerating safe-haven demand as gold and Bitcoin [BTC] compete for investor attention.

Gold recorded a fresh all-time high above $4,420 per ounce on the 22nd of December 2025. The move reflected persistent inflation concerns, geopolitical risks, and renewed central bank demand.

Gold’s performance reinforced its status as a traditional haven during periods of macro stress.

BTC sentiment strengthened alongside gold’s rally, reviving comparisons between the two assets. Investors again questioned whether BTC could benefit from gold-driven capital reallocation.

Kazakhstan’s reserve strategy adds fuel to the narrative

Attention intensified after reports claimed Kazakhstan planned to sell part of its gold reserves. The country reportedly aimed to allocate up to $300 million into BTC and crypto assets.

Source: X

Is Kazakhstan planning to sell gold at ATHs to buy the Bitcoin dip? If confirmed, such a move would reflect opportunistic reserve management, rather than defensive positioning, by reallocating from an outperforming asset into one trading below recent highs.

Sentiment shifts as Bitcoin dominates long-term preference

Public sentiment indicators added another dimension to the discussion.

Peter Schiff, a longtime gold advocate, has often described Bitcoin as purely speculative. To reinforce his view, he recently shared a poll.

The poll asked participants how they would invest $100,000 by the 19th of December 2028. The choices were simple: Bitcoin, gold, or silver as a single long‑term holding.

Source: X

Bitcoin led the poll with 62.4% of responses, indicating stronger long-term investor preference compared to gold and silver. The result highlighted a clear tilt in sentiment toward BTC as a long-term allocation.

What does historical data say about gold-to-Bitcoin rotation?

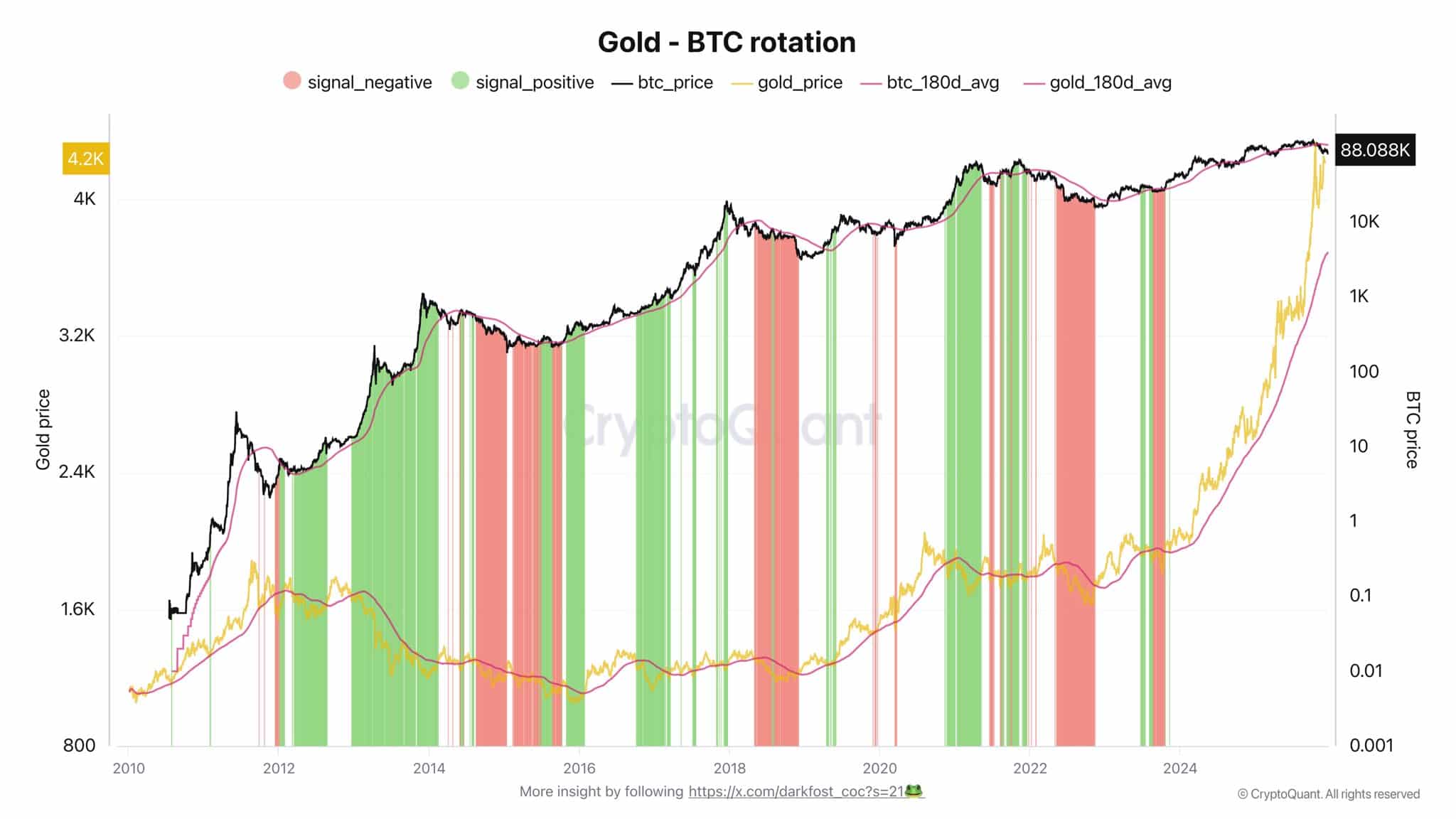

Analyst Darkfost argued that the gold-to-Bitcoin rotation narrative lacks consistent historical backing.

At the time of gold’s breakout on the 22nd of December 2025, BTC was trading around $88,000. Using a 180-day moving average framework, he showed that Bitcoin’s strength did not reliably follow gold peaks.

Source: CryptoQuant

Positive signals appeared when BTC traded above its 180-day average, while gold traded below. Negative signals occurred when both assets traded below their respective averages.

However, the results varied widely across cycles. BTC sometimes outperformed after gold rallies, but in many cases, both assets moved together. Darkfost’s message was clear: gold making new highs does not automatically trigger capital rotation into Bitcoin.

Final Thoughts

- Gold’s ATH revived Bitcoin rotation narratives, but historical evidence remained mixed and context-dependent.

- Sentiment and sovereign signals increased, yet consistent capital rotation into Bitcoin remained unproven.