BlackRock Names Bitcoin the Top Investment Theme of 2025, Elevating Bitcoin to Digital Gold in Core Portfolios

In New York on December 22, 2025, BlackRock—the world’s largest asset manager—publicly framed Bitcoin as a leading investment theme for the year. The head of the iShares division outlined a framework that positions Bitcoin alongside U.S. Treasury bonds and the Tech Big Seven as three pillars of a modern, diversified portfolio. The move signals a substantive shift from tentative forays toward integrating digital assets into macroeconomic strategy and global asset allocation.

Macro-mirror thesis centers on a Bitcoin performance that increasingly mirrors concerns about sovereign debt and currency devaluation. By labeling Bitcoin as digital gold within a global macro framework, the firm aims to provide institutional readers with a rationale for substantial exposure beyond traditional banking. Analysts anticipate 2026 will bring yield-generating instruments, such as Bitcoin premium-income ETFs using covered-call strategies, shifting the discussion from ‘why hold Bitcoin’ to ‘how to optimize Bitcoin exposure’ for risk-managed portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump: Tariffs Have Led to Great Economic Numbers for the US, Situation Will Only Get Better

Gnosis Chain to Hard Fork and Recover $120M Lost in Balancer Hack

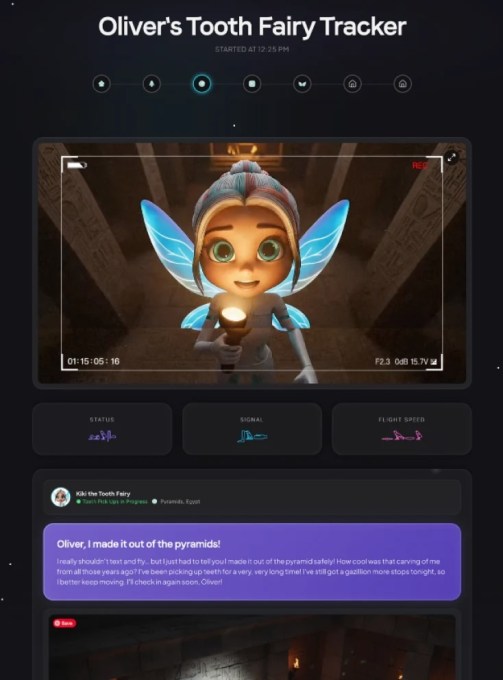

The tooth fairy just got reimagined for the tech-savvy generation