VanEck Sees Weak On-Chain Activity but Improving Liquidity Amid Bitcoin Selloff

Quick Breakdown

- VanEck reports declining Bitcoin on-chain activity alongside rising volatility and reduced speculative leverage.

- Corporate treasuries added about 42,000 BTC, offsetting outflows from Bitcoin ETPs.

- Miner capitulation and long-term holder conviction signal potential market stabilisation.

VanEck has flagged a weakening of on-chain activity across the Bitcoin network, even as liquidity conditions improve and speculative excesses unwind, pointing to early signs of stabilisation beneath December’s market selloff. In its Mid-December 2025 Bitcoin ChainCheck, the asset manager said structural indicators suggest the market is undergoing a healthy reset rather than entering a prolonged downturn.

VanEck said in a latest report that Bitcoin miner “capitulation” could signal a potential near-term price bottom. Data shows Bitcoin hashrate fell 4% over the past month as of Dec. 15, marking the largest one-month decline since April 2024. VanEck noted that since 2014, when…

— Wu Blockchain (@WuBlockchain) December 23, 2025

On-Chain activity softens as volatility rises

Bitcoin declined about 9% over the past 30 days, with realised volatility climbing above 45%, its highest level since April 2025, according to VanEck. The pullback coincided with a sharp cooling in speculative positioning. Perpetual futures basis rates dropped to lows near 3.7% annualised, well below the 2025 average, signalling reduced leverage and risk appetite.

On-chain metrics echoed the slowdown. Network hash rate, transaction fees, and new address growth all posted month-on-month declines, reflecting softer usage and miner stress during the period. VanEck noted that selling pressure was concentrated among medium-term holders, with balances held by investors aged one to five years falling noticeably. By contrast, long-term holders, those with Bitcoin dormant for more than five years, remained largely inactive, reinforcing the view that core conviction remains intact.

Corporate accumulation counters ETP outflows

Despite outflows from exchange-traded products, corporate buyers emerged as a key source of demand. VanEck said digital asset treasuries accumulated roughly 42,000 BTC over the past month, the largest corporate buying spree since July 2025, lifting total corporate holdings to approximately 1.09 million BTC.

Meanwhile, Bitcoin ETP holdings declined by about 120 basis points month-on-month, underscoring a growing divergence between balance-sheet-driven accumulation and market-based investment flows. VanEck also highlighted miner capitulation as a potential contrarian indicator, noting that the network hash rate fell 4% over 30 days, the steepest drop since April 2024, a pattern historically associated with improved forward returns.

The analysis comes as VanEck continues to expand its digital asset footprint, including the recent launch of a Solana-linked ETF, reflecting sustained institutional interest even as near-term Bitcoin signals remain mixed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Stalls Below $90K as Traders Eye $86K Support, Says Michaël van de Poppe

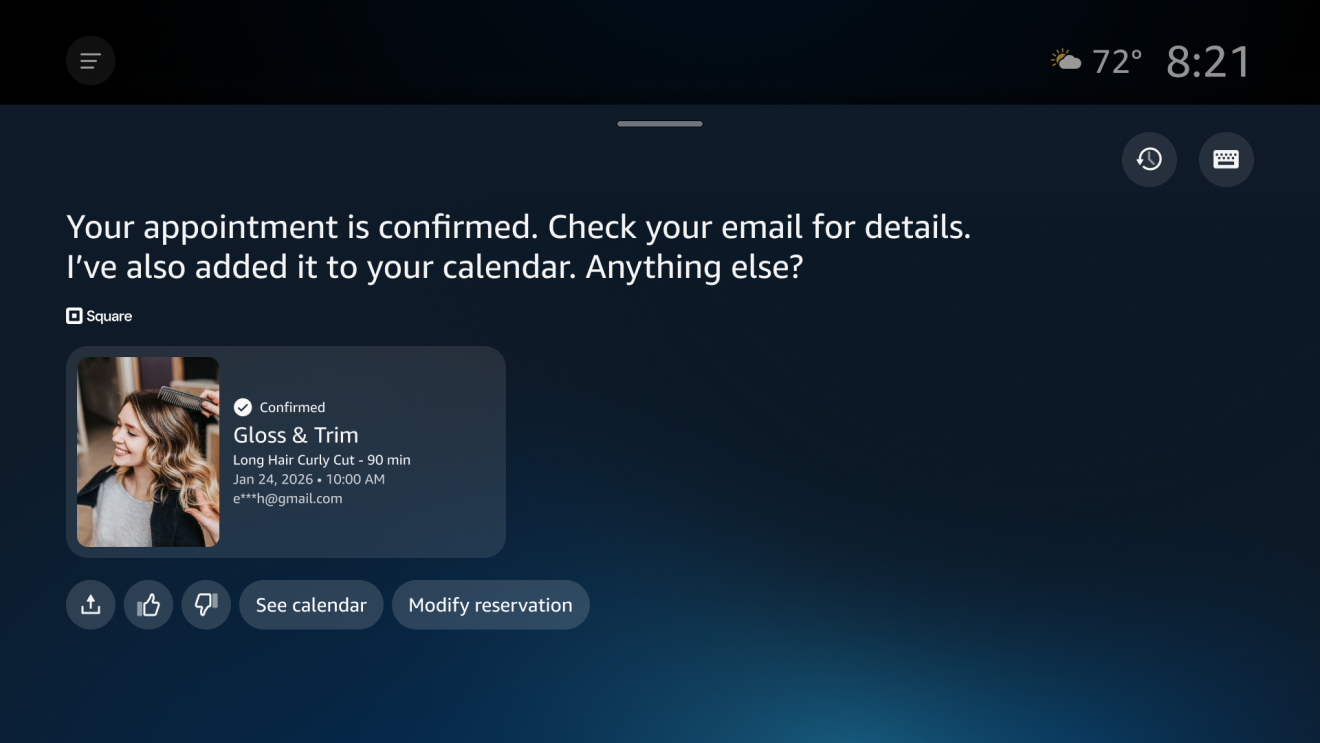

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

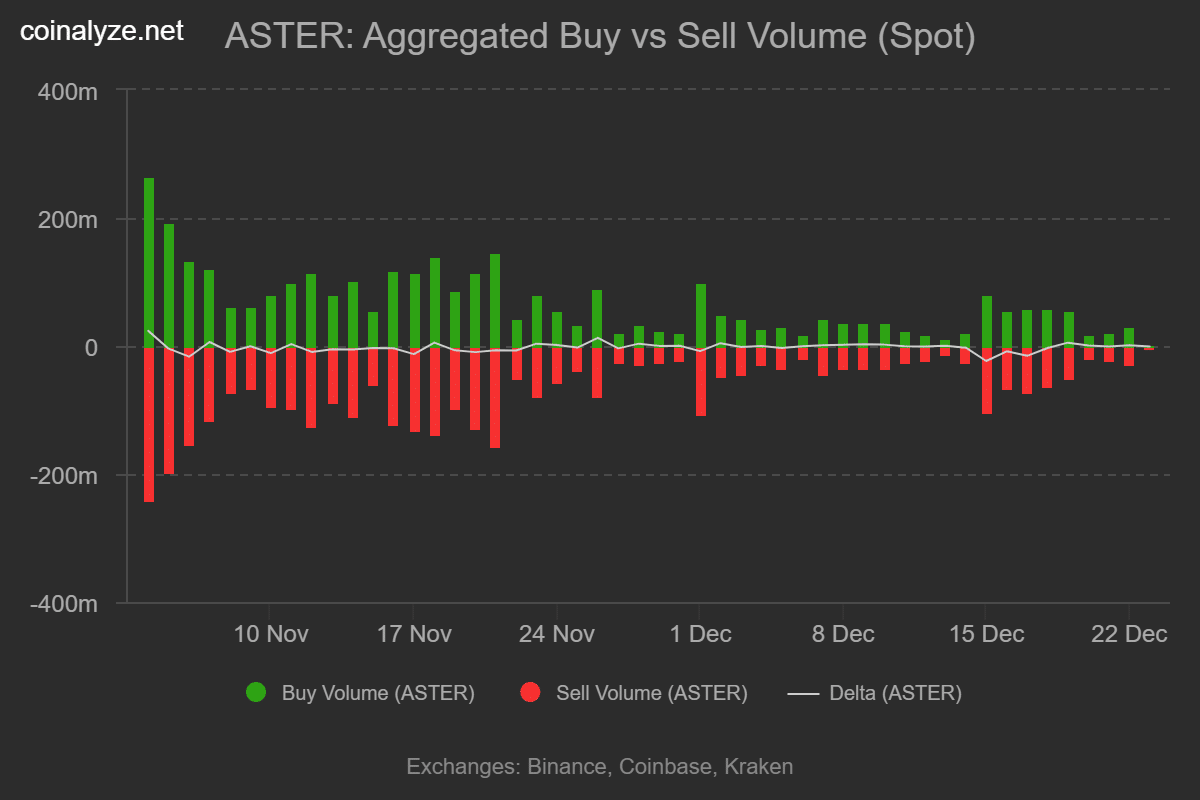

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share