NFT sales show minor drop to $65.5M, Ethereum sales plunge 24%

According to CryptoSlam data, NFT sales volume has edged down by 0.47% to $65.58 million, essentially flat from last week’s $67.76 million.

- NFT sales stayed flat at $65.6M, but buyers and sellers jumped over 24%.

- DMarket reclaimed first place as Bitcoin BRC-20 NFTs surged over 300%.

- Bitcoin NFT volume rose sharply while Ethereum and Solana sales declined.

Market participation has continued its strong rebound, with NFT buyers climbing by 26.31% to 292,030 and sellers rising by 24.44% to 205,205. NFT transactions remained nearly unchanged, down just 0.95% to 869,747.

DMarket reclaims top spot with Bitcoin BRC-20 surge

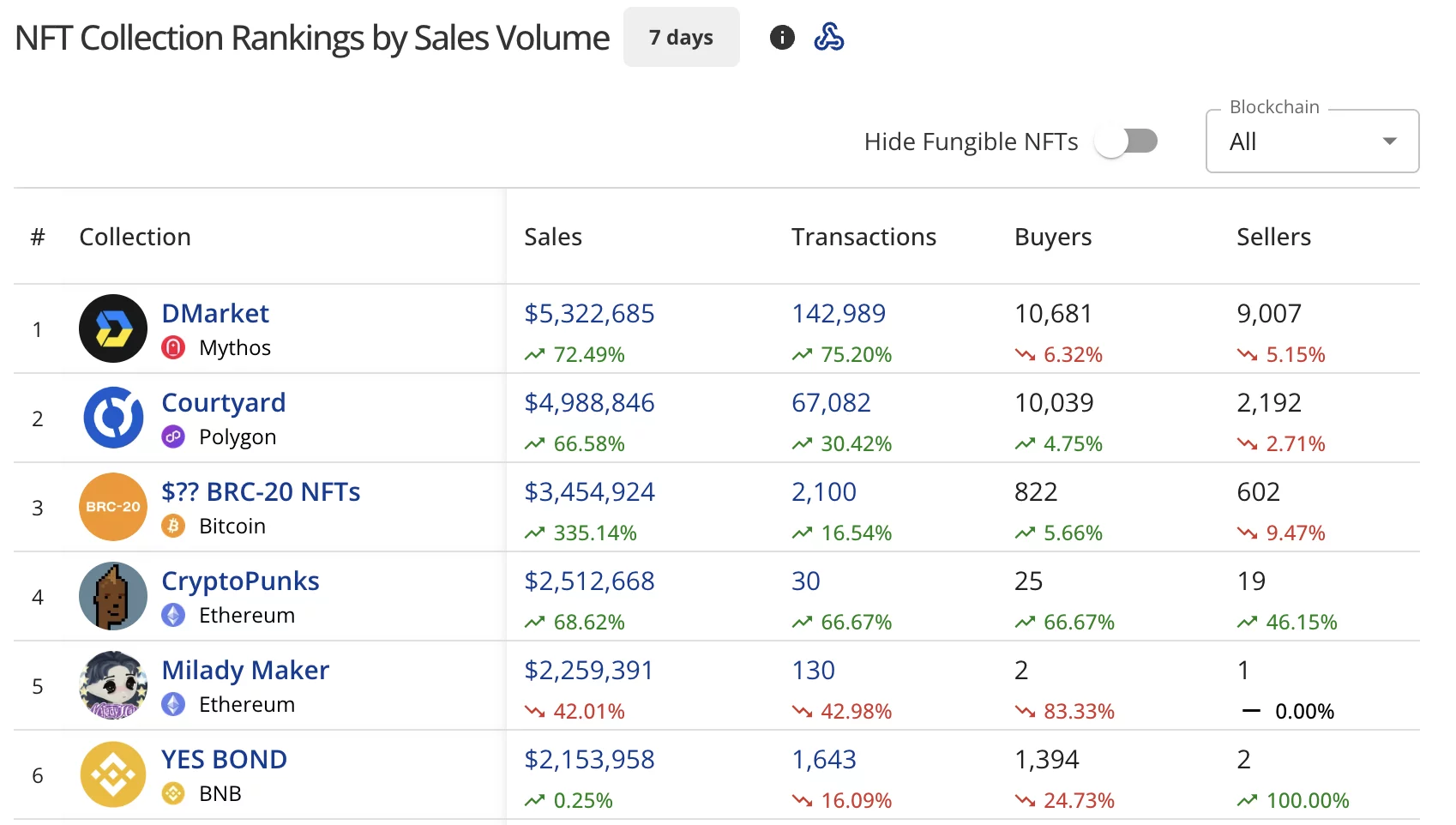

DMarket on the Mythos blockchain has reclaimed first place with $5.32 million in sales, surging 72.49% from last week’s $3.09 million. The collection processed 142,989 transactions with 10,681 buyers and 9,007 sellers.

Courtyard on Polygon (POL) held second position at $4.99 million, up 66.58% from last week’s $2.97 million. The collection recorded 67,082 transactions with 10,039 buyers and 2,192 sellers.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

$?? BRC-20 NFTs on Bitcoin (BTC) exploded into third place with $3.45 million, posting a massive 335.14% surge.

The collection saw 2,100 transactions with 822 buyers and 602 sellers, highlighting Bitcoin NFT momentum.

CryptoPunks jumped to fourth with $2.51 million, up 68.62% from last week’s $1.77 million. The Ethereum (ETH) collection had 30 transactions with 25 buyers and 19 sellers.

Milady Maker dropped to fifth at $2.26 million, plummeting 42.01% from last week’s $3.68 million. The collection saw 130 transactions with just 2 buyers and 1 seller.

YES BOND on BNB held sixth place at $2.15 million, posting minimal growth at 0.25% from last week’s $2.12 million. The collection recorded 1,643 transactions.

Bitcoin surges as Ethereum and Solana decline

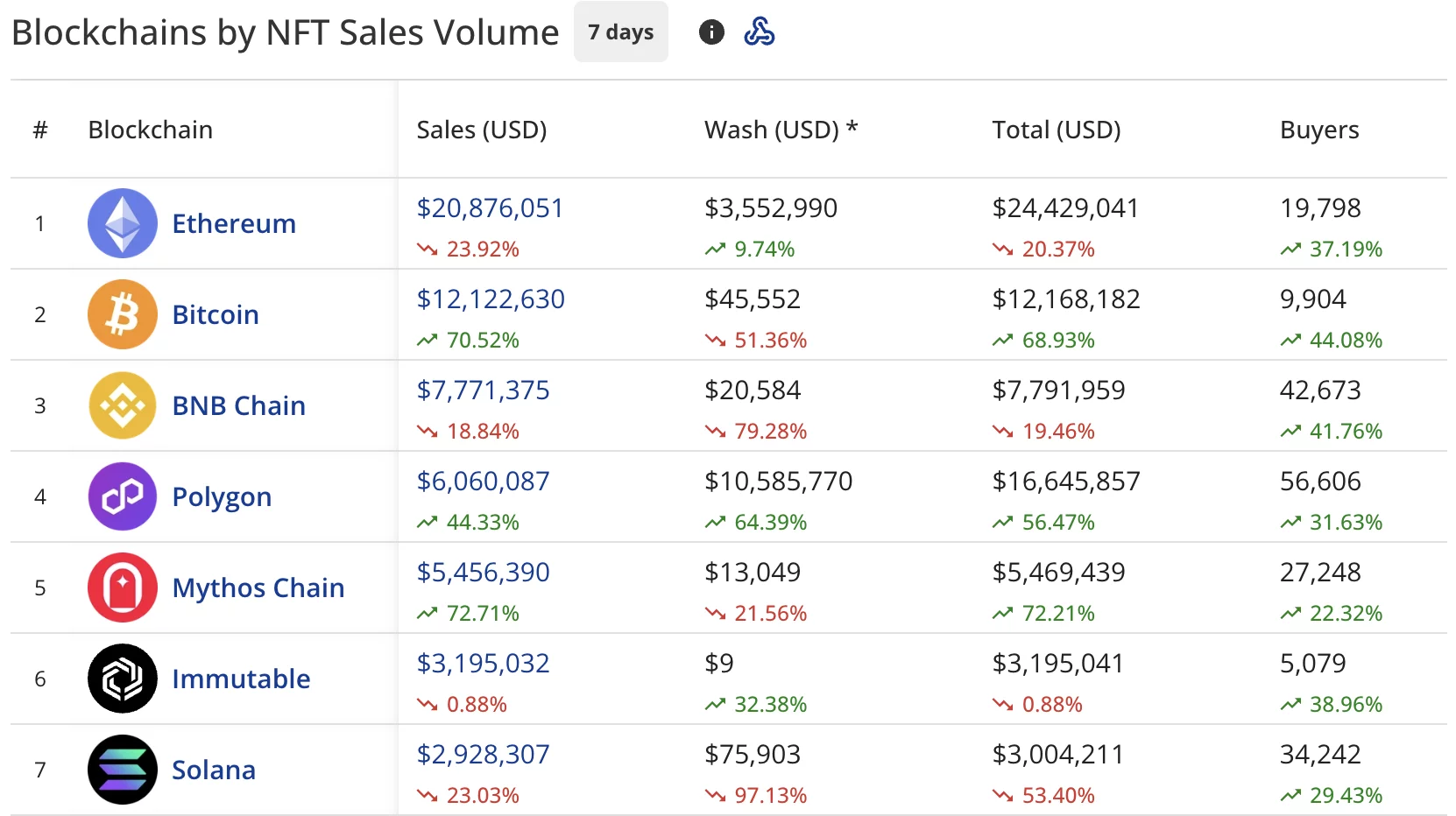

Ethereum maintained first position with $20.88 million in sales, down 23.92% from last week’s $28.06 million.

The network recorded $3.55 million in wash trading, bringing its total to $24.43 million. Buyers climbed 37.19% to 19,798.

Bitcoin surged to second place with $12.12 million, jumping 70.52% from last week’s $7.38 million. The blockchain recorded $45,552 in wash trading, with buyers jumping 44.08% to 9,904.

BNB Chain (BNB) dropped to third at $7.77 million, down 18.84% from last week’s $9.62 million. The blockchain had $20,584 in wash trading, with buyers rising 41.76% to 42,673.

Source: Blockchains by NFT Sales Volume (

CryptoSlam)

Source: Blockchains by NFT Sales Volume (

CryptoSlam)

Polygon secured fourth position with $6.06 million, up 44.33% from last week’s $4.12 million.

The blockchain recorded $10.59 million in wash trading, bringing its total to $16.65 million. Buyers increased 31.63% to 56,606.

Mythos Chain climbed to fifth at $5.46 million, surging 72.71% from last week’s $3.22 million. The blockchain attracted 27,248 buyers, up 22.32%.

Immutable (IMX) held sixth position at $3.20 million, essentially flat with a 0.88% decline from last week’s $3.19 million. Buyers jumped 38.96% to 5,079.

Solana (SOL) placed seventh with $2.93 million, down 23.03% from last week’s $3.96 million. The network had 34,242 buyers, up 29.43%.

Bitcoin BRC-20 NFTs dominate top sales

Two $X@AI and $?? BRC-20 NFTs led individual sales:

- $X@AI BRC-20 NFTs topped at $1.92 million (21.7344 BTC), sold four days ago

- $?? BRC-20 NFTs placed second at $1.79 million (20.4401 BTC), sold two days ago

BTC Domain #372a75d6671ec00a1337f33999fb75acf9 sold for $362,729.32 (4.1293 BTC) six days ago.

Two CryptoPunks rounded out the top five:

- CryptoPunks #8408 sold for $118,176.63 (39 ETH) five days ago

- CryptoPunks #8476 sold for $110,904.23 (36.6 ETH) five days ago

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana’s Top 10 Protocols Highlight Surging DeFi Liquidity and Revenue Growth

Wheat Shows Early Recovery on Friday

US Crude output to decline as prices remain soft – Commerzbank

OPEC+ production misses targets in December – Commerzbank