300658, major asset restructuring! On the previous trading day, the stock price surged over 11%!

Show original

By:e公司

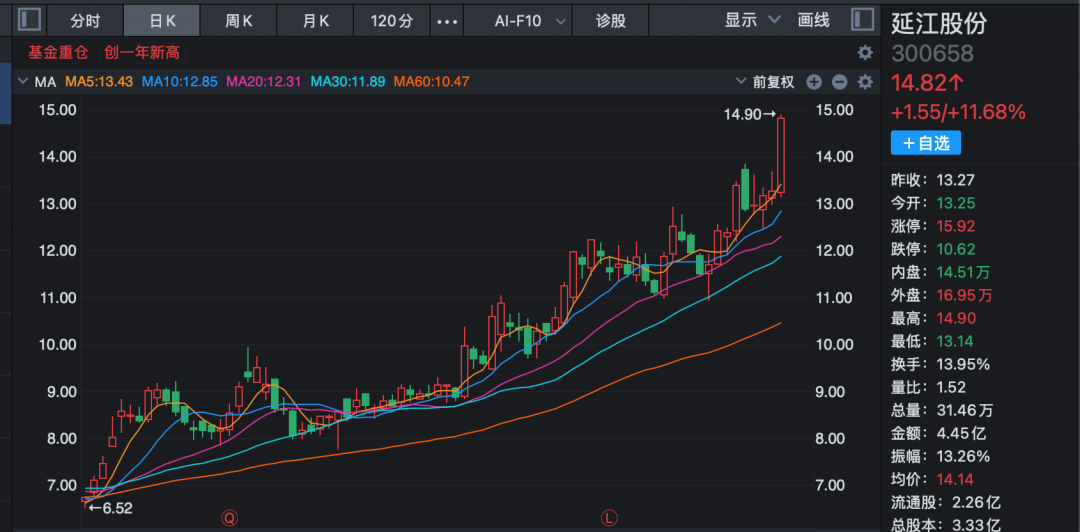

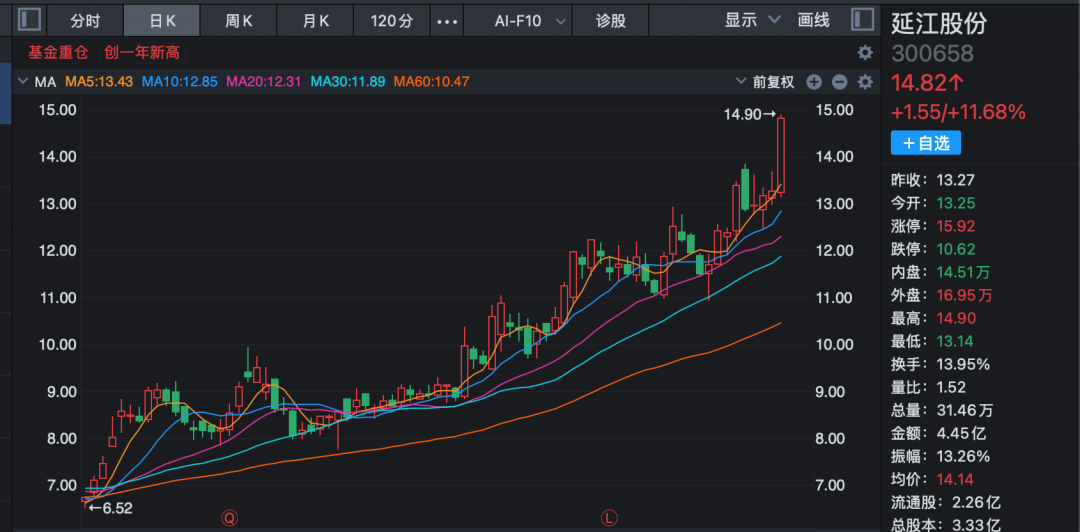

Another listed company is planning a major asset restructuring. On the evening of January 4, 2026, Yanjiang Co., Ltd. (300658) announced that the company intends to acquire control of Ningbo Yongqiang Technology Co., Ltd. (“Yongqiang Technology”) by issuing shares and paying cash, and will raise supporting funds. This transaction is expected to constitute a major asset restructuring. Due to uncertainties regarding certain matters, and in order to protect the interests of investors and avoid significant impact on the company's securities trading, Yanjiang Co., Ltd. stock will be suspended from trading starting January 5, 2026. The company expects to announce the transaction plan within no more than 10 trading days. On December 31, 2025, Yanjiang Co., Ltd. reached an intention agreement with Yongqiang Technology’s actual controller JIANGQIHE and his concerted parties QIANGYUAN, as well as Ningbo Yuanlu Zai Technology Partnership (Limited Partnership). The matter is still in the planning stage, and the specific proportion of shares to be purchased, transaction parties, and other related details are still under discussion. In the secondary market, Yanjiang Co., Ltd. has already surged in advance. On December 31, 2025, the company closed up 11.68% at 14.82 yuan per share, with a market value of 4.9 billion yuan.  Public information shows that Yongqiang Technology was established in 2019, mainly engaged in the R&D and production of IC substrates, high-end display substrates, and high-speed high-frequency substrates. These products are widely used in new infrastructure fields such as 5G/6G communications, AI, data centers, and the Internet of Vehicles. Its high-end products have passed performance certifications from leading domestic companies such as Intel, Huawei, Inspur, Sugon, New H3C, and Accelink. According to the company website, Yongqiang Technology has frequently received capital investments and has completed multiple rounds of financing, with a valuation exceeding 1 billion yuan. In terms of core business, Yanjiang Co., Ltd. is mainly engaged in the R&D, production, and sales of surface materials for disposable hygiene products. This asset restructuring is a cross-sector acquisition. In fact, there were signs of Yanjiang Co., Ltd. planning a merger and acquisition earlier. In the 2024 annual report, the company stated that one of its key focuses for 2025 is to “prudently select, cultivate, and develop a second business track,” indicating continued attention to and exploration of opportunities in other emerging sectors to promote the company’s future development to a higher level. In the field of disposable hygiene products, Yanjiang Co., Ltd. holds a leading market position. The company’s main products are 3D perforated non-woven fabrics and PE perforated films, mainly used as surface materials for feminine hygiene products, baby diapers, and other disposable hygiene products. Its clients include leading domestic and international hygiene companies such as Procter & Gamble, Kimberly-Clark, and Hengan. In recent years, Yanjiang Co., Ltd.’s main business has maintained a steady growth momentum. In the first three quarters of 2025, the company achieved revenue of 1.295 billion yuan, a year-on-year increase of 22.99%; net profit was 42.5018 million yuan, up 27.95% year-on-year. In particular, third-quarter net profit reached 16.6626 million yuan, with a year-on-year growth rate of 209.1%. Benefiting from overseas product upgrades and global production capacity layout, Yanjiang Co., Ltd.’s market space and profit elasticity are gradually being released. Currently, the company has localized factories in Egypt, the United States, and India. Since 2022, its Singapore subsidiaries “Singapore Holdings” and “Yanjiang International” have gradually carried out related operations according to their strategic positioning and have achieved certain results. Yanjiang Co., Ltd. stated that major overseas clients are upgrading their surface materials, starting with the replacement and upgrading of mid- to high-end series products. Currently, the Egyptian subsidiary’s hot air production line has a theoretical capacity of 12,000 tons/year. About 10,000 tons of capacity have been verified by the production line, and it is expected to reach full production in the first half of 2026. The US subsidiary’s hot air production line is expected to start commercial production in 2026. In terms of profitability, the net profit margin of the domestic parent company and the Egyptian subsidiary both increased year-on-year in the first three quarters, with the Egyptian subsidiary experiencing a larger increase. The US and Indian subsidiaries are currently at breakeven.

Public information shows that Yongqiang Technology was established in 2019, mainly engaged in the R&D and production of IC substrates, high-end display substrates, and high-speed high-frequency substrates. These products are widely used in new infrastructure fields such as 5G/6G communications, AI, data centers, and the Internet of Vehicles. Its high-end products have passed performance certifications from leading domestic companies such as Intel, Huawei, Inspur, Sugon, New H3C, and Accelink. According to the company website, Yongqiang Technology has frequently received capital investments and has completed multiple rounds of financing, with a valuation exceeding 1 billion yuan. In terms of core business, Yanjiang Co., Ltd. is mainly engaged in the R&D, production, and sales of surface materials for disposable hygiene products. This asset restructuring is a cross-sector acquisition. In fact, there were signs of Yanjiang Co., Ltd. planning a merger and acquisition earlier. In the 2024 annual report, the company stated that one of its key focuses for 2025 is to “prudently select, cultivate, and develop a second business track,” indicating continued attention to and exploration of opportunities in other emerging sectors to promote the company’s future development to a higher level. In the field of disposable hygiene products, Yanjiang Co., Ltd. holds a leading market position. The company’s main products are 3D perforated non-woven fabrics and PE perforated films, mainly used as surface materials for feminine hygiene products, baby diapers, and other disposable hygiene products. Its clients include leading domestic and international hygiene companies such as Procter & Gamble, Kimberly-Clark, and Hengan. In recent years, Yanjiang Co., Ltd.’s main business has maintained a steady growth momentum. In the first three quarters of 2025, the company achieved revenue of 1.295 billion yuan, a year-on-year increase of 22.99%; net profit was 42.5018 million yuan, up 27.95% year-on-year. In particular, third-quarter net profit reached 16.6626 million yuan, with a year-on-year growth rate of 209.1%. Benefiting from overseas product upgrades and global production capacity layout, Yanjiang Co., Ltd.’s market space and profit elasticity are gradually being released. Currently, the company has localized factories in Egypt, the United States, and India. Since 2022, its Singapore subsidiaries “Singapore Holdings” and “Yanjiang International” have gradually carried out related operations according to their strategic positioning and have achieved certain results. Yanjiang Co., Ltd. stated that major overseas clients are upgrading their surface materials, starting with the replacement and upgrading of mid- to high-end series products. Currently, the Egyptian subsidiary’s hot air production line has a theoretical capacity of 12,000 tons/year. About 10,000 tons of capacity have been verified by the production line, and it is expected to reach full production in the first half of 2026. The US subsidiary’s hot air production line is expected to start commercial production in 2026. In terms of profitability, the net profit margin of the domestic parent company and the Egyptian subsidiary both increased year-on-year in the first three quarters, with the Egyptian subsidiary experiencing a larger increase. The US and Indian subsidiaries are currently at breakeven.

Public information shows that Yongqiang Technology was established in 2019, mainly engaged in the R&D and production of IC substrates, high-end display substrates, and high-speed high-frequency substrates. These products are widely used in new infrastructure fields such as 5G/6G communications, AI, data centers, and the Internet of Vehicles. Its high-end products have passed performance certifications from leading domestic companies such as Intel, Huawei, Inspur, Sugon, New H3C, and Accelink. According to the company website, Yongqiang Technology has frequently received capital investments and has completed multiple rounds of financing, with a valuation exceeding 1 billion yuan. In terms of core business, Yanjiang Co., Ltd. is mainly engaged in the R&D, production, and sales of surface materials for disposable hygiene products. This asset restructuring is a cross-sector acquisition. In fact, there were signs of Yanjiang Co., Ltd. planning a merger and acquisition earlier. In the 2024 annual report, the company stated that one of its key focuses for 2025 is to “prudently select, cultivate, and develop a second business track,” indicating continued attention to and exploration of opportunities in other emerging sectors to promote the company’s future development to a higher level. In the field of disposable hygiene products, Yanjiang Co., Ltd. holds a leading market position. The company’s main products are 3D perforated non-woven fabrics and PE perforated films, mainly used as surface materials for feminine hygiene products, baby diapers, and other disposable hygiene products. Its clients include leading domestic and international hygiene companies such as Procter & Gamble, Kimberly-Clark, and Hengan. In recent years, Yanjiang Co., Ltd.’s main business has maintained a steady growth momentum. In the first three quarters of 2025, the company achieved revenue of 1.295 billion yuan, a year-on-year increase of 22.99%; net profit was 42.5018 million yuan, up 27.95% year-on-year. In particular, third-quarter net profit reached 16.6626 million yuan, with a year-on-year growth rate of 209.1%. Benefiting from overseas product upgrades and global production capacity layout, Yanjiang Co., Ltd.’s market space and profit elasticity are gradually being released. Currently, the company has localized factories in Egypt, the United States, and India. Since 2022, its Singapore subsidiaries “Singapore Holdings” and “Yanjiang International” have gradually carried out related operations according to their strategic positioning and have achieved certain results. Yanjiang Co., Ltd. stated that major overseas clients are upgrading their surface materials, starting with the replacement and upgrading of mid- to high-end series products. Currently, the Egyptian subsidiary’s hot air production line has a theoretical capacity of 12,000 tons/year. About 10,000 tons of capacity have been verified by the production line, and it is expected to reach full production in the first half of 2026. The US subsidiary’s hot air production line is expected to start commercial production in 2026. In terms of profitability, the net profit margin of the domestic parent company and the Egyptian subsidiary both increased year-on-year in the first three quarters, with the Egyptian subsidiary experiencing a larger increase. The US and Indian subsidiaries are currently at breakeven.

Public information shows that Yongqiang Technology was established in 2019, mainly engaged in the R&D and production of IC substrates, high-end display substrates, and high-speed high-frequency substrates. These products are widely used in new infrastructure fields such as 5G/6G communications, AI, data centers, and the Internet of Vehicles. Its high-end products have passed performance certifications from leading domestic companies such as Intel, Huawei, Inspur, Sugon, New H3C, and Accelink. According to the company website, Yongqiang Technology has frequently received capital investments and has completed multiple rounds of financing, with a valuation exceeding 1 billion yuan. In terms of core business, Yanjiang Co., Ltd. is mainly engaged in the R&D, production, and sales of surface materials for disposable hygiene products. This asset restructuring is a cross-sector acquisition. In fact, there were signs of Yanjiang Co., Ltd. planning a merger and acquisition earlier. In the 2024 annual report, the company stated that one of its key focuses for 2025 is to “prudently select, cultivate, and develop a second business track,” indicating continued attention to and exploration of opportunities in other emerging sectors to promote the company’s future development to a higher level. In the field of disposable hygiene products, Yanjiang Co., Ltd. holds a leading market position. The company’s main products are 3D perforated non-woven fabrics and PE perforated films, mainly used as surface materials for feminine hygiene products, baby diapers, and other disposable hygiene products. Its clients include leading domestic and international hygiene companies such as Procter & Gamble, Kimberly-Clark, and Hengan. In recent years, Yanjiang Co., Ltd.’s main business has maintained a steady growth momentum. In the first three quarters of 2025, the company achieved revenue of 1.295 billion yuan, a year-on-year increase of 22.99%; net profit was 42.5018 million yuan, up 27.95% year-on-year. In particular, third-quarter net profit reached 16.6626 million yuan, with a year-on-year growth rate of 209.1%. Benefiting from overseas product upgrades and global production capacity layout, Yanjiang Co., Ltd.’s market space and profit elasticity are gradually being released. Currently, the company has localized factories in Egypt, the United States, and India. Since 2022, its Singapore subsidiaries “Singapore Holdings” and “Yanjiang International” have gradually carried out related operations according to their strategic positioning and have achieved certain results. Yanjiang Co., Ltd. stated that major overseas clients are upgrading their surface materials, starting with the replacement and upgrading of mid- to high-end series products. Currently, the Egyptian subsidiary’s hot air production line has a theoretical capacity of 12,000 tons/year. About 10,000 tons of capacity have been verified by the production line, and it is expected to reach full production in the first half of 2026. The US subsidiary’s hot air production line is expected to start commercial production in 2026. In terms of profitability, the net profit margin of the domestic parent company and the Egyptian subsidiary both increased year-on-year in the first three quarters, with the Egyptian subsidiary experiencing a larger increase. The US and Indian subsidiaries are currently at breakeven.

Editor:Chen Lixiang

Proofread :Lv Jiubiao

— END —

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Metaplanet’s Gerovich, Bitmine’s Lee drum up corporate crypto holdings

Cointelegraph•2026/01/17 20:24

US penalties are having a significant impact on Russia

101 finance•2026/01/17 20:03

Avalanche Breaks Trendline Near $13.7, Solana Nears a Decision Point, But BlockDAG’s $0.001 Price Window Is Stealing the Spotlight

BlockchainReporter•2026/01/17 19:00

Zcash Faces Weekend Challenges with Price Pressures

Cointurk•2026/01/17 18:36

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,288.24

+0.31%

Ethereum

ETH

$3,316.98

+1.20%

Tether USDt

USDT

$0.9995

+0.01%

BNB

BNB

$952.62

+2.31%

XRP

XRP

$2.07

+0.84%

Solana

SOL

$144.44

+0.36%

USDC

USDC

$0.9998

+0.01%

TRON

TRX

$0.3174

+2.61%

Dogecoin

DOGE

$0.1389

+1.52%

Cardano

ADA

$0.4017

+3.44%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now