ETF inflows return as crypto enters 2026, but market is 'still wrestling with internal fatigue': analysts

Crypto markets have entered 2026 on firmer footing after spot exchange-traded fund inflows turned positive again, even as onchain indicators have continued to weaken beneath the surface.

Bitcoin spent the final days of 2025 consolidating just below key resistance near $92,000, with institutional flows stabilizing prices amid thin holiday liquidity, according to analyst notes shared with The Block. They said the shift marked a notable contrast from earlier in December, when sustained ETF outflows had weighed on sentiment.

"The result was a market supported by external inflows, but still wrestling with internal fatigue," said Timothy Misir, head of research at BRN. "Optimism has returned, but conviction remains conditional."

From Dec. 29 through Jan. 2, spot bitcoin ETFs recorded net inflows of $459 million, alongside roughly $14 billion in trading volume. Ether ETFs added $161 million, while XRP ETFs attracted $43 million, data cited by BRN showed. The rebound followed several weeks of persistent redemptions and signaled renewed institutional engagement as balance sheets reset for the new year.

Price action, however, has largely remained range-bound. Bitcoin has oscillated between the mid-$87,000s and low-$90,000s, trading around $93,000 on Monday, while ether held near $3,200, according to The Block's prices page. Broader altcoin performance was mixed, reflecting cautious positioning rather than broad-based risk appetite.

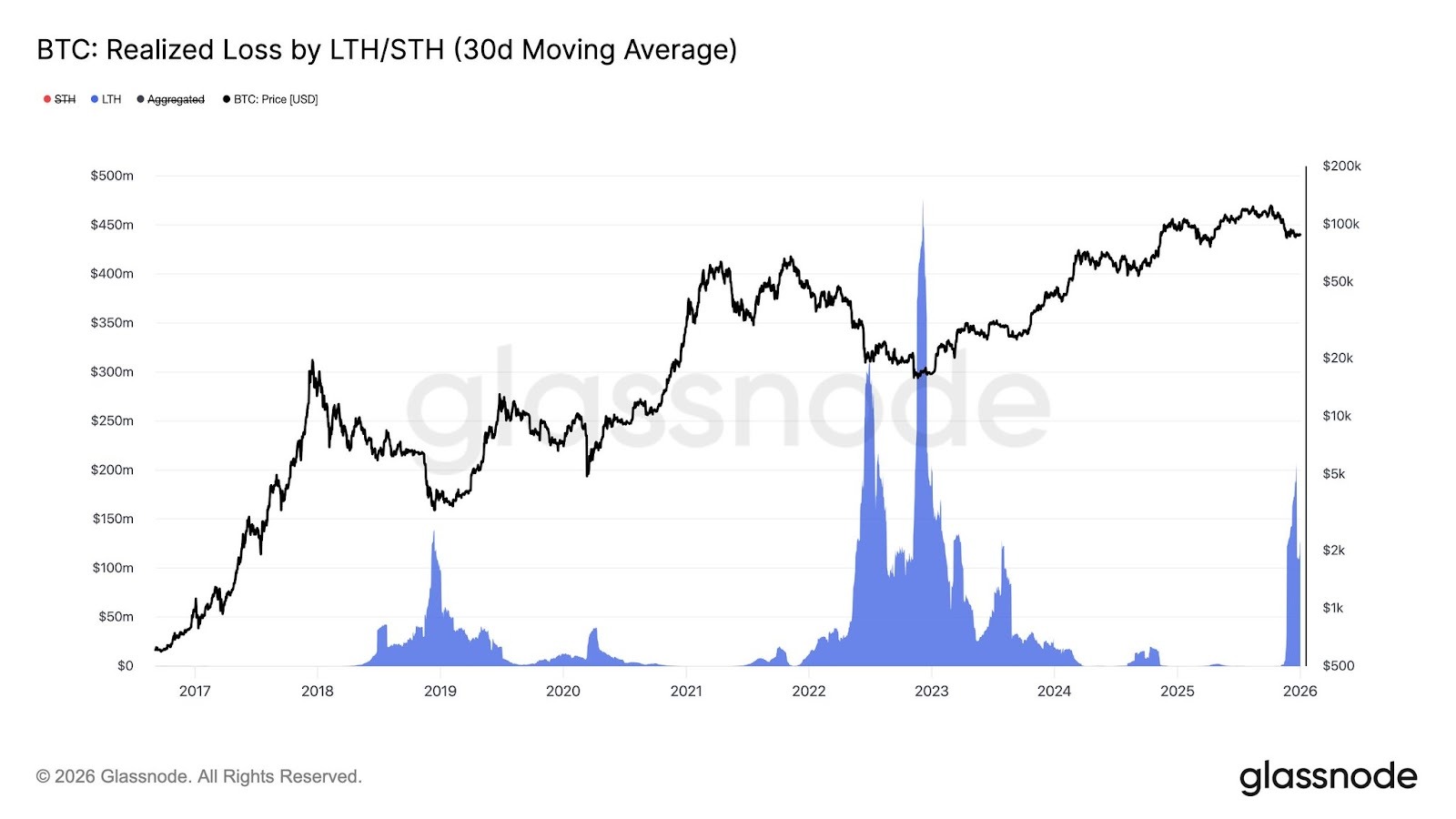

While ETF inflows have provided surface-level support, onchain signals have continued to soften. The 30-day change in bitcoin’s realized capitalization turned negative in late December, marking the end of one of the longest uninterrupted periods of positive capital inflows in the network’s history.

Bitcoin realized loss by LTH/STH (30d moving average) | Image: Glassnode

At the same time, long-term holders have begun realizing losses at an increasing pace despite relatively stable prices.

Misir described the divergence as a familiar late-cycle dynamic. "Price compresses, volatility fades, and time becomes the primary source of stress," he said. "Investors exit not because of fear, but because of exhaustion."

The structure suggests a transition away from a flow-driven phase toward one that tests patience. ETF inflows may help prevent deeper drawdowns, analysts have said, but sustained upside would likely require renewed expansion in onchain capital formation rather than reliance on secondary market demand alone.

QCP Capital echoed the cautious tone, noting that crypto’s early-January strength has coincided with broader risk assets, even as liquidity conditions remain fragile following the holidays.

In a Jan. 5 update, the firm said positioning has turned more constructive in options markets, with reduced put skew and growing interest in longer-dated upside exposure. However, QCP warned that recent U.S. sessions have continued to fade rallies, even as liquidity is expected to normalize quickly after the holiday lull.

Meanwhile, the market’s recent price behavior — including bitcoin’s move above $93,000 — was covered earlier by The Block, as traders digested geopolitical developments tied to U.S. operations in Venezuela.

Macro headlines have since taken a back seat to forward-looking data risk. Analysts have broadly said the Venezuela development has reinforced geopolitical uncertainty without materially altering the near-term macro outlook for risk assets. Attention has now shifted to incoming economic data, with early-January releases expected to play an outsized role in shaping rate expectations and broader market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DDC Enterprise makes its initial treasury purchase of 200 bitcoin in 2026

NEXST Brings KISS OF LIFE to Life: Debut VR Concerts on the Ultimate Web3 Entertainment Platform

Qnity Electronics’ Fourth Quarter 2025 Financial Results: What Should You Anticipate

Hollywood tycoon’s high-stakes showdown for Warner Bros heads to the UK