Google Faces 'Cannibalization' Threat While Microsoft's Azure Expands: Specialist Discusses How AI Responses Might Significantly Reduce GOOG's Advertising Income

AI's Impact on Tech Giants: Diverging Analyst Views for 2026

As artificial intelligence continues to reshape the technology sector, experts remain split on what the future holds for leading companies. Some warn that Alphabet Inc.—the parent company of Google—may see its main advertising revenue threatened by its own push into generative AI. Meanwhile, Microsoft is seen as potentially benefiting from the shift, thanks to steady growth in its cloud services.

The Search Engine Dilemma

Cory Johnson, Chief Market Strategist at Epistrophy Capital Research, recently told Schwab Network that Google faces a unique challenge: to stay ahead, it must disrupt its own lucrative business model. Traditionally, Google has earned vast sums by directing users to click on search links. However, with generative AI now able to provide direct answers, the need for those clicks—and the associated ad revenue—diminishes.

“This approach eats into their core business,” Johnson explained. He noted that when Google delivers AI-generated answers instead of links, it directly impacts their main source of income.

Data also shows that users are much less likely to leave Google’s platform for other sites when presented with AI-powered responses compared to standard search results.

Microsoft's Advantage in the AI Era

On the other hand, John Freeman, Co-Founder of Ravenswood Partners, believes Microsoft is better positioned for the coming years. He points to Microsoft’s Azure cloud platform, which recently achieved 35% growth, as a major driver of AI-related gains—without the risk of disrupting its own core businesses.

Freeman also highlighted that Microsoft’s main profit sources, such as Windows and Microsoft 365, are unlikely to be significantly affected by AI in the short term, making the company a relatively safer investment.

The Infrastructure Opportunity

Both analysts agree that the biggest near-term investment potential lies in the infrastructure needed to support AI’s rapid expansion. Johnson emphasized the broad increase in spending on data centers, networking, and energy, while Freeman drew attention to the “memory trade.”

Freeman specifically recommended Micron Technology Inc. and Lam Research Corp. as key beneficiaries, given the soaring demand for DRAM memory required by ever-larger AI models.

Alphabet’s Stock Performance

Alphabet’s Class A shares have climbed 76% over the past six months and 65% in the last year. On Monday, the stock closed at $316.54, up 0.44% for the day.

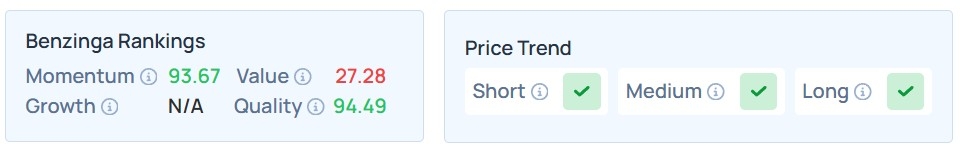

Benzinga’s Edge Stock Rankings indicate that GOOGL shows strong price momentum across short, medium, and long-term periods, though its value rating remains low.

Further Reading

Note: This article was created in part with the assistance of AI tools and reviewed by Benzinga’s editorial team.

Image credit: Shutterstock

Stock Snapshot

- GOOGL (Alphabet Inc): $316.60

- GOOG (Alphabet Inc): $317.20

- LRCX (Lam Research Corp): $193.75

- MSFT (Microsoft Corp): $472.75

- MU (Micron Technology Inc): $311.42

© 2026 Benzinga.com. All rights reserved. Benzinga does not offer investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zuckerberg’s Threads starts 2026 ahead of Musk’s X in user count

Bitcoin Sees $1.65B Exodus From Exchanges as Holders Move to Cold Storage