Oil: Venezuela shift may pressure Oil prices – OCBC

Political transition in Venezuela could revive its Oil sector and weigh on global Oil prices, though OPEC’s quota pause provides some support for Brent. Amid geopolitical uncertainty and ongoing central-bank demand, Gold remains a preferred safe-haven, with a 2026 year-end target of $4,800, OCBC's FX analysts Sim Moh Siong and Christopher Wong note.

OPEC pause supports Brent, medium-term downside limited

"US strike triggers political transition in Venezuela, raising prospects for sanctions relief and Oil sector revival. This could add to downside pressure to global Oil prices in the medium-term. We maintain our forecast for Brent to bottom near USD59/bbl by year-end, pending clarity on Venezuela’s new government and resource policy. OPEC’s pause in quota hikes supports soft floor for Brent in high-USD50s."

"Recent events underscore risks to global order and reinforce the role of Gold as a strategic hedge and portfolio diversifier. We maintain a constructive outlook on Gold amid Fed still biased toward easing, persistent central-bank demand and geopolitical uncertainty. We project Gold at USD4,800 for end-2026."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

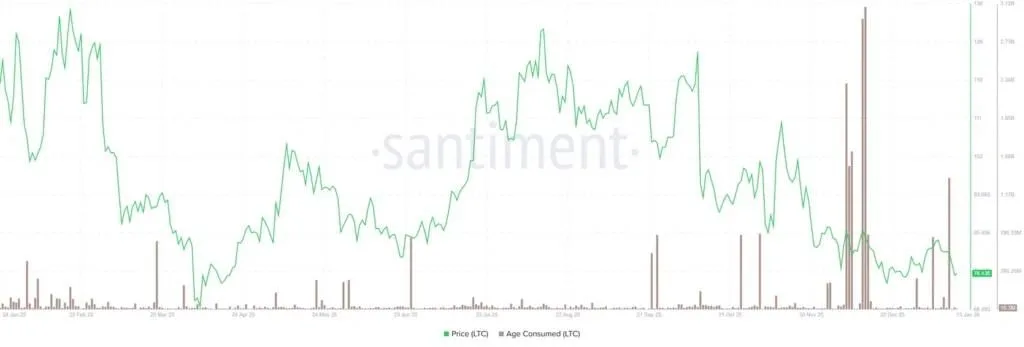

Litecoin Price Prediction: Will LTC Hold Key $72 Support?

Analysts Bullish On BlockDAG Hitting $1 in 2026 – Why It’s The Best Crypto To Buy Before Launch

FAA de EEUU advierte a aerolíneas sobre posibles acciones militares en Centroamérica y Sudamérica

Trump administration urges tech firms to purchase $15 billion in power plants they might never operate