Ways to Use Technical Analysis for Trading SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META, and TSLA

Morning Market Overview

Greetings, traders!

Today’s trading session features a relatively quiet economic calendar, so market participants are likely to focus more on positioning than on major economic news. At 8:55 AM ET, the Redbook Retail Sales report will provide a snapshot of consumer spending. Shortly after, at 9:45 AM ET, the final S&P Global Services and Composite PMIs for December will be released. While these may influence early market sentiment, they are not expected to set a lasting direction on their own.

Later in the morning, at 11:00 AM ET, the Treasury will share details on the 4- and 8-week bill auctions, which could offer subtle clues about short-term funding demand. In the afternoon, at 2:00 PM ET, the Federal Reserve will publish the Discount Rate Minutes, giving traders a deeper look into recent policy discussions following the latest Fed decision.

With the most significant data releases scheduled for later in the week, markets may remain within established ranges, with occasional volatility driven by shifts in positioning and liquidity.

Key Stocks in Focus: SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META, TSLA

SPDR S&P 500 ETF Trust (SPY)

SPY starts the day at 687.50, with buyers aiming to maintain recent momentum. If the price holds above this level, the next targets are 689.10 and potentially 690.75. A sustained move above these points could open the way to 692.25, where sellers may become more active. Continued strength would suggest renewed institutional interest, even with a lighter economic calendar.

Should SPY drop below 687.50, sellers may push the price down to 685.90. A further decline could test support at 684.25, and a break below this area may accelerate losses toward 682.50. Failure to recover these levels could signal waning momentum and increased risk of rotational selling.

Invesco QQQ Trust Series 1 (QQQ)

QQQ opens at 618.75, with bulls working to defend the recent consolidation area. Holding above this level could see the price move up to 620.40 and then 622.10. If buyers stay in control, an advance toward 624.00 is possible, especially if overall market sentiment remains positive.

If QQQ falls below 618.75, sellers may target 617.10, with further downside potentially bringing 615.50 and 613.75 into play. Losing these supports would indicate a pullback in risk appetite among growth stocks.

Apple Inc. (AAPL)

Apple opens at 266.50, where buyers are looking to regain momentum after recent weakness. Holding this level could allow for a move up to 268.10 and then 269.75. If momentum builds, the price could extend to 271.25 as buyers try to reestablish control.

If AAPL cannot stay above 266.50, sellers may drive the price to 265.10, with further declines possibly reaching 263.75 and 262.25. Continued selling would suggest further distribution is underway.

Microsoft Corp. (MSFT)

Microsoft begins the session at 472.75, with bulls seeking to stabilize after recent consolidation. Holding this support could lead to advances toward 474.50 and 476.25. Continued strength may push the price to 478.50, signaling renewed confidence in large-cap tech.

If MSFT loses 472.75, sellers may test 471.00, with further weakness potentially exposing 469.25 and 467.50. A break below these levels would reflect broader caution in the mega-cap tech sector.

NVIDIA Corporation (NVDA)

NVIDIA starts at 189.00, with buyers watching for follow-through after recent volatility. Staying above this level could see the price rise to 191.00 and then 193.25. If momentum continues, a move toward 195.50 is possible.

If NVDA slips below 189.00, sellers may target 187.25 and, if weakness persists, 185.50. Ongoing downside would suggest buyers are stepping back ahead of bigger market events.

Alphabet Inc Class A (GOOGL)

Alphabet opens at 317.00, with buyers aiming to defend this support. Holding firm could allow the price to move up to 319.00 and 321.25, with continued strength possibly carrying the stock to 323.50.

If 317.00 does not hold, sellers may push GOOGL to 315.25 and potentially 313.50. A break below these levels would point to declining demand and greater downside risk.

Meta Platforms Inc (META)

Meta starts at 658.75, with bulls looking to keep the price near recent highs. Holding this level could lead to moves toward 661.00 and 664.25, with further gains possible up to 667.50 if buyers remain active.

If META falls below 658.75, sellers may target 656.25 and 653.50. Continued selling would indicate short-term exhaustion after the recent rally.

Tesla Inc. (TSLA)

Tesla opens at 449.25, with buyers trying to stabilize after recent swings. Holding above this level could allow for a move to 452.00 and then 455.50. Stronger momentum may push the price up to 459.00.

If TSLA cannot hold 449.25, sellers may drive the price to 446.50 and potentially 443.75. A break below these levels would increase the risk of accelerated declines.

Final Thoughts

Traders are encouraged to remain patient, respect key technical levels, and avoid overtrading in these thinner market conditions. Wishing everyone a safe and successful trading day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

STB turns down UP-NS merger filing, citing it as “incomplete”

PI Price Analysis: PI Holds $0.20 Support After Triangle Breakdown—What’s Next?

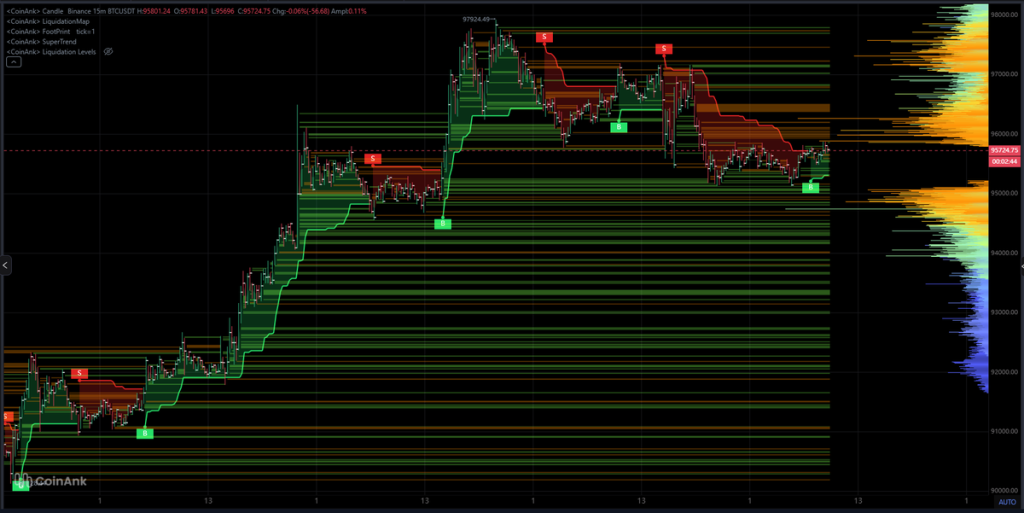

Bitcoin Trend Cools After Spike to $98K: Key BTC Price Levels to Watch Over the Next 48 Hours