What Can You Anticipate From Xylem’s Fourth Quarter 2025 Earnings Announcement

Xylem Inc. (XYL): Company Overview and Earnings Outlook

Xylem Inc. (XYL), based in Washington, D.C., specializes in the design, production, and maintenance of engineered solutions and products. With a market capitalization of $33.4 billion, the company’s portfolio includes water and wastewater pumps, treatment and testing systems, industrial pumps, valves, heat exchangers, and dispensing devices. As a prominent force in the global water technology sector, Xylem is preparing to release its financial results for the fourth quarter of fiscal year 2025.

Anticipated Earnings Performance

Market analysts are forecasting that Xylem will post diluted earnings of $1.41 per share, representing a 19.5% increase from the $1.18 per share reported in the same quarter last year. Notably, the company has exceeded Wall Street’s earnings per share expectations for the past four quarters.

Full-Year and Future Projections

For the entire fiscal year, analysts anticipate Xylem will achieve earnings per share of $5.06, an 18.5% rise from the $4.27 reported in 2024. Looking ahead to fiscal 2026, EPS is projected to climb another 9.5% to reach $5.54.

Image source: www.barchart.com

Stock Performance Comparison

Over the past year, Xylem’s share price has increased by 18.6%, outpacing the S&P 500 Index’s 16.2% gain. However, it lagged behind the Industrial Select Sector SPDR Fund (XLI), which posted a 20.4% return during the same period.

Image source: www.barchart.com

Drivers of Growth and Strategic Initiatives

Xylem’s strong performance is attributed to robust demand for its water management offerings, effective pricing strategies, productivity improvements, and targeted investments. The company’s leadership anticipates ongoing expansion, fueled by increased adoption of advanced metering infrastructure and operational streamlining, even in the face of broader economic challenges. Additionally, divesting its international metering division is expected to enhance profit margins.

Recent Earnings Highlights

On October 28, 2025, Xylem’s stock saw a slight uptick following the release of its third-quarter results. The company reported adjusted earnings per share of $1.37, surpassing analysts’ expectations of $1.24. Revenue reached $2.3 billion, exceeding the projected $2.2 billion. For the full year, Xylem forecasts adjusted EPS between $5.03 and $5.08, with anticipated revenue totaling $9 billion.

Analyst Ratings and Price Target

The consensus among analysts is moderately optimistic, with a “Moderate Buy” recommendation overall. Of the 21 analysts covering Xylem, 12 rate it as a “Strong Buy,” one as a “Moderate Buy,” and eight suggest holding the stock. The average price target stands at $169.94, implying a potential upside of 22.3% from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

STB turns down UP-NS merger filing, citing it as “incomplete”

PI Price Analysis: PI Holds $0.20 Support After Triangle Breakdown—What’s Next?

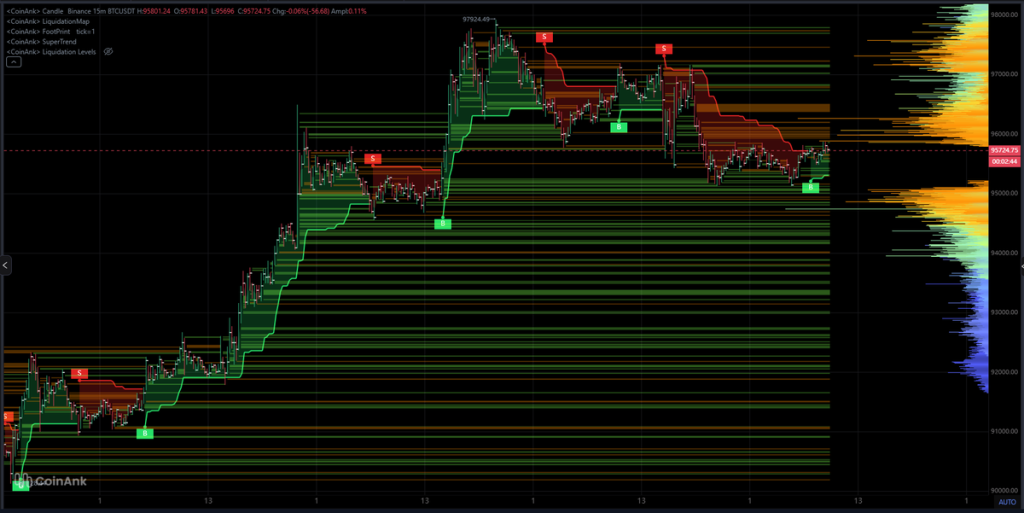

Bitcoin Trend Cools After Spike to $98K: Key BTC Price Levels to Watch Over the Next 48 Hours