Australian Dollar climbs higher following a rebound from previous declines

Australian Dollar Extends Gains Despite Inflation Data

On Wednesday, the Australian Dollar (AUD) continued its upward momentum against the US Dollar (USD), marking its fourth consecutive day of gains. However, the AUD/USD currency pair encountered resistance after the release of Australia’s November inflation figures.

According to the Australian Bureau of Statistics, the nation’s Consumer Price Index (CPI) increased by 3.4% year-over-year in November, down from October’s 3.8%. This result fell short of the anticipated 3.7%, yet remained above the Reserve Bank of Australia’s (RBA) 2–3% target range. The data reflected the slowest inflation pace since August, with housing expenses rising at their lowest rate in three months.

On a monthly basis, Australia’s CPI was unchanged in November, mirroring the previous month’s result. The RBA’s Trimmed Mean CPI climbed 0.3% month-over-month and 3.2% year-over-year. In a separate report, seasonally adjusted building permits soared by 15.2% from the previous month, reaching a near four-year high of 18,406 units in November 2025, rebounding from a revised 6.1% decline. Yearly approvals also surged by 20.2%, reversing a 1.1% drop in October.

The Australian Financial Review highlighted that the RBA may not have finished tightening monetary policy, as inflation is projected to remain persistently high over the next year. This outlook has led to expectations of at least two more interest rate increases.

US Dollar Weakens Ahead of Key Economic Reports

- The US Dollar Index (DXY), which tracks the greenback against a basket of six major currencies, edged lower after modest gains in the previous session, hovering near 98.60 at the time of reporting.

- Investors are awaiting significant US economic releases, including the ISM Services PMI and JOLTs job openings, which could influence Federal Reserve policy expectations. The Nonfarm Payrolls (NFP) report, due Friday, is forecast to show a December job increase of 55,000, down from November’s 64,000.

- Federal Reserve Governor Stephen Miran stated on Tuesday that the central bank should implement substantial rate cuts this year to maintain economic growth. Meanwhile, Minneapolis Fed President Neel Kashkari cautioned about the possibility of a sharp rise in unemployment.

- Over the weekend, the US carried out a major military operation in Venezuela. President Donald Trump announced that Venezuelan President Nicolas Maduro and his spouse had been apprehended and removed from the country.

- On Monday, Maduro pleaded not guilty to US narco-terrorism charges, setting the stage for a significant legal confrontation with broad geopolitical consequences, as reported by Bloomberg.

- The US ISM Manufacturing PMI declined for the third consecutive month, falling to 47.9 in December 2025—the lowest since October 2024—from 48.2 in November, and missing expectations of 48.3. This points to a faster contraction in US manufacturing, driven by drops in output and inventory levels.

- Market participants are pricing in two more Federal Reserve rate cuts in 2026. There is also anticipation that President Trump will nominate a new Fed chair to succeed Jerome Powell when his term concludes in May, potentially signaling a shift toward a more accommodative monetary stance.

- China’s RatingDog Services PMI slipped to 52.0 in December from 52.1 in November, while the Manufacturing PMI edged up to 50.1 from 49.9. Given the close trade ties between Australia and China, shifts in the Chinese economy could significantly impact the AUD.

- The minutes from the RBA’s December meeting revealed that policymakers are prepared to tighten policy further if inflation does not moderate as expected. Attention is now on the fourth-quarter CPI report, due January 28, with analysts suggesting that a stronger-than-anticipated core inflation reading could prompt a rate hike at the RBA’s February 3 meeting.

Australian Dollar Hits New 15-Month Peak Near 0.6750

On Wednesday, the AUD/USD pair was trading around 0.6740. Technical analysis of the daily chart shows the pair moving higher within an ascending channel, indicating ongoing bullish momentum. However, the 14-day Relative Strength Index (RSI) at 70 signals that the pair may be overbought.

The currency pair has reached its highest level since October 2024 and is now targeting the upper boundary of the ascending channel near 0.6830.

Initial support is found at the nine-day Exponential Moving Average (EMA) of 0.6708, followed by the lower boundary of the ascending channel around 0.6700. Should the pair fall below this support zone, it could test the 50-day EMA near 0.6625.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

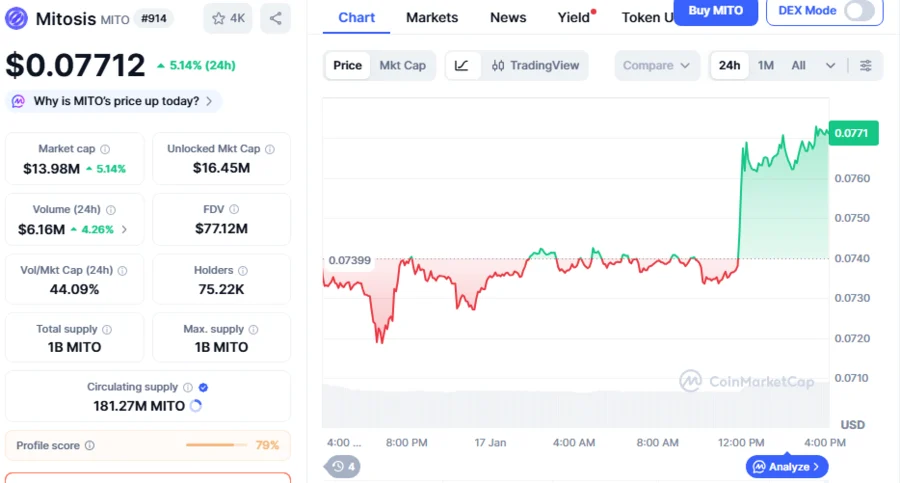

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds