US Dollar Index stays muted around 98.50 as risk appetite improves, focus shifts to upcoming US data

US Dollar Index Softens Ahead of Key Economic Reports

The US Dollar Index (DXY), which tracks the performance of the US Dollar against a basket of six major currencies, is experiencing a slight decline after modest gains in the previous session. During Wednesday’s Asian trading hours, the index hovered near 98.50. Market participants are now turning their attention to upcoming US economic releases that may influence expectations for future Federal Reserve actions.

Upcoming Data in Focus

Later today, investors will closely watch the release of the US ADP Employment Change and the ISM Services PMI figures for December. Looking ahead, Friday’s US Nonfarm Payrolls (NFP) report is anticipated to show an increase of 55,000 jobs for December, a decrease from November’s 64,000 gain.

Market Sentiment and Geopolitical Developments

Despite recent geopolitical tensions—including US involvement in Venezuela and the detention of President Nicolas Maduro—the US Dollar, often seen as a safe-haven asset, has edged lower as traders appear largely unfazed by these events.

Federal Reserve Uncertainty and Policy Outlook

The Dollar is also under pressure due to growing divisions within the Federal Reserve and uncertainty surrounding President Donald Trump’s upcoming nomination for the next Fed Chair, which has added to the ambiguity of the US monetary policy outlook. According to the CME Group’s FedWatch tool, futures markets are currently assigning an approximately 82.8% chance that the central bank will maintain interest rates at the January 27–28 meeting.

Fed Officials’ Perspectives

- Fed Governor Stephen Miran advocated on Tuesday for significant interest rate cuts this year to help preserve economic growth.

- Minneapolis Fed President Neel Kashkari cautioned that the unemployment rate could see a notable increase.

- Richmond Fed President Tom Barkin, who does not vote on policy decisions this year, emphasized the need for rate adjustments to be “finely tuned” in response to new data, citing risks to both employment and inflation targets, as reported by Reuters.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

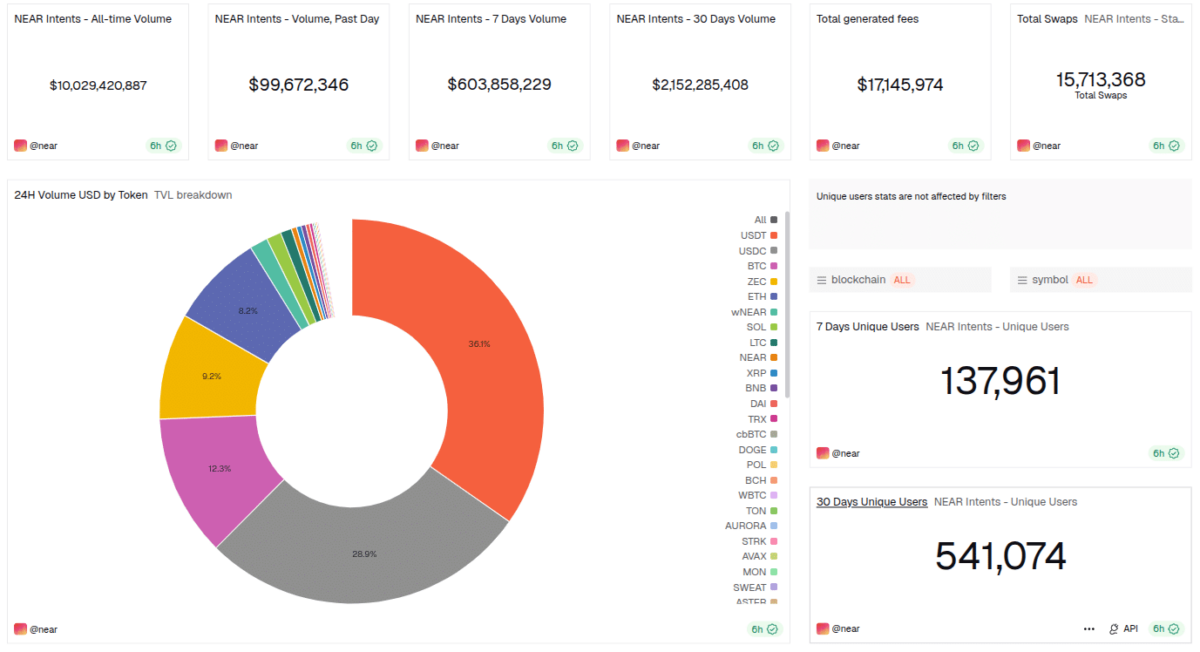

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund