When is the Eurozone Prelim HICP inflation and how could it affect EUR/USD?

The Eurozone Prelim HICP Overview

The Eurostat will publish the preliminary Eurozone Harmonized Index of Consumer Prices (HICP) data for December later on Wednesday at 10:00 GMT.

Eurozone HICP inflation is expected to ease to 2.0% year-over-year (YoY) in December, from 2.1% in November. Meanwhile, the annual core inflation is anticipated to remain consistent at 2.4% in the reported month.

The monthly Eurozone inflation and core inflation were at -0.3% and -0.5%, respectively, in November.

How could the Eurozone Prelim HICP affect EUR/USD?

The EUR/USD pair may gain ground if Eurozone HICP data comes in stronger than expected. The inflation and core inflation are both expected to come above the European Central Bank's (ECB) target of 2.0% YoY. However, the pair remains subdued following the release of Germany’s Retail Sales, which climbed 1.1% year-over-year (YoY) in November, following an increase of 0.9% in October. Monthly Retail Sales fell 0.6% in November, against a 0.3% decline in October and the market expectations of a 0.2% increase.

The EUR/USD pair also depreciates as the US Dollar (USD) rebounds and continues to gain ground ahead of the upcoming US economic data that could shape expectations for Federal Reserve (Fed) policy. US ADP Employment Change and ISM Services Purchasing Managers’ Index (PMI) data for December will be eyed later in the day.

Technically, the EUR/USD pair extends its losses, trading around 1.1680 at the time of writing. Technical analysis of the daily chart indicates a potential for a bearish bias; the 14-day Relative Strength Index (RSI) at 43.22 confirms waning momentum.

The EUR/USD pair moves below the 50-day Exponential Moving Average (EMA) at 1.1682. A close below the medium-term average would put downward pressure on the pair to test the monthly low of 1.1589, set on December 1. Rebounding above the 50-day EMA would maintain the medium-term price momentum and support the pair to target the nine-day EMA at 1.1720, followed by the three-month high of 1.1808, which was recorded on December 24.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Billionaire CEO Michael Novogratz Makes Statement on Cryptocurrency Market Bill

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

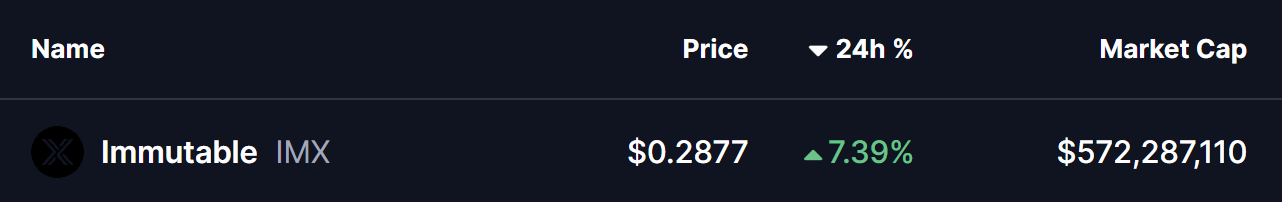

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!