XRP could see a pullback as momentum fades, but institutional demand remains strong. Can XRP make a comeback?

As of January 7, XRP is trading at approximately $2.26, reflecting a decline of about 5.4% over the past 24 hours. The price moved down from an intraday high near $2.39 to a low around $2.22 before recovering slightly to stabilize in the $2.25–$2.27 range. Trading volume remains robust at around $7 billion in the last 24 hours, supporting a market cap of roughly $137 billion.

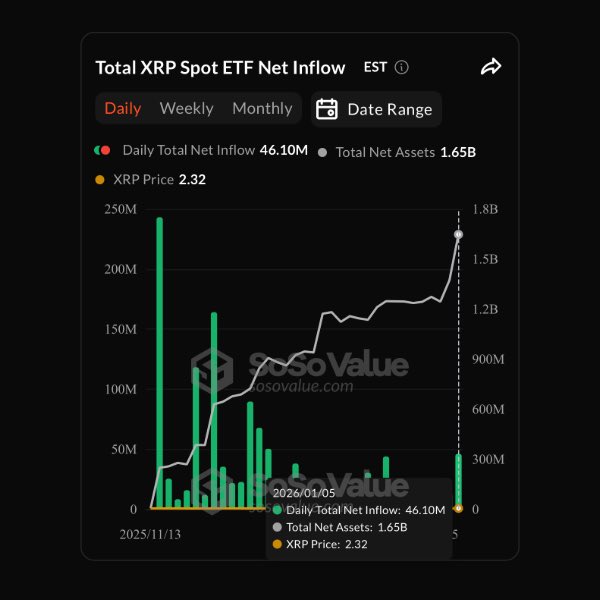

This daily pullback follows a strong recent rally, with XRP posting gains of 20–25% over the past week amid broader altcoin rotation and growing institutional interest. Notable drivers include significant inflows into XRP ETFs. Despite short-term volatility, sentiment remains bullish.

Where’s XRP Momentum Headed?

Looking at the XRP chart from TradingView, the price has shown strong upward momentum, especially with the recent sharp move above the $2.20 resistance level. This is a key point of interest, as the price is currently testing the $2.40 area, signaling a potential continuation of this bullish trend.

The RSI indicator, placed at 66.35, is declining from overbought levels, which suggests that the market has already overstretched. The RSI’s position indicates that the market is bullish, but a correction may be in store if bulls do not attack with conviction.

Elsewhere, the RSI Trend indicator, value above 75, is still showing a bullish trend, reinforcing the idea that XRP’s price action is supported by positive momentum. However, as the indicator enters overbought levels, there is a risk that the bullish trend could slow down or experience a short-term reversal if the momentum starts to wane.

XRP Investors Positioning?

Despite signs of exhaustion on the daily chart, the institutional demand for XRP is still exceptionally strong. On January 5, ETF clients purchased $46.1 million in XRP, bringing the total net assets in ETFs to a massive $1.65 billion.

Typically, it means that investors are increasingly positioning themselves in XRP, possibly in anticipation of further price gains. As of January 6, XRP’s ETF market continues to see robust institutional demand, with a daily total net inflow of $9.22 million. This brings the cumulative total net inflow to $1.25 billion.

thecryptobasic.com

thecryptobasic.com