Morgan Stanley Research Report: Why Might "US Data" Be Misinterpreted? Reassessing the Global IP Platform Value of Pop Mart

On January 5, 2026, Morgan Stanley released an important research report on Pop Mart International Group (9992.HK) .

The core judgment of this report is not complicated but very representative—the market is overly focused on the US and Labubu, while underestimating the overall growth potential of Pop Mart as a “global IP platform.”

In this article, I will break down Morgan Stanley’s logic into three layers.

1. What is the market worried about?

—— US Data and Labubu “Single Point Risk”

Over the past quarter, Pop Mart’s share price fluctuations have been highly correlated withhigh-frequency North American sales data.

Mainstream market concerns are focused on two points:

North America’s 2025 sales have been revised down to about RMB 6 billion

Has Labubu’s popularity in the US already “peaked”?

Morgan Stanley clearly points out:

The market is mechanically extrapolating the exceptionally high third-quarter figures into a trend of decline.

Their assessment is:

A more reasonable level for North American sales in 2025 isabout RMB 7.1 billion

The fourth quarter was not a collapse in demand, but rather a high base effect from third-quarter online pre-sales

The real incremental growth in the fourth quarter comes fromnon-Labubu products + offline channels

In other words,the “slowdown” in the data has been misread as a “recession.”

2. The Overlooked Key Variables

—— Offline Return + IP Breadth

Morgan Stanley believes that a very important and often ignored change is taking place in the North American market:

1️⃣ Online → Offline Is Not a Bad Thing

At one point, North American online sales accounted for 60%–70%, highly concentrated on Labubu

Since the fourth quarter, offline sales have rebounded significantly quarter-on-quarter

Single store annualized output is about RMB 45–50 million, with an investment payback period of only 1–2 months

In offline scenarios:

IP structure is more diversified

Users spend more time in stores

It’s more favorable for “discovery-based consumption” and cross-purchasing

This is precisely the path Pop Mart has repeatedly validated in China and the Asia-Pacific region.

2️⃣ Labubu ≠ All of Pop Mart

A very critical data point is:

Among about 200 new products in 2025, only around 10 are Labubu

Non-Labubu IPs grew 131% year-on-year in the first half of 2025

Morgan Stanley expects another ~120% growth in the second half

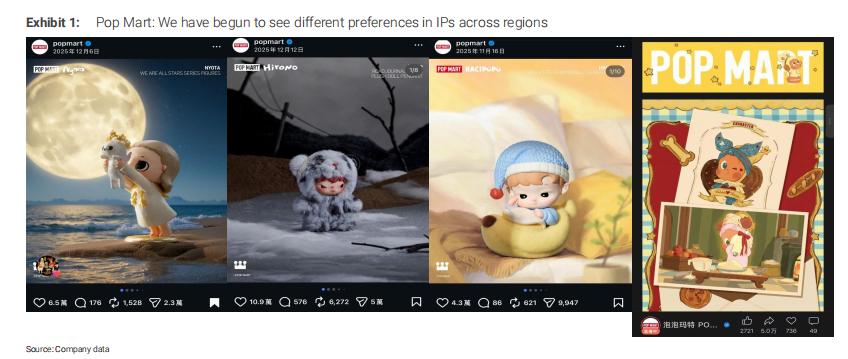

More importantly,different regions are developing differentiated IP preferences:

China: Twinkle Twinkle

Overseas: Hirono, Hacipupu, Nyota, etc.

This means Pop Mart is not “betting on a single character,” but rather operating amulti-IP, cross-regional portfolio pool.

3. Where Is the Real Pricing Error?

—— The Market Underestimates “Group Momentum”

Morgan Stanley believes that the current share price problem is not about short-term data, but thatthe valuation anchor is pegged to the wrong variable.

The current market consensus:

2026 profit is about less than RMB 15.3 billion

Assumes profit growth will significantly slow down in 2026–2027

But Morgan Stanley’s assessment is:

2026 group revenue about RMB 48 billion (+26%)

Net profit about RMB 15.4 billion

If quarterly growth of 5%–10% is achieved in 2026, the current forecast is still conservative

With a share price of about HK$200:

Corresponds to about 16x PE in 2026

If group momentum materializes, there’s significant room for re-rating

My understanding:

In this report, I think the most important sentence is actually:

In 2026, market discussions will shift from “the US + Labubu” to “overall Pop Mart momentum.”

Pop Mart’s real moat is not any single hit product, but rather:

IP ownership

DTC (direct-to-consumer) full-chain control

Rapidly iterative product flywheel

User retention created by offline scenarios

This makes it more like anIP operation platform, rather than a traditional toy company in the conventional sense.

If you only focus on Labubu, this company will always seem “expensive”;

but if you view it within the framework ofglobal kidult consumption structural upgrade, it is still in the early stages.

Of course, this is still a business that isextremely sensitive to product strength, aesthetics, and operations, so volatility will not be small.

But at least from the 2026 pricing logic,the market may not be fully keeping up with its pace yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

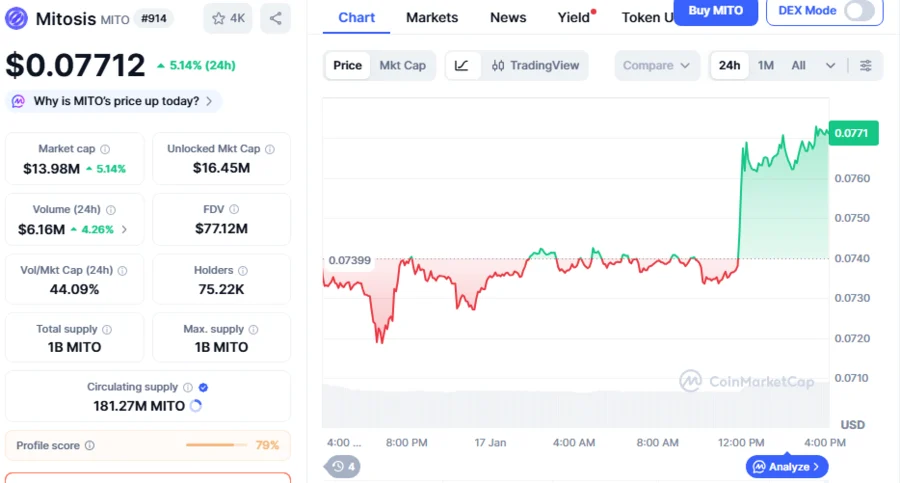

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds