Regeneron Upgraded From Underperform to Buy – Here’s the Reason

Regeneron Pharmaceuticals Sees Analyst Sentiment Shift

Regeneron Pharmaceuticals Inc. (NASDAQ: REGN) is experiencing a notable change in analyst outlook, raising questions about what’s fueling this renewed confidence in the biotech leader.

Following a recent analyst upgrade, investors are examining the factors behind this surge in optimism.

BofA Securities Upgrades Regeneron

On Wednesday, Bank of America (BofA) Securities elevated its rating on Regeneron Pharmaceuticals, highlighting several reasons for the move, such as increased sales of key products.

Analyst Tazeen Ahmad shifted Regeneron’s rating from Underperform to Buy and boosted the price target from $627 to $860.

BofA’s earlier Underperform stance on Eylea SD has largely materialized, with consensus forecasts declining. Now, Ahmad is more bullish on Eylea HD, citing multiple label expansions and projecting revenues that surpass current consensus estimates.

The bank’s outlook on Eylea HD has grown more favorable, especially after recent label updates and the anticipated approval of a prefilled syringe version by mid-2026.

According to Ahmad, feedback from the field suggests that larger practices—which account for most anti-VEGF treatments—are increasingly choosing Eylea HD over Vabysmo.

For 2026, Ahmad estimates that Regeneron’s U.S. Eylea franchise will generate $4.35 billion in revenue.

Growth Drivers Beyond Eylea

BofA also points to further upside from Dupixent, developed in partnership with Sanofi SA (NASDAQ: SNY), as well as promising pipeline opportunities in 2026. Notably, a Phase 3 readout for fianlimab (LAG-3) in melanoma is expected in the first half of that year.

Additional Catalysts on the Horizon

Other potential growth triggers include anticipated positive developments at a major competitor’s conference in January and an expected favorable resolution of Regeneron’s Most Favored Nation (MFN) negotiations with the White House. A positive outcome could lift a lingering cloud over the stock, including a likely exemption from MFN CMMI demonstration projects.

In December 2025, Regeneron and Tessera Therapeutics Inc. announced a worldwide partnership to advance and commercialize TSRA-196.

TSRA-196 is Tessera’s leading investigational in vivo Gene Writing therapy targeting alpha-1 antitrypsin deficiency (AATD), a hereditary condition that can impact the lungs, liver, or both.

Additionally, in October 2025, Regeneron released updated results from its experimental gene therapy DB-OTO, designed to address severe genetic hearing loss caused by mutations in the otoferlin (OTOF) gene.

Stock Performance

REGN Price Movement: As of Wednesday’s publication, Regeneron shares had climbed 4.60% to $812.27, reaching a new 52-week high, according to Benzinga Pro data.

Image credit: Shutterstock

Stock Snapshot

- Regeneron Pharmaceuticals Inc (REGN): $812.91 (+4.60%)

- Sanofi SA (SNY): $47.92 (-0.93%)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Future Contracts Tap into Altcoin Potential at CME Group

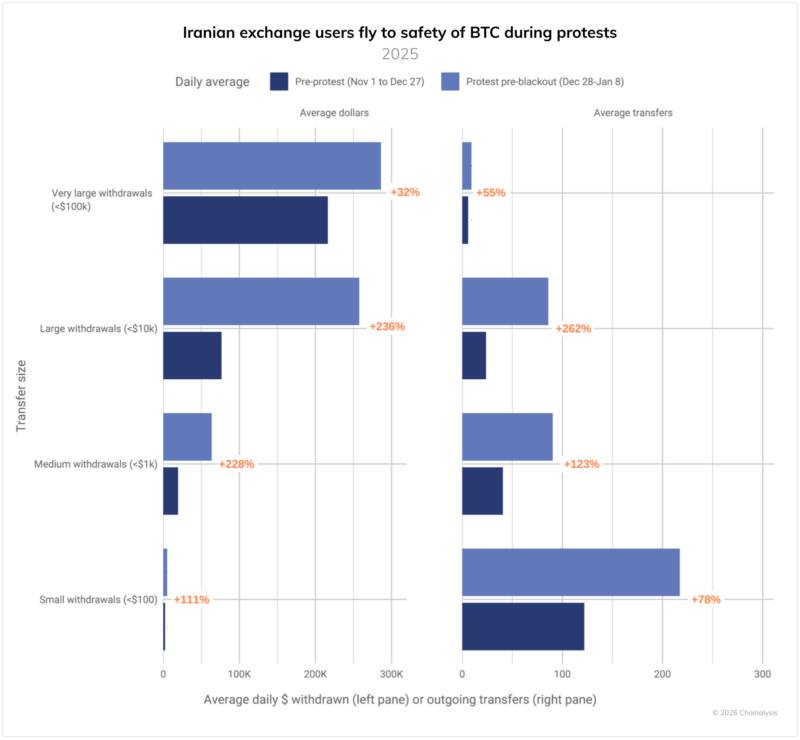

$7.8 Billion and Growing: What Iran’s Crypto Data Reveals About Crisis

Why is Sweetgreen's business struggling?