Is Chipotle Stock Poised for a 'Fiery Comeback' in 2026?

Chipotle Faces Slower Sales as Younger and Lower-Income Customers Cut Back

Smith Collection / Gado / Getty Images

Chipotle has recently experienced a dip in sales, largely due to reduced spending by younger and lower-income diners.

Main Insights

- Experts have highlighted Chipotle as a leading restaurant stock, noting that its shares are currently undervalued. They believe that new business initiatives could help turn things around.

- While the restaurant industry is expected to see better conditions in 2026—especially for fast-casual chains—analysts remain split on the future performance of Starbucks.

Investors might want to reconsider Chipotle as a potential opportunity.

The company’s stock has lost favor after its primary customer base—young professionals with higher incomes—began dining out less frequently. However, with share prices down nearly 40% in 2025, some analysts see this as a chance to buy at a bargain, especially as Chipotle Mexican Grill (CMG) introduces new business strategies.

Both Oppenheimer and Deutsche Bank have named Chipotle among their top restaurant picks, suggesting that limited-time menu items and new sauces could attract more guests. The brand’s recently launched high-protein menu, which includes smaller and more affordable choices, may also appeal to Americans focused on weight management, including those using GLP-1 medications, according to Oppenheimer.

Oppenheimer described Chipotle as being on the brink of a “spicy comeback,” noting that the company is deploying more aggressive sales tactics in 2026, especially as expectations have dropped.

Their research also pointed out that Chipotle continues to offer strong value for money, which could help it outperform competitors if consumer spending on dining out improves.

What Investors Should Know

Market observers suggest that restaurant spending is unlikely to shift significantly in the near term. Factors like the World Cup and changes to the tax code may not influence the industry until later in the year.

Oppenheimer has set a price target of $51 for Chipotle, while Deutsche Bank projects $49. Other analysts are more cautious, expecting the stock to hover near its current price of $39, with the consensus estimate around $46, according to Visible Alpha.

Restaurants struggled in 2025 as lower-income and younger consumers tightened their budgets. Additionally, the departure of 2 to 3 million people due to stricter immigration policies further challenged the industry, analysts noted.

Looking ahead, experts do not foresee conditions worsening in 2026. Deutsche Bank anticipates that events like the World Cup, the United States’ 250th anniversary, and tax reforms that benefit some consumers could help boost sales.

However, the new tax changes are unlikely to benefit lower-income groups, which means quick-service chains may continue to feel the squeeze. Still, analysts believe McDonald’s (MCD) and Domino’s Pizza (DPZ) are well-positioned to thrive in this environment.

Industry Outlook: Fast-Casual Chains May Outperform

Deutsche Bank expects fast-casual and casual dining establishments to perform better than other segments. Both Deutsche Bank and Oppenheimer favor Darden Restaurants (DRI), which owns Olive Garden, and Shake Shack (SHAK). However, they differ in their outlook for Starbucks (SBUX).

While Deutsche Bank lists Starbucks among its top picks, Oppenheimer remains cautious, stating that the company would need to see a significant jump in sales before they are confident in a recovery. “Ultimately, we must remain careful,” they concluded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BOJ Leaves Yen Observers Anxious for Hints of Interest Rate Increases

Trump Demands Countries Pay $1 Billion to Remain on His Peace Council

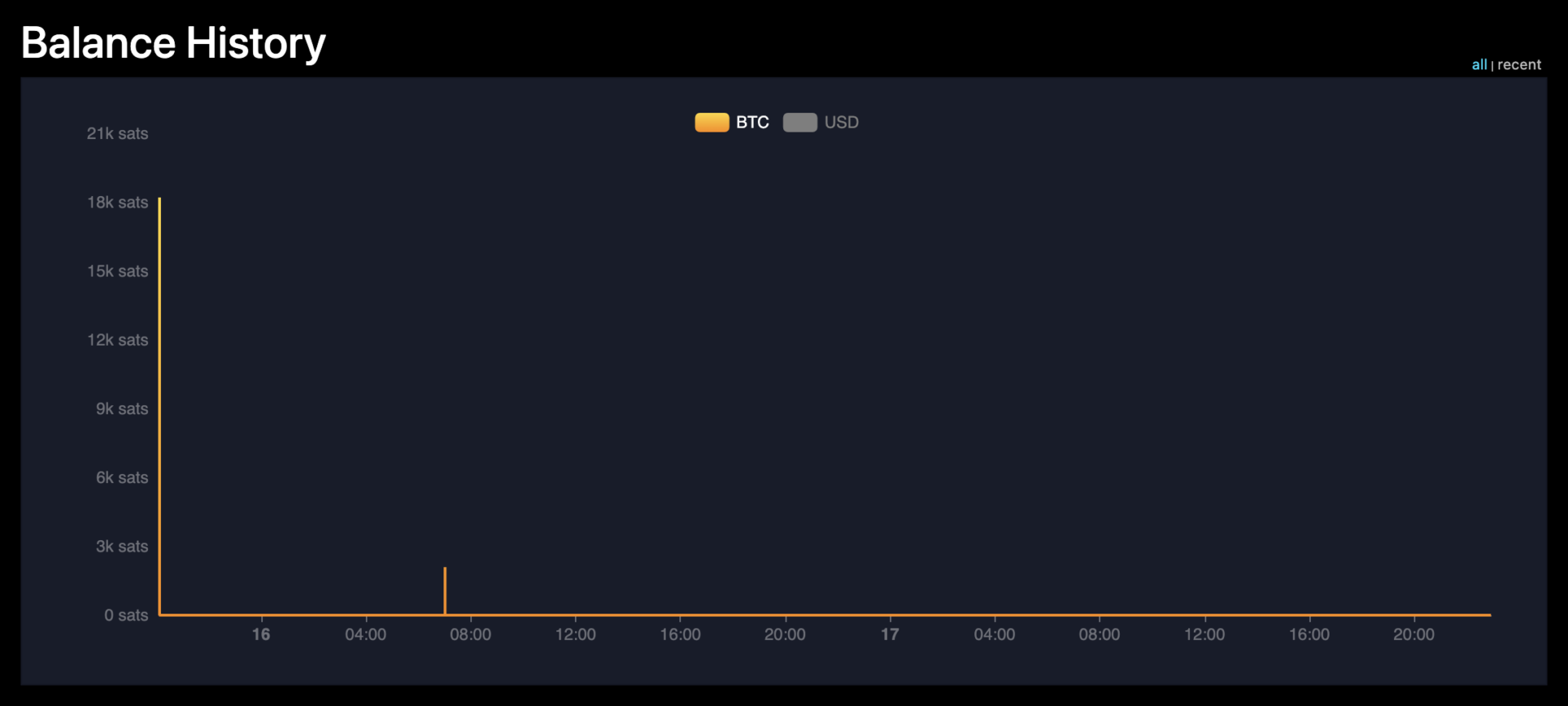

Bitcoin bots drain compromised wallet in RBF fee war