8 top spots to store your money in 2026

Smart Strategies for Managing Your Cash in 2026

As the new year begins, many people are reassessing their personal finances and the broader economic climate in the United States. Although the cost of essentials like food, housing, and utilities remains elevated, inflation has eased over the past year. This has led the Federal Reserve to lower interest rates three times in 2025. Meanwhile, the job market has softened and unemployment has increased.

Given these circumstances, it’s more important than ever to have accessible cash reserves. Whether you’re dealing with job loss or simply higher living expenses, having cash available can provide essential financial security. Choosing the right place to store and grow your money is a key decision.

Top 8 Places to Store Your Cash

The ideal spot for your cash depends on your individual goals and needs. Some accounts offer better returns, while others provide easier access to your funds. Here are eight options to consider for your cash in 2026:

1. High-Yield Savings Accounts

High-yield savings accounts (HYSAs) stand out for their attractive interest rates and easy access to your money. Unlike traditional savings accounts, HYSAs typically offer higher yields, especially from online banks with lower operating costs. The best HYSAs currently offer up to 4% APY, making them a solid choice for growing your savings. However, be aware that some banks may restrict the number of monthly withdrawals you can make.

2. Money Market Accounts

Money market accounts (MMAs) blend features of savings and checking accounts. They often pay higher interest than standard savings accounts and usually come with a debit card or checks for convenient access. While MMAs are more flexible, they may still have withdrawal limits and often require a higher minimum balance, which may not suit those with smaller savings.

3. Short-Term Certificates of Deposit (CDs)

Certificates of deposit allow you to lock in a fixed interest rate for a set period. You generally cannot access your funds until the CD matures without incurring a penalty, but you benefit from guaranteed interest. Short-term CDs, with terms of a year or less, offer competitive rates without tying up your money for too long. In the current market, some short-term CDs feature especially attractive rates.

4. Treasury Bills

Treasury bills are short-term government securities with maturities from four weeks to one year. You purchase them at a discount and receive the full face value at maturity. While not insured by the FDIC, they are considered extremely safe since they are backed by the U.S. government. Treasury bills are a good option if you’ve reached the FDIC insurance limit at your bank or want a low-risk place for your cash. They are also highly liquid and can be sold before maturity, with current yields similar to those of HYSAs and CDs.

5. Series I Bonds

I Bonds are low-risk securities issued by the U.S. Treasury. Their returns combine a fixed rate and an inflation-adjusted rate, updated every six months. The current yield is just over 4%. I Bonds earn interest for up to 30 years, but you can cash them out after 12 months (with a penalty if redeemed before five years). Interest from I Bonds is exempt from state and local taxes, but you only receive your earnings when you cash out or the bond matures. There is an annual purchase limit of $10,000 per person.

6. Money Market Funds

Money market funds are mutual funds that invest in low-risk, short-term debt and cash equivalents. While not insured, they are considered very safe and typically pay dividends in line with short-term interest rates. These funds are highly liquid, allowing you to withdraw your money at any time without penalty. To open a money market fund, you’ll need a brokerage account, but they can serve as a secure place for emergency or short-term savings.

7. High-Yield Checking Accounts

High-yield checking accounts offer interest rates similar to HYSAs, but with the added flexibility of unlimited withdrawals and standard checking features. To qualify for the best rates, you may need to meet requirements such as setting up direct deposit or maintaining a minimum balance. While these accounts can help you earn more on your everyday funds, they are not a substitute for a dedicated savings account, which typically offers higher yields and helps prevent overspending.

8. Cash Management Accounts

Cash management accounts (CMAs) combine the benefits of checking and savings accounts, often offering interest, bill pay, direct deposit, and debit card access. CMAs are typically linked to investment accounts, making it easy to move funds between cash and investments. They are especially useful for those with large cash balances, as they often provide FDIC insurance above the standard $250,000 by partnering with multiple banks. CMAs are also convenient for managing all your finances in one place.

How to Choose the Right Place for Your Cash

When deciding where to keep your cash in 2026, consider these three main factors:

- Risk Tolerance: Assess how much uncertainty you’re comfortable with in exchange for potentially higher returns. While all the options above are generally low-risk, some carry slightly more risk than others.

- Liquidity: Think about how quickly you might need access to your funds. For daily expenses and emergencies, prioritize accounts with high liquidity. For longer-term goals, you might opt for accounts with less immediate access, like CDs.

- Returns: Higher yields can help your savings grow faster, but they often come at the cost of reduced liquidity or security. Balance your desire for returns with your need for access and safety.

Many people find it helpful to use a mix of account types to balance risk, liquidity, and growth potential.

Up Next

- How to deposit cash into a bank account

- Do you know your cash burn rate? Here’s why it matters.

- Is it safe to store money in apps like Venmo, PayPal, and Cash App?

Tips to Make the Most of Your Cash

If you want to stretch your dollars further in 2026, consider these strategies:

- Open a high-yield hybrid account: Some accounts let you earn interest on both checking and savings balances. For example, the Axos ONE account offers up to 4.31% APY on savings and 0.51% APY on checking. SoFi provides similar options.

- Use micro-savings tools: Automate your savings by rounding up purchases or using other micro-savings features. For instance, Ally Bank offers a program that rounds up transactions and moves the difference into your savings account.

- Look for sign-up bonuses: Many banks offer cash incentives for opening new accounts and meeting certain requirements. For example, Chase Bank gives $300 to new checking customers who set up at least $500 in direct deposits within 90 days.

- Set up automatic transfers: Make saving effortless by scheduling regular transfers from your checking to your savings account. This approach helps your savings grow consistently without relying on willpower alone.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

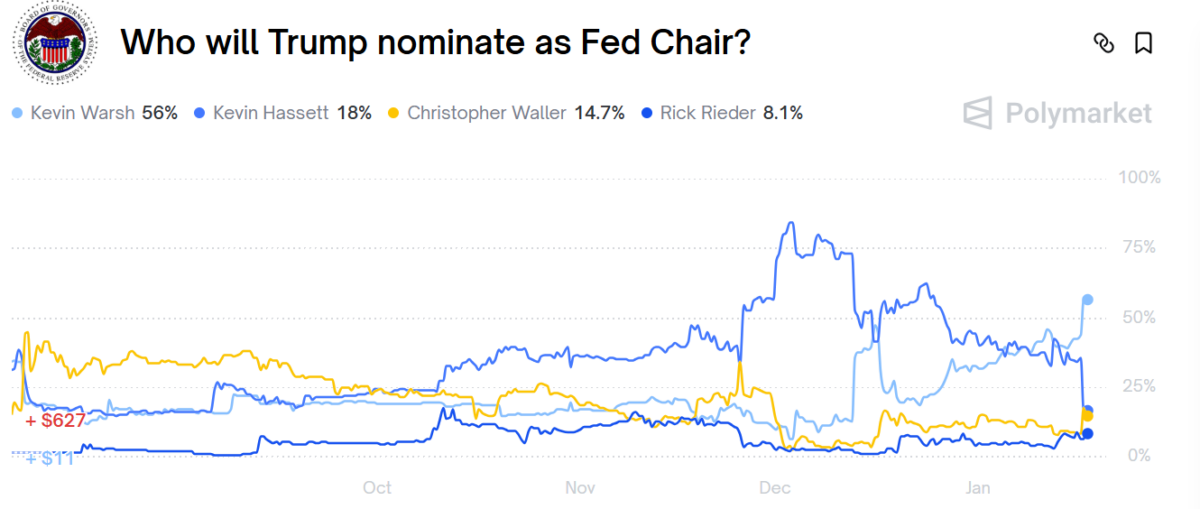

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally