GBP/JPY Price Analysis: Pulls back below 211, momentum shifts bearish

The GBP/JPY retreated for the second consecutive day on Wednesday after hitting a yearly high of 212.16 on Tuesday, dives below 211.00 and posted losses of 0.27%. As Thursday’s Asian session begins, the pair trades unchanged at 210.85.

A scarce economic docket in Japan and the UK, leaves traders adrift to geopolitical developments and risk appetite. A fall in global equity markets on Wednesday undermined the GBP/JPY, which is so far down 0.12% in the year.

GBP/JPY Price Analysis: technical outlook

The GBP/JPY technical picture remains constructive, but a sudden momentum shifts as depicted by the Relative Strength Index (RSI) suggests that a retracement is on the cards.

The RSI from being around 70 it is closing to 60, an indication of bulls losing strength.

With that said, if GBP/JPY clears the December 24 low of 210.06, a drop below 210.00 is likely and would exacerbate a test of December 9 swing high turned support at 208.95. A breach of the latter will expose the 50-day SMA at 206.74.

On the bullish front, if the cross-pair aims above 211.00, bulls could push the exchange rate towards the 212.00 mark.S

GBP/JPY Price Chart – Daily

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

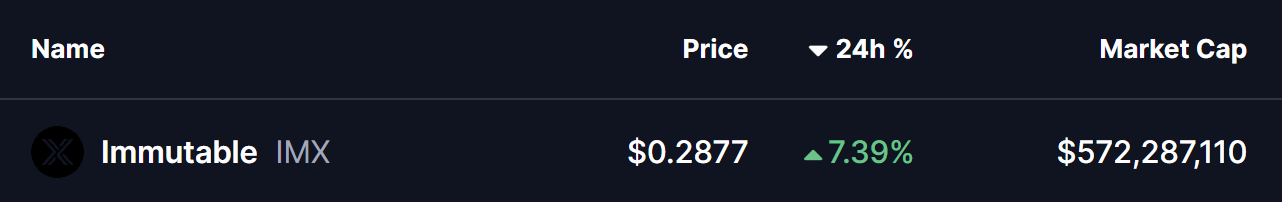

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside