Fleeing the AI Valuation High Ground: Wall Street Strategists Shift Focus, Mid-tier Consumer Stocks May Lead in 2026

Show original

By:格隆汇

Glonghui January 8th|Amid concerns over a slowdown in AI-driven trade growth, strategists across Wall Street are searching for new engines to drive the US stock market bull run. A team led by Ben Snider at Goldman Sachs is focusing on companies that benefit from increased spending by middle-class consumers. Snider's team is optimistic about healthcare providers, materials producers, and manufacturers of essential consumer goods. However, they are particularly bullish on companies that sell "non-essential" rather than "essential" goods. The Goldman Sachs team believes that the US economy is set to accelerate, which will boost the profits of companies with stable growth but lower profit margins—a group that has outperformed since October. "Stocks exposed to middle-income consumer spending are particularly attractive. Value stocks will continue to outperform the broader market into early 2026. The real income growth of middle-income consumers will accelerate, which should translate into improved sales growth." Charlie McElligott, cross-asset macro strategist at Nomura Securities International, said: "Economic growth is being repriced upwards. If this happens, it will be a good sign for more traditional value sectors."

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

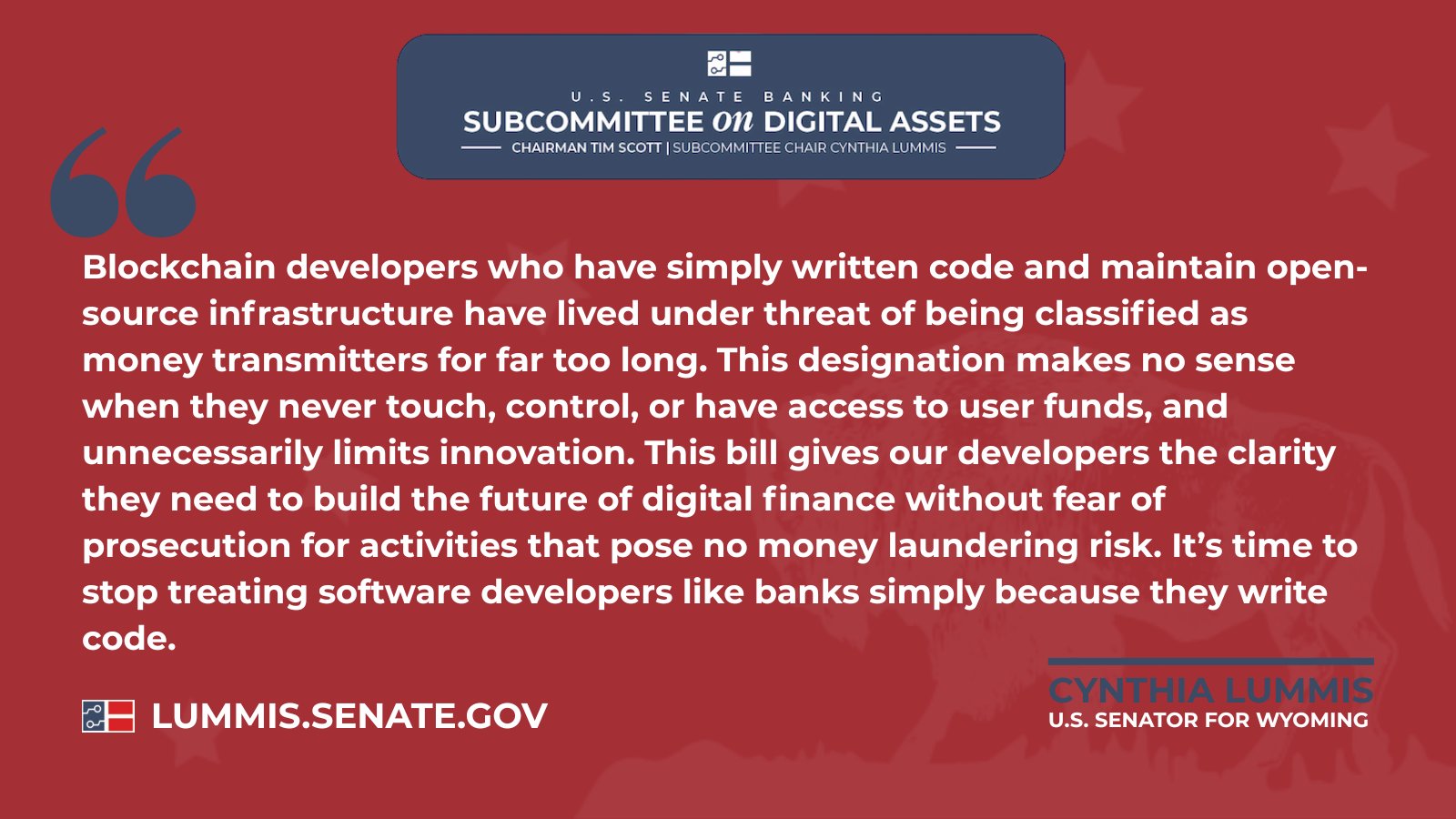

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

AMBCrypto•2026/01/17 10:03

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

BlockchainReporter•2026/01/17 10:00

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com

Kriptoworld•2026/01/17 09:51

TRON Holds Long-Term Ascending Channel as Weekly Trend Stays Firm

Cryptotale•2026/01/17 09:48

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,205.8

-0.33%

Ethereum

ETH

$3,298

-0.20%

Tether USDt

USDT

$0.9995

-0.01%

BNB

BNB

$942.37

+0.77%

XRP

XRP

$2.06

-0.09%

Solana

SOL

$144.51

+1.06%

USDC

USDC

$0.9997

-0.01%

TRON

TRX

$0.3111

+1.26%

Dogecoin

DOGE

$0.1374

-1.34%

Cardano

ADA

$0.3953

+1.06%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now