Money market funds drew in $935 billion over the past year. In 2026, anticipate that figure to be about half as much.

Money Market Funds Continue to Attract Investors

Money market funds have seen a remarkable influx of capital, with $935 billion in new investments last year alone, according to research from Morgan Stanley. This surge exceeded expectations for 2024 and challenged the notion that Federal Reserve rate cuts would prompt widespread withdrawals. Looking ahead, Morgan Stanley anticipates that these funds will keep growing, albeit at a slower rate, with an additional $500 billion expected in 2026—pushing total assets beyond $8.6 trillion by the end of that year.

Even as interest rates potentially decline, many financial advisors still view money market funds as a vital component of their clients’ portfolios. However, they remain adaptable, exploring alternative investment opportunities as well. Gregory Guenther, CFP and managing director at GRANTvest Financial Group, explains, “We rely on money market funds for emergency savings, upcoming expenses, available capital, and as a buffer against market volatility.”

Stay Informed

Related Reads

Understanding the Appeal of Money Market Funds

Money market funds, which focus on short-term, low-risk debt instruments, have gained significant traction since the Federal Reserve began raising interest rates in 2022. The rate hikes peaked in mid-2023, with the federal funds rate reaching a range of 5.25% to 5.5%. Morgan Stanley’s analysis for 2025 revealed:

- Individual investors contributed 34% of total inflows to money market funds, while institutional investors were responsible for 64%.

- Yields for money market funds have surpassed 3% only twice in the past twenty years. For about half of that period, yields were near zero as the Fed maintained rates at historic lows.

Despite several rate reductions, the federal funds rate currently stands between 3.5% and 3.75%, keeping money market funds attractive for those seeking yield. As of Monday, the Vanguard Federal Money Market Fund offered a 7-day yield of 3.69%, while the Fidelity Government Money Market Fund stood at 3.43%. The Crane 100 Money Fund Index reported a yield of 3.58%.

Pete Crane, president of Crane Data, notes, “Yields remain compelling compared to the last two or three decades.” He also points out that traditional bank deposit products—such as checking, savings, and certificates of deposit—are still lagging behind. “Even the lowest-performing money market fund will outperform the best bank deposit over time by a significant margin,” he adds.

Adapting to Changing Rates

Some advisors are preparing for further rate cuts. Catherine Valega, founder of Green Bee Advisory, remarks, “As the Fed continues to lower rates, yields on these funds will decrease as well. I’ll be reassessing liquid alternatives for my clients.”

Exploring Other Opportunities

Other financial professionals are shifting away from money market funds in favor of direct investments in underlying assets. Hardik Patel, founder of Trusted Path Wealth Management, shares, “Yields on Treasury bills have surpassed those of money market funds, so I’ve started moving some assets into T-bills. However, I still use money market funds for cash needed in the near term or for upcoming obligations.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polygon Labs said to have laid off 60 staff following new $250 million acquisition

Hacker swipes $282 million in cryptocurrency through social engineering targeting hardware wallets

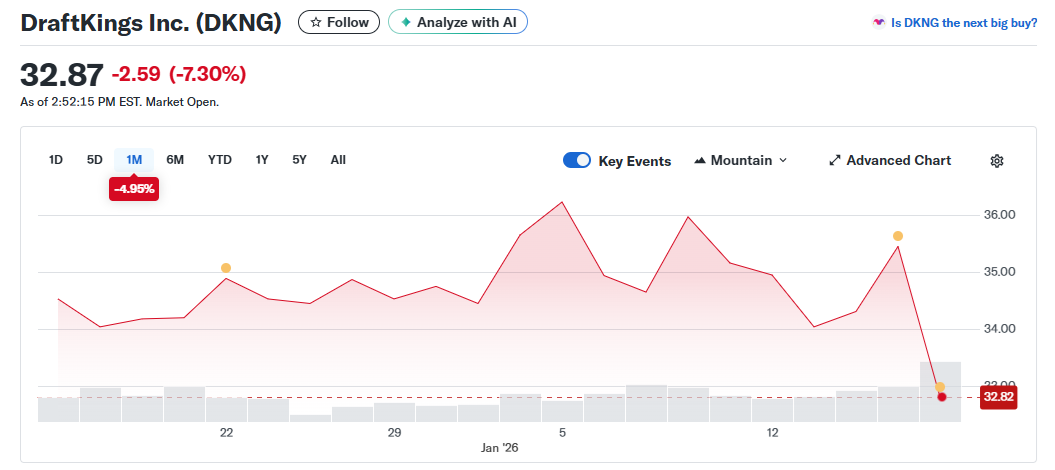

Gambling stocks tumble as platforms lose share to Kalshi and Polymarket

Clients Can Fund IBKR Accounts Via USDC