AZZ (AZZ) Shares Rise: Key Information You Should Be Aware Of

Recent Developments at AZZ

AZZ (NYSE:AZZ), a company specializing in metal coatings and infrastructure solutions, saw its stock rise by 4.7% during morning trading after releasing its fourth-quarter financial results. The company outperformed analyst projections for both revenue and earnings, posting a 5.5% year-over-year increase in revenue to $425.7 million. Adjusted earnings reached $1.52 per share, surpassing Wall Street expectations. Alongside these strong results, AZZ's management issued full-year revenue guidance of $1.66 billion, exceeding analyst forecasts, and slightly raised its outlook for adjusted earnings per share—demonstrating optimism about the company’s future prospects.

Market Reaction and Stock Performance

AZZ’s stock typically experiences low volatility, with only four instances of price swings greater than 5% in the past year. Today’s uptick suggests that investors view the latest financial update as significant, though it may not fundamentally alter the market’s perception of the company.

One of the most notable movements in the past year occurred six months ago, when AZZ shares surged 9.9% following the announcement of record-breaking first-quarter results for fiscal 2026 and an upward revision of full-year guidance.

Financial Highlights and Outlook

In that quarter, AZZ reported adjusted earnings per share of $1.78—a 21.9% increase from the previous year and well above the consensus estimate of $1.58. Although total sales reached $422 million, marking a 2.1% year-over-year rise, this figure fell slightly short of analyst expectations. The company’s Metal Coatings division was a key driver of profitability, with sales climbing 6.0% to $187.2 million thanks to increased demand for hot-dip galvanized steel and enhanced operational efficiency. Encouraged by these results, AZZ raised its full-year fiscal 2026 guidance, now projecting adjusted earnings per share between $5.75 and $6.25—reflecting management’s confidence in ongoing growth.

Since the start of the year, AZZ shares have gained 5.5%. Currently trading at $115.82, the stock is near its 52-week high of $119.54 set in September 2025. An investor who purchased $1,000 worth of AZZ shares five years ago would now see that investment grow to $2,344.

Industry Trends and Future Opportunities

The 1999 book Gorilla Game accurately predicted the rise of tech giants like Microsoft and Apple by focusing on early identification of dominant platforms. Today, enterprise software firms integrating generative AI are emerging as the next industry leaders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026

XRP Hits $2.17 But Digitap ($TAP) Is Technically The Best Crypto To Buy 2026

Pump.fun Revolutionizes Fee System: Catalyst for New Dynamics in the Memecoin Arena

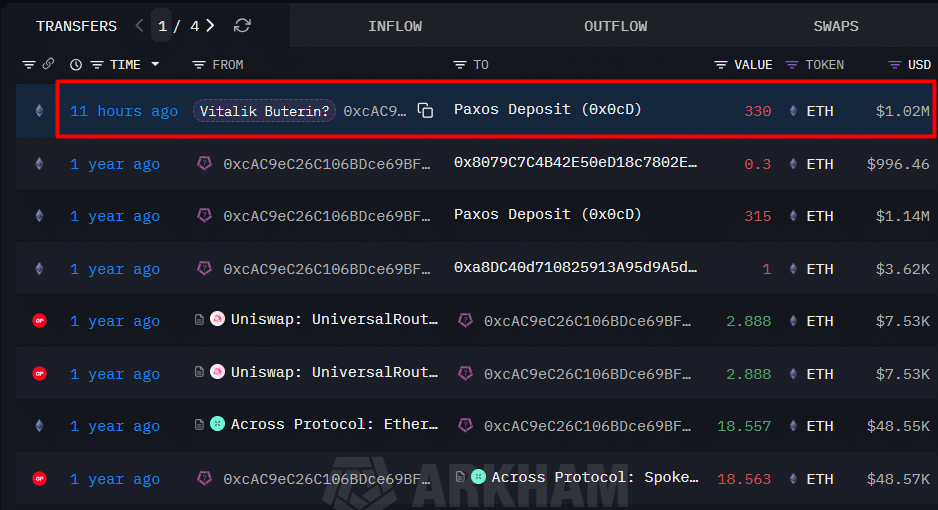

Ethereum locks 1mln as Vitalik Buterin warns of ‘corposlop’ – Identity crisis ahead?