Is the Market Showing Optimism or Pessimism Toward Planet Labs PBC?

Planet Labs PBC Sees Increase in Short Interest

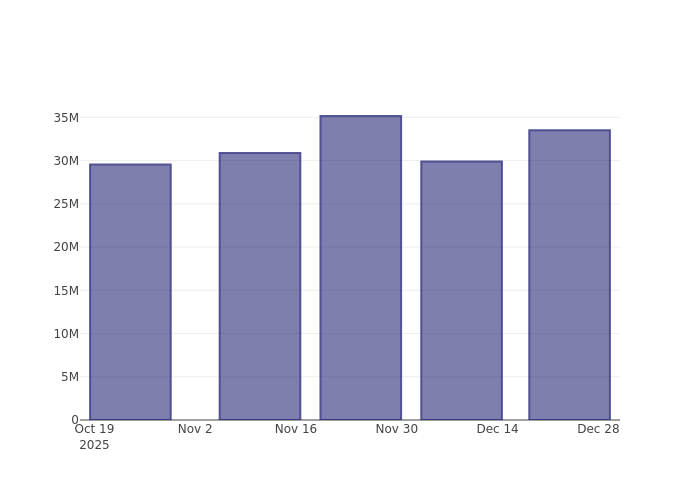

Recent data shows that short interest in Planet Labs PBC (NYSE: PL) has climbed by 9.52% since the previous report. There are now 33.5 million shares sold short, representing 13% of the company’s publicly traded shares. At the current trading pace, it would take traders an average of 2.16 days to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been borrowed and sold by traders who anticipate a decline in the stock’s price. Short selling allows investors to profit if the stock price drops, but they face losses if the price rises instead.

Monitoring short interest can provide insight into how investors feel about a stock. A rise in short interest often indicates growing pessimism, while a decline can suggest increasing optimism among traders.

Short Interest Trends for Planet Labs PBC

The chart above illustrates the upward trend in the percentage of Planet Labs PBC shares being sold short over the past three months. While this doesn’t guarantee an imminent drop in share price, it does highlight that more investors are betting against the stock.

How Planet Labs PBC Compares to Its Industry Peers

Analysts and investors often compare companies to similar businesses—known as peers—based on factors like industry, size, and financial structure. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest among Planet Labs PBC’s peer group is 5.97% of float. This means Planet Labs PBC currently has a higher level of short interest than most comparable companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Dynamics of Bitcoin Shift with Institutional Flow Influence

Cache Wallet Integrates NexFi for Instant, Transparent Global Transfers

GBP/JPY Price Forecast: Pound tests support at 212.0 on intervention threats

JPMorgan Establishes a New Group to Capitalize on the Surge in Private Markets