Why the red-hot surge in metal markets may be on the verge of faltering

Metals Market Surge Faces Potential Slowdown

-

Experts anticipate that the recent surge in gold, silver, and copper prices may soon lose momentum.

-

Both precious and industrial metals experienced significant gains in 2025, with silver soaring by 150%.

-

However, some metals now appear to be overbought, and the enthusiasm among investors is expected to diminish.

The dramatic rise in precious metals may reach its peak this year.

Following a period of sharp increases for precious and industrial metals in 2025, analysts predict that the strong demand for gold, silver, and copper is likely to subside, potentially leading to a drop from their current record highs.

According to a recent report from Capital Economics, the "fear of missing out" that has fueled demand for precious metals is expected to fade in 2026, possibly resulting in a swift decline in prices.

In another analysis, the firm forecasts that copper, which is currently valued at around $13,200 per ton, could fall to approximately $10,500 per ton by year-end—a decrease of about 20%.

Back in October, Capital Economics also projected that gold could end 2026 at roughly $3,500 per ounce, signaling a 21% drop from its present price.

David Oxley, chief climate and commodities economist at Capital Economics, noted that the rapid price increases in late 2025 may have been driven in part by heightened activity from retail investors.

Oxley explained that the impressive rallies in metals like silver and copper were fueled by supply shortages at a time when demand—particularly from data centers and AI infrastructure—was climbing. Both metals are currently experiencing limited availability as demand surges.

He added that elevated prices often encourage increased recycling and production, which can boost overall supply. At the same time, demand for certain metals, such as silver, appears to have become less responsive to price changes, suggesting that a market correction may be on the horizon.

"Looking forward, the saying that 'high prices are the cure for high prices' is likely to hold true over time," Oxley remarked.

He further stated, "Despite increasingly optimistic forecasts from other analysts, we maintain our view that gold and other precious metals will finish this year below their current values."

Technical Indicators Signal Overbought Conditions

Some metals are already showing technical signs of being overbought. For example, Société Générale's analysis of gold's Relative Strength Index indicates that gold is more overbought now than ever before.

Silver, too, appears to be overheating, according to Wells Fargo Investment Institute, which referenced the metal's RSI in a December report.

Speculation and Market Adjustments

Joe Mazzola, head of trading and derivatives strategy at Charles Schwab, attributed some of the recent strength in precious metals to speculative buying.

Meanwhile, Deutsche Bank analyst Michael Hsueh pointed out that the annual rebalancing of the Bloomberg Commodity Index in January could reduce the index's exposure to gold and silver, potentially putting downward pressure on their prices.

If metals experience the kind of declines some experts are forecasting, it would mark a reversal of what has been an extraordinary rally.

Record-Breaking Year for Metals

-

Gold, often seen as a safe haven and hedge against inflation, gained 64% in 2025—its strongest performance since 1979.

-

Silver skyrocketed by 150% in 2025, also marking its best year since 1979.

-

Copper prices in New York jumped over 40%, achieving their best annual gain since the global financial crisis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC emphasizes interoperability over closed networks in tokenization

WeLab’s $220M Raise Shows Institutional Bet on Asia Fintech

Ethereum Faces Challenges: Market Trends and Investor Insights

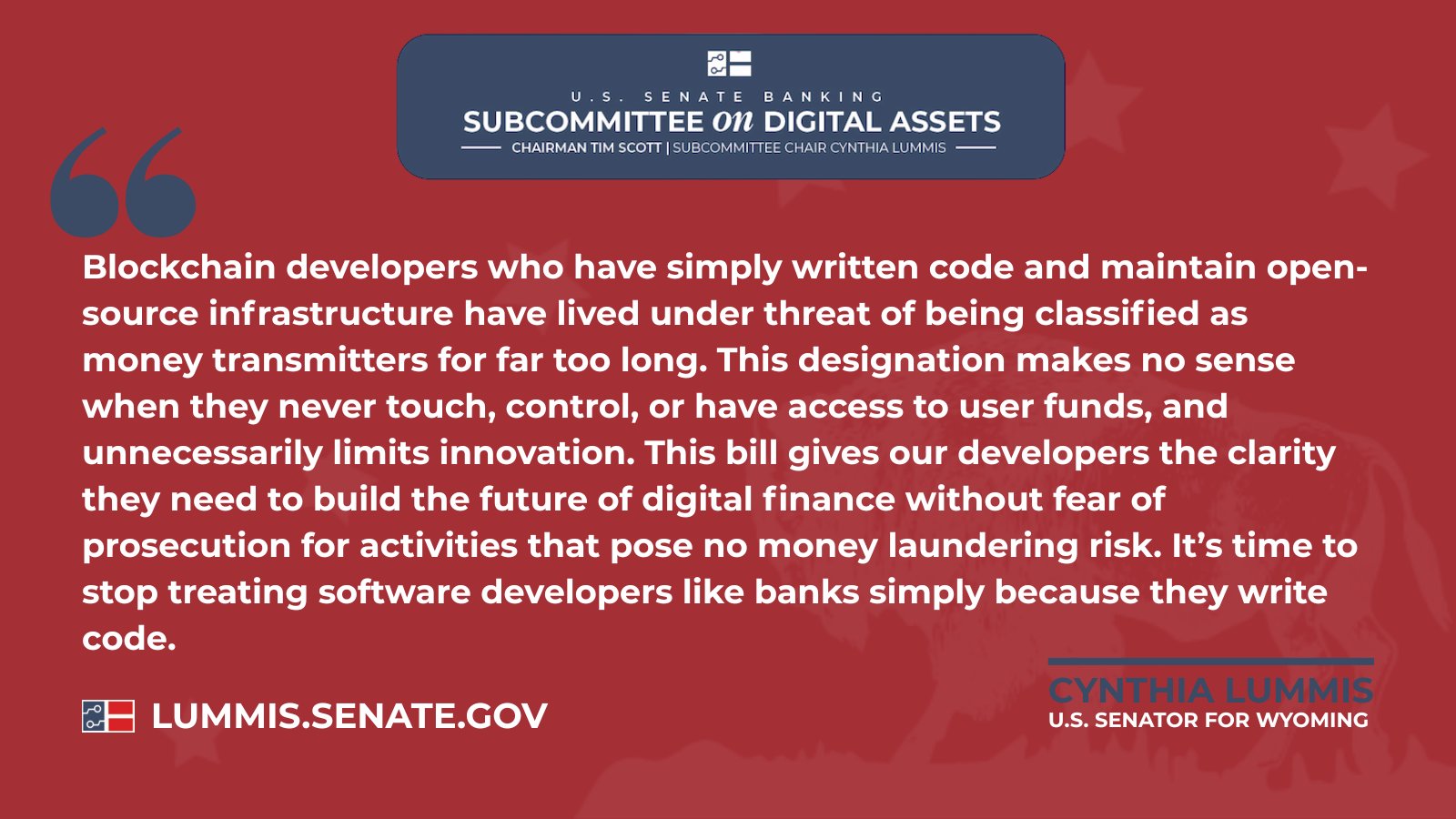

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill