Is Exxon Mobil Stock Worth Buying, Selling, or Holding in January 2026?

Investor Spotlight on Oil Stocks Amid Geopolitical Shifts

Oil stocks have captured renewed attention from investors this week after significant geopolitical events: the United States has apprehended Venezuelan President Nicolás Maduro. This development has sparked speculation that American oil companies could be instrumental in revitalizing Venezuela’s long-neglected energy sector. Shares of major U.S. energy firms, including Exxon Mobil (XOM), have surged as the market anticipates the reopening of Venezuela’s vast crude oil reserves, which have suffered from years of limited investment and sanctions.

With these evolving factors in Venezuela and broader industry trends at play, is now the right time to consider XOM shares? Let’s delve deeper.

Related Updates from Barchart

Exxon Mobil: Company Overview

Exxon Mobil stands as one of the globe’s leading integrated energy corporations, involved in the discovery, extraction, refining, and distribution of oil, natural gas, and petrochemical products worldwide. Based in Spring, Texas, the company operates through key divisions such as upstream, downstream, and chemicals, and is increasingly investing in lower-emission technologies and innovative energy solutions. With a market value of $499 billion, Exxon Mobil is recognized as a dominant force in the energy sector.

Over the past year, Exxon Mobil’s share price has mirrored both the cyclical nature of energy markets and the impact of recent geopolitical events. Early in 2026, following the U.S. capture of Venezuela’s president, energy stocks—including Exxon—experienced a notable rally. This event was seen by investors as a potential opening for American oil giants to re-enter Venezuela’s oil market.

In the days after the announcement, XOM shares rose sharply, reaching a new 52-week peak of $125.93 on January 5. Over the last year, the stock has delivered a 15% gain.

This so-called “Venezuela effect” has shifted investor sentiment, positioning energy stocks as strategic assets within the broader geopolitical landscape, even as oil prices themselves remain relatively steady.

Venezuela’s Oil Industry: Opportunities and Challenges

Despite possessing the world’s largest proven oil reserves—over 300 billion barrels—Venezuela currently accounts for less than 1% of global oil production. Years of mismanagement, lack of investment, and U.S. sanctions have led to a dramatic decline in output and left the country’s energy infrastructure in disrepair.

While some industry experts estimate that revitalizing Venezuela’s oil sector could require more than $100 billion and a decade of work, analysts at J.P. Morgan suggest that production could rise to between 1.3 and 1.4 million barrels per day within two years if there is a political transition. U.S. oil majors like Exxon Mobil are viewed as likely participants, especially given the demand for Venezuela’s heavy crude oil.

XOM currently trades at a valuation above its industry peers, with a forward price-to-earnings ratio of 17.

Exxon Mobil’s Q3 2025 Financial Results

On October 31, Exxon Mobil reported its third-quarter 2025 earnings, posting an adjusted earnings per share (EPS) of $1.88. This figure slightly surpassed analyst expectations but was down from $1.92 in the same quarter of 2024.

The company generated approximately $85.3 billion in revenue for the quarter, a decrease from $90 billion a year earlier. However, year-to-date oil-equivalent production increased to 4.7 million barrels per day, with record output in the Permian Basin (nearly 1.7 million boepd) and Guyana (over 700,000 boepd).

Exxon Mobil maintained strong cash generation, with $14.8 billion in operating cash flow and $6.3 billion in free cash flow, though free cash flow was lower than the previous year. The company returned $9.4 billion to shareholders through $4.2 billion in dividends and $5.1 billion in share buybacks, reinforcing its commitment to shareholder returns.

Additionally, Exxon reaffirmed that its full-year 2025 capital expenditures would come in just below the lower end of its $27–$29 billion guidance, reflecting prudent spending and ongoing structural cost reductions, which are expected to surpass $18 billion cumulatively by 2030.

Analysts expect Exxon’s EPS to fall 11% year-over-year to $6.92 in fiscal 2025, followed by a modest 2% increase to $7.06 in 2026.

Analyst Outlook for Exxon Mobil Shares

In the past month, UBS reiterated its “Buy” rating and set a $145 price target after Exxon’s corporate update. TD Cowen also raised its target to $135 from $128, maintaining a “Buy” rating and highlighting improved long-term earnings and cash flow prospects.

Currently, Exxon Mobil holds a consensus rating of “Moderate Buy.” Of the 27 analysts covering the stock, 14 recommend a “Strong Buy,” one suggests a “Moderate Buy,” 11 rate it as “Hold,” and one issues a “Strong Sell.”

The average analyst price target for XOM is $131.35, implying a potential upside of 7%. The highest target on Wall Street stands at $158, which would represent a possible 28% gain from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026

XRP Hits $2.17 But Digitap ($TAP) Is Technically The Best Crypto To Buy 2026

Pump.fun Revolutionizes Fee System: Catalyst for New Dynamics in the Memecoin Arena

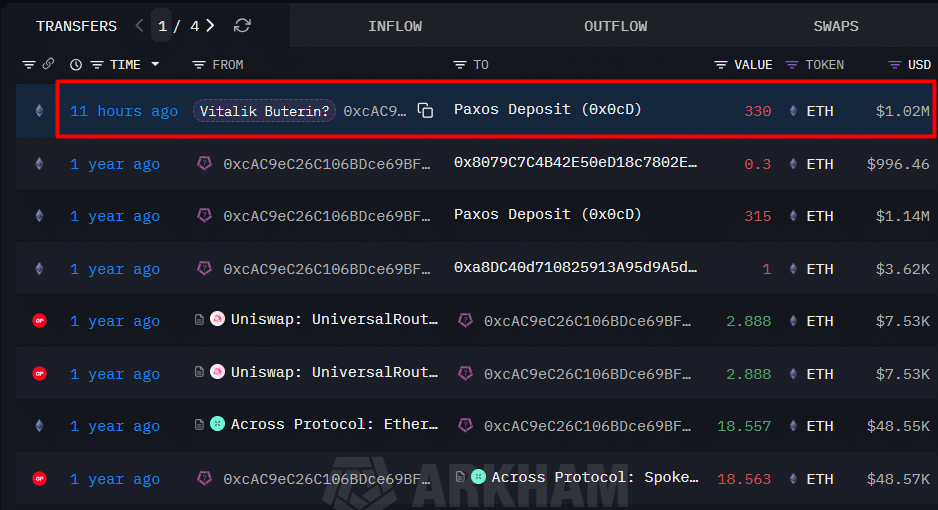

Ethereum locks 1mln as Vitalik Buterin warns of ‘corposlop’ – Identity crisis ahead?