Wingtech pursues international arbitration against Dutch state over Nexperia seizure

By Toby Sterling

AMSTERDAM, Jan 9 (Reuters) - China's Wingtech is seeking international arbitration in pursuit of up to $8 billion in damages following the Netherlands' seizure of chipmaker Nexperia, two sources familiar with the legal proceedings told Reuters.

The move, part of a broader fight over Nexperia which has upset supply chains for carmakers around the globe, could move the dispute from Dutch courts, where a key hearing is set for January 14.

Wingtech, which owns Nexperia, served formal notice to the Dutch foreign and economic affairs ministries on October 15, which opened a six-month period for the parties to settle before arbitration begins.

The Dutch state seized control of Nexperia on September 30, saying the move was needed to prevent the company's Chinese CEO from moving operations and intellectual property to China. The Dutch government suspended the move in November but its action prompted a breakdown between the company's European production and Chinese packaging and distribution arms.

Wingtech's case invokes Article 10 of the Netherlands-China investment treaty, which says that each country's investors should be treated on equal terms as domestic investors and compensated in the event of state interference.

The Dutch economic affairs ministry and Wingtech declined comment.

Under the treaty, arbitration would be heard at the International Centre for Settlement of Investment Disputes, which is part of the World Bank.

Steffen Hindelang, a professor of trade law at Sweden's Uppsala University who is not involved in the case, said the Dutch intervention at Nexperia was sufficient grounds for arbitration, though it was not possible to say what the result might be.

The Dutch state might argue that its intervention was legal and did not harm Nexperia's value.

However, any state action at a company "impacts the value of your investment and calls into question whether you can successfully divest", Hindelang said.

Nexperia reported $331 million in profit on $2.06 billion in sales in 2024.

(Reporting by Toby Sterling; Editing by Emelia Sithole-Matarise)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

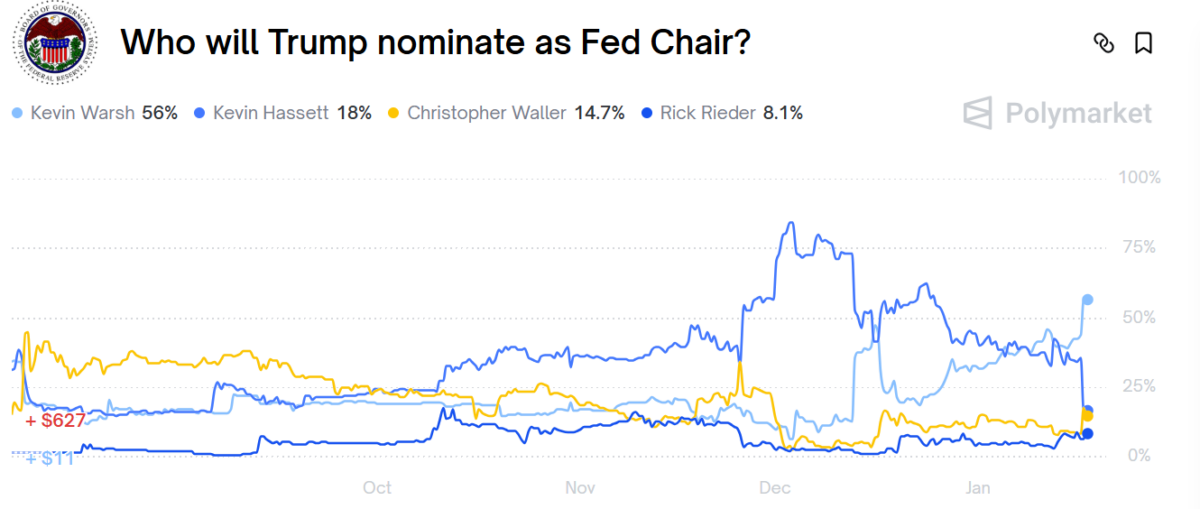

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA