Shiba Inu price action shows clear signs of consolidation after a sharp rally earlier this month. The SHIB/USD pair has shifted into a corrective phase, reflecting cooling momentum across the broader meme coin market.

After reaching a local peak near $0.00001000, price began forming lower highs on the 4-hour chart. Consequently, traders now monitor whether this pullback represents healthy consolidation or the start of deeper downside pressure.

Besides short-term weakness, SHIB continues trading above its long-term trend support. The 200-period exponential moving average near $0.00000810 remains intact. Hence, the broader recovery structure still holds, despite recent selling pressure. However, the loss of short-term averages suggests bulls face a near-term challenge.

From a technical perspective, SHIB recently slipped below the 20 EMA around $0.00000878. Additionally, price now hovers close to the 50 EMA near $0.00000850. This positioning signals near-term bearish control while longer-term buyers remain active.

Significantly, the $0.00000850 zone acts as immediate support and aligns with short-term trend balance. A sustained move below $0.00000810 would weaken market structure and increase downside risk.

SHIB Price Dynamics (Source: Trading View)

SHIB Price Dynamics (Source: Trading View)

Consequently, the next downside target could emerge near $0.00000755, which aligns with a key Fibonacci retracement. Below that level, $0.00000682 represents a major swing low and invalidation point.

On the upside, SHIB must reclaim $0.00000885 to shift sentiment. Moreover, a break above $0.00000900 could reopen the path toward $0.00000935 and the $0.00001000 region.

Source:

Source:

SHIB futures data highlights growing speculative behavior rather than sustained conviction. Open interest has historically surged during sharp price expansions, often exceeding $500 million. However, these spikes frequently unwind once momentum fades. Consequently, leverage-driven rallies tend to remain short-lived.

Recent sessions show open interest rebounding toward $109 million while price remains range-bound. This divergence suggests renewed derivatives activity without clear directional commitment. Hence, short-term traders continue dominating price action.

Source:

Source:

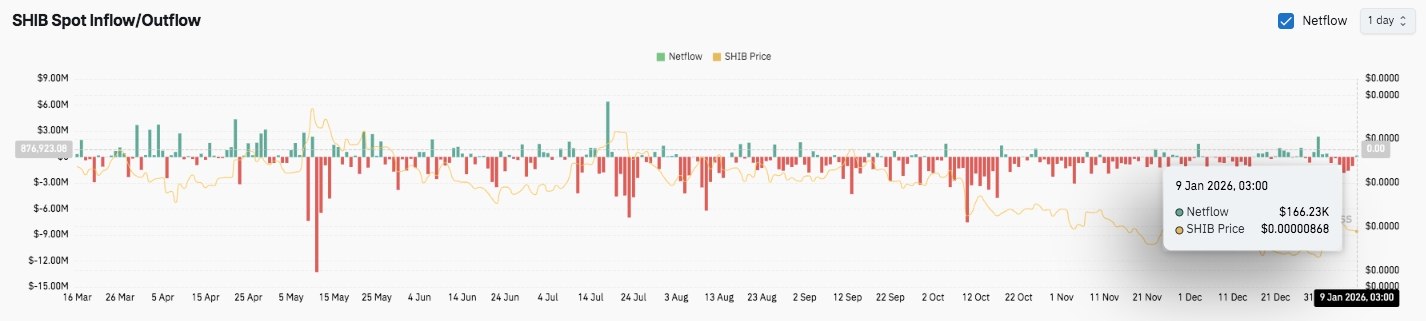

Spot market data further supports a defensive stance among participants. Outflows have consistently outweighed inflows during recent months. Large withdrawal spikes coincided with notable price pullbacks in May, July, and October.

Although recent inflows reached roughly $166,000, the figure remains modest. Additionally, the inflow lacks follow-through compared with earlier distribution phases. Consequently, accumulation signals remain limited.

Shiba Inu price trades at a critical inflection point as technical levels tighten into a narrow range. The structure shows compression, suggesting a volatility expansion phase may approach.

On the upside, immediate resistance levels sit at $0.00000885, $0.00000935, and $0.00001000. A confirmed breakout above this zone could open the path toward $0.00001150 and $0.00001200. These levels mark prior distribution zones and psychological barriers.

On the downside, $0.00000850 remains the first line of defense for buyers. Below that, the $0.00000810 region near the 200 EMA acts as a pivotal trend support. A sustained loss of this level could expose SHIB to deeper downside targets at $0.00000755 and $0.00000682. The broader structure still favors recovery as long as price holds above the long-term average.

Technically, SHIB appears to be coiling within a tightening range, reflecting indecision between buyers and sellers. Momentum indicators remain subdued, while volume lacks strong directional commitment. Consequently, a decisive move outside the current range could trigger accelerated price action.

The short-term outlook depends on whether buyers can defend the $0.00000810–$0.00000850 support zone. Holding this area would allow SHIB to challenge the $0.00000885–$0.00000935 resistance cluster. Strong inflows and improving momentum could extend gains toward $0.00001000 and beyond.

However, failure to hold support risks breaking the consolidation base and shifting control back to sellers. For now, SHIB remains in a pivotal zone, where confirmation will define the next directional move.