Stock Market Update: Nasdaq 100 and S&P 500 Futures Rise as Investors Look Ahead to December Employment Data— Spotlight on General Motors, Offerpad, and Tilray

US Stock Market Update: Futures Rebound Amid Global Unrest

On Friday, US stock futures reversed earlier declines and moved higher, following a mixed performance the previous day. Major indices were all in positive territory in premarket trading.

Investor sentiment was influenced by escalating tensions in Iran, which pushed WTI crude oil prices higher. Gold prices remained steady, while silver saw modest gains.

With the Iranian government implementing a nationwide internet shutdown to suppress protests, traders are closely monitoring the potential impact on global markets and the broader economy.

The US Supreme Court is expected to deliver a decision today regarding tariffs imposed by former President Donald Trump. Investors are also awaiting the release of December's employment data.

The yield on the 10-year US Treasury note stood at 4.18%, while the two-year yield was at 3.50%. According to CME Group's FedWatch tool, there is an 86.2% probability that the Federal Reserve will maintain current interest rates at its January meeting.

Premarket Futures Performance

| Index | Change |

|---|---|

| Dow Jones | +0.05% |

| S&P 500 | +0.08% |

| Nasdaq 100 | +0.15% |

| Russell 2000 | +0.11% |

ETF Movers

The SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust ETF (QQQ), which mirror the S&P 500 and Nasdaq 100 respectively, both traded higher before the opening bell. SPY rose 0.067% to $689.97, while QQQ gained 0.084% to $620.99, based on Benzinga Pro data.

Stocks to Watch

General Motors

- General Motors Co. (GM) fell 0.63% in premarket trading after disclosing a $7.1 billion loss related to its electric vehicle investments.

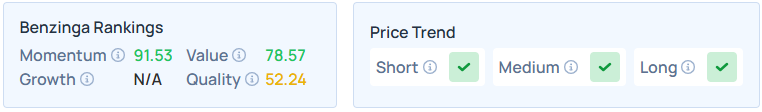

- According to Benzinga’s Edge Stock Rankings, GM shows a strong price trend across all timeframes and holds a moderate quality score.

Rio Tinto

- Rio Tinto PLC ADR (RIO) dropped 2.46% after confirming merger discussions with Glencore.

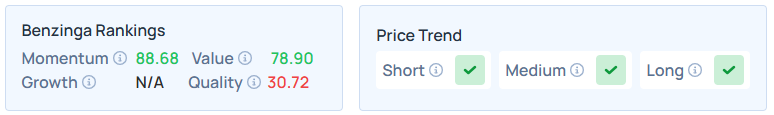

- Benzinga's Edge Stock Rankings indicate Rio Tinto maintains a robust price trend across all periods and boasts a high value rating.

Tilray Brands

- Tilray Brands Inc. (TLRY) surged 8.32% after reporting second-quarter results that exceeded analyst expectations on both revenue and earnings.

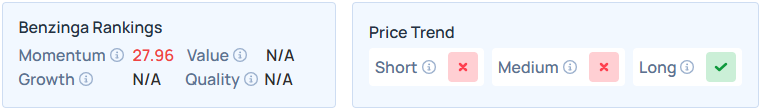

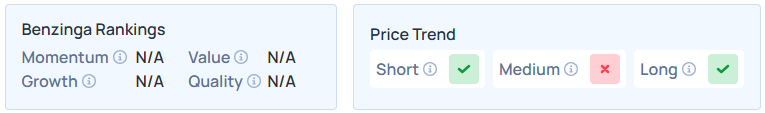

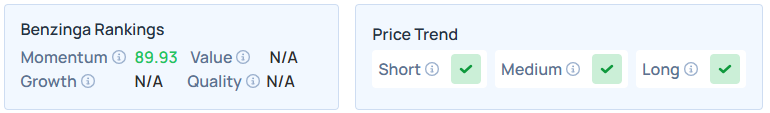

- TLRY demonstrates a strong long-term price trend, though its short- and medium-term trends are weaker.

Offerpad Solutions

- Offerpad Solutions Inc. (OPAD) jumped 38.82% following a new housing market proposal from former President Trump.

- Benzinga’s Edge Stock Rankings show OPAD has strong short- and long-term price momentum, but a weaker medium-term trend.

Kalvista Pharmaceuticals

- Kalvista Pharmaceuticals Inc. (KALV) shares rose 13.65% after the company announced preliminary global net product revenue for the fourth quarter, estimating EKTERLY sales between $35 million and $49 million.

- KALV maintains a strong price trend across all timeframes, according to Benzinga's Edge Stock Rankings.

Highlights from the Previous Session

US markets saw widespread gains, with Energy and Consumer Staples leading the way. Information Technology and Health Care were the only sectors to post losses.

| Index | Change | Closing Value |

|---|---|---|

| Nasdaq Composite | -0.44% | 23,480.02 |

| S&P 500 | +0.0077% | 6,921.46 |

| Dow Jones | +0.55% | 49,266.11 |

| Russell 2000 | +1.11% | 2,603.90 |

Analyst Perspectives

Scott Wren from Wells Fargo Investment Institute encourages investors to look beyond daily headlines and focus on the underlying economic and policy trends shaping the markets.

- He highlights four key themes for the year: resilient capital spending on AI, substantial tax incentives, ongoing Federal Reserve rate reductions, and regulatory easing.

- Wren predicts that productivity, driven by automation, will become an even more prominent topic in 2026 as companies adapt to labor shortages.

- While Technology and Communication Services led in 2025, he believes the influence of AI will extend into other sectors, particularly Industrials and Utilities, which are crucial for data center development.

- He also sees opportunities in Midstream Energy and Industrial Metals, such as copper, to support infrastructure growth. Wren concludes that following these innovation trends is key to success in 2026, rather than reacting to short-term news.

Key Economic Data to Watch

Investors will be monitoring several important releases on Friday:

- The US employment report for December is due at 8:30 a.m. ET.

- Additional data, including the unemployment rate, average hourly earnings, October housing starts, and January's University of Michigan consumer sentiment, will be released by 9:45 a.m. ET.

- Richmond Fed President Tom Barkin is scheduled to speak at 1:35 p.m. ET.

Commodities, Gold, Cryptocurrency, and Global Markets

- Crude oil futures climbed 0.28% in early New York trading, reaching around $57.92 per barrel.

- Gold slipped 0.13% to approximately $4,471.65 per ounce, while the US Dollar Index rose 0.13% to 99.0620.

- Bitcoin (BTC) traded 0.51% higher at $90,195.78 per coin.

- Asian markets ended the day mixed: India's Nifty 50 and Australia's ASX 200 declined, while China's CSI 300, Japan's Nikkei 225, Hong Kong's Hang Seng, and South Korea's Kospi advanced. European markets also showed mixed performance in early trading.

Further Reading

- Palantir, Profits, And Power: Beth Kindig Uses 2025 Trends To Find The Next Market Leaders

Image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZKP Shows Growing Momentum With 100x ROI Projections: Is It the Top Crypto to Buy in 2026?

Weekly Crypto Gainers – Dash Up 129%, Monero and ICP Post Double-Digit Rallies

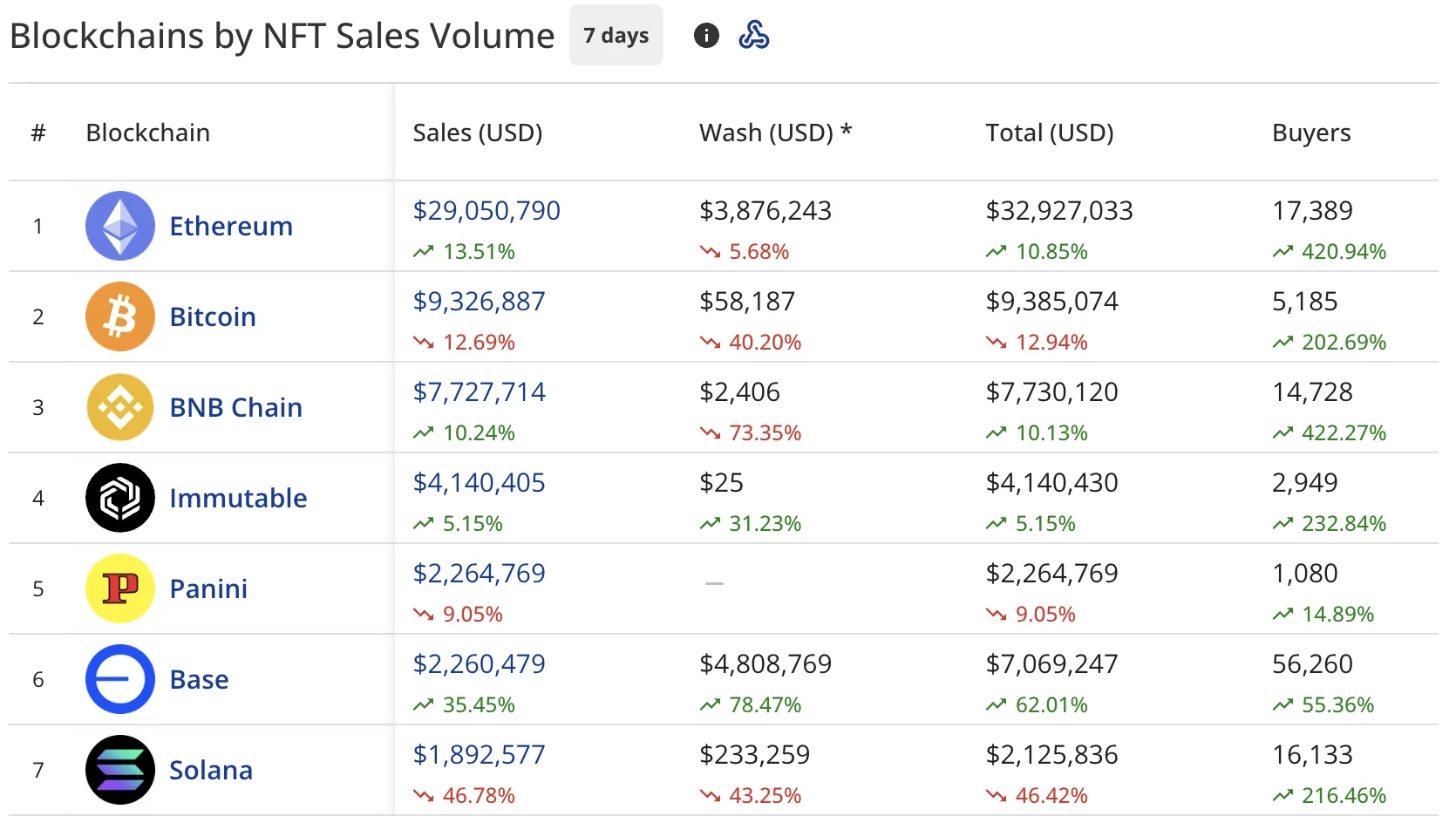

NFT buyers rise 120% despite sales staying flat at $61.5 million

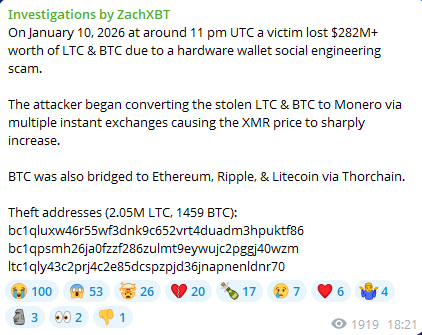

Was Monero’s (XMR) Surge Fueled by a $282M Theft Swap? Chart Says No!