GBX Q4 In-Depth Analysis: Strong Order Flow and Steady Leasing Counterbalance Drop in Volume

Greenbrier (GBX) Surpasses Expectations in Q4 CY2025

Greenbrier, a leader in rail transportation and listed on the NYSE as GBX, reported fourth-quarter revenue for calendar year 2025 that exceeded analyst forecasts, despite a 19.4% decrease from the previous year, totaling $706.1 million. The company’s projected revenue for the full year stands at $2.95 billion (midpoint), which is 2.1% higher than what analysts anticipated. Greenbrier also posted a GAAP earnings per share of $1.14, outperforming consensus estimates by 31%.

Should You Consider GBX Now?

Q4 CY2025 Key Financial Highlights

- Revenue: $706.1 million, beating analyst expectations of $655.6 million (down 19.4% year-over-year, 7.7% above estimates)

- GAAP EPS: $1.14, compared to analyst projections of $0.87 (31% above estimates)

- Adjusted EBITDA: $97.6 million, surpassing the $88.34 million forecast (13.8% margin, 10.5% beat)

- Full-Year Revenue Guidance: Maintained at $2.95 billion (midpoint)

- Full-Year GAAP EPS Guidance: $4.25 (midpoint), 3% higher than analyst estimates

- Operating Margin: 8.7%, a decrease from 12.8% in the same period last year

- Sales Volume: Down 2.6% year-over-year (compared to a 25.5% drop in the prior year’s quarter)

- Market Cap: $1.66 billion

StockStory’s Perspective

Greenbrier’s fourth-quarter performance surpassed Wall Street’s expectations for both revenue and earnings, even as sales declined sharply year-over-year. The company attributes its strong results to its integrated manufacturing and leasing operations, strict cost management, and ongoing efficiency improvements. CEO Lorie Tekorius highlighted the company’s resilience, noting robust liquidity and continued efforts to streamline production and reduce overhead. While demand for new railcars remained subdued, order activity picked up late in the quarter, especially for higher-value specialty railcars.

Looking forward, Greenbrier’s guidance for the year reflects optimism in its diverse backlog and steady leasing income. Management stressed that adaptability and ongoing efficiency measures will be crucial in navigating a volatile market. CEO Tekorius emphasized Greenbrier’s readiness to respond swiftly and profitably to market changes, while CFO Michael Donfris expects margins to improve in the second half of the year as production increases. The company also plans to continue optimizing its fleet and making strategic asset sales to enhance shareholder value.

Management Insights

Leadership credited the quarter’s results to proactive adjustments in production, careful management of the company’s portfolio, and a surge in orders late in the period. They also pointed out that ongoing uncertainty around trade policies continues to influence customer investment decisions.

Additional Management Commentary

- Order Momentum Late in Q4: Commercial activity gained strength toward the end of the quarter, with Greenbrier securing about 3,700 new railcar orders, many of which were higher-value specialty models. This uptick in orders during a typically slow period highlights the company’s competitive edge.

- Production Adjustments: Greenbrier continued to align its manufacturing capacity with current demand, including workforce reductions primarily in Mexico, to keep overhead costs in check and prepare for future growth.

- Leasing Platform Performance: Lease fleet utilization stayed high at nearly 98%, with double-digit increases in renewal rates compared to those set four to five years ago. While specialty car lease rates remained stable, there was some pressure on standard railcar leases, prompting a focus on pricing discipline and credit quality.

- Efficiency Initiatives: The company prioritized cost savings and process improvements across North America and Europe. European operations are undergoing restructuring and resizing, with management confident these changes will boost competitiveness and profitability over time.

- Asset Sales and Capital Recycling: Greenbrier took advantage of a strong secondary market to sell railcars from its fleet, generating significant gains that contributed to both earnings and cash flow. Management expects such transactions to remain part of its capital allocation strategy.

What Will Drive Future Results?

Greenbrier’s future performance will be shaped by stronger order flow, reliable leasing revenue, and a rebound in margins during the latter half of the year.

- Order Backlog and Production Growth: Management anticipates that the recent increase in orders will lead to a ramp-up in production in the second half of the year, with plans to rehire as manufacturing demand grows.

- Cost Control and Efficiency: Continued focus on reducing overhead and improving processes is expected to support margin expansion as volumes recover. CFO Donfris highlighted that higher production levels later in the year should help absorb fixed costs more effectively.

- Trade Policy and Economic Uncertainty: While tariffs and changing trade agreements haven’t significantly affected financial results so far, management noted that policy uncertainty is causing customers to delay investments. Maintaining operational flexibility and strong industry relationships will be key to overcoming these challenges.

Upcoming Catalysts to Watch

In the next few quarters, key areas to monitor include: (1) whether the recent momentum in orders continues and leads to sustained production increases, (2) ongoing progress in cost management and operational efficiency, especially in Europe, and (3) the stability of leasing income and gains from asset sales as market conditions change. Success in these areas will be critical for Greenbrier to achieve its targets and navigate industry challenges.

Greenbrier’s shares are currently trading at $52.85, slightly down from $53.49 before the earnings release. Is this a buying opportunity or a signal to sell?

Why Now Might Be the Right Time to Diversify Your Portfolio

Relying on just a handful of stocks can put your financial future at risk. There’s a limited window to acquire top-tier assets before the market broadens and prices move out of reach.

Don’t wait for the next bout of market turbulence. Explore our Top 5 Growth Stocks for this month—a handpicked selection of high-quality companies that have delivered a remarkable 244% return over the past five years (as of June 30, 2025).

This list features well-known names like Nvidia, which soared 1,326% from June 2020 to June 2025, as well as lesser-known success stories such as Tecnoglass, which achieved a 1,754% five-year return. Discover your next potential winner with StockStory today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

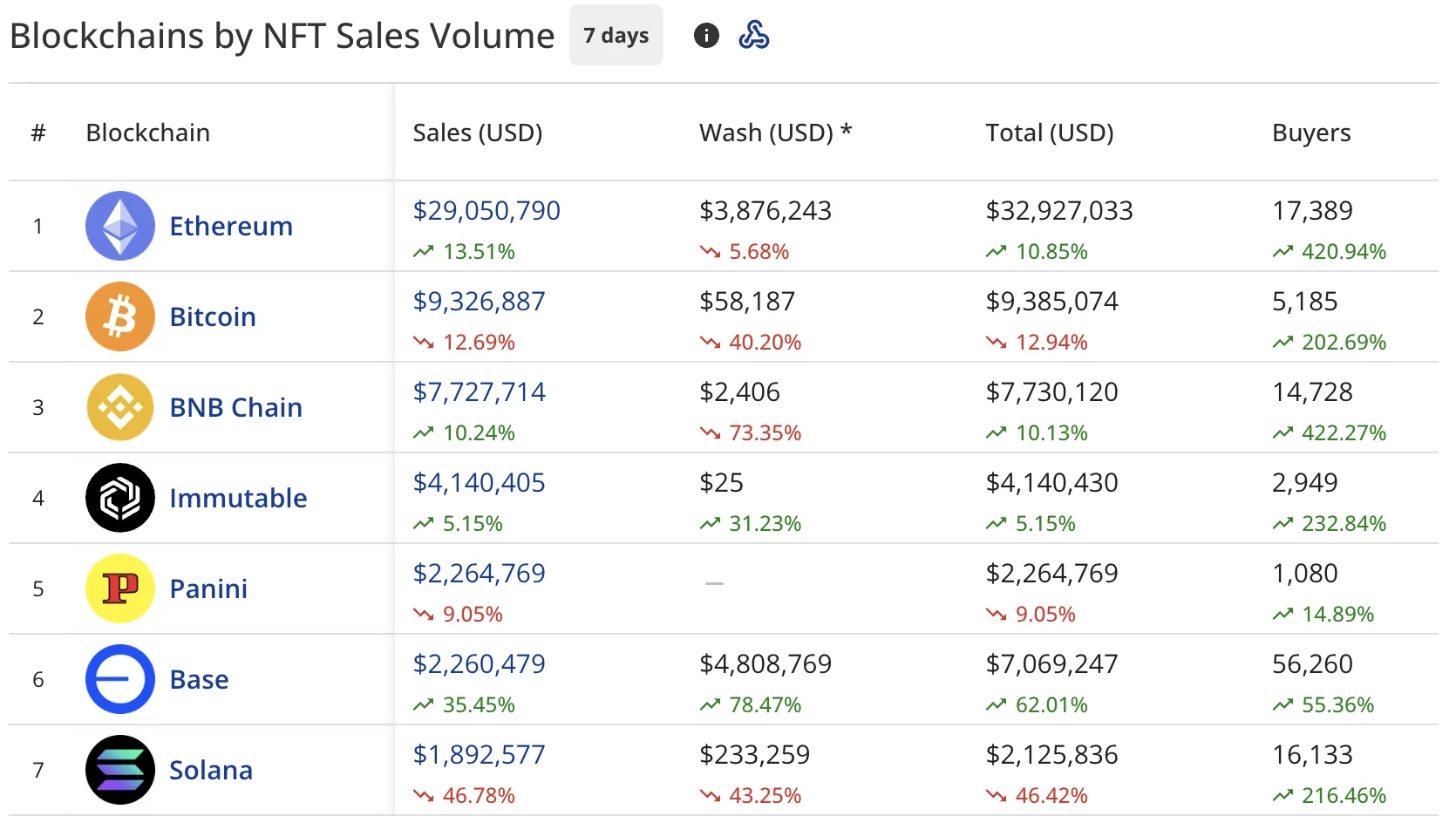

NFT buyers rise 120% despite sales staying flat at $61.5 million

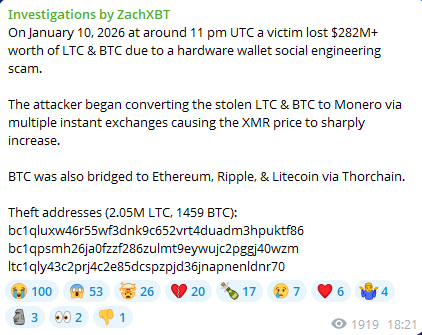

Was Monero’s (XMR) Surge Fueled by a $282M Theft Swap? Chart Says No!

Trump’s renewed attacks on the Fed evoke 1970s inflation fears and global market backlash

Bitcoin Flashes Near-Identical Fractal Before The 2021 Bull Run Started