Jim Cramer Advises Not to Pursue Stocks That Have Already Risen '30% or 40%' This Year, Calling It 'An Invitation to Lose Money'

Jim Cramer Urges Investors to Avoid Buying Into Market Rallies

Financial analyst Jim Cramer, well-known for his role on CNBC, has advised caution for those considering jumping into stocks after the latest surge in the markets. He emphasized that purchasing shares after a significant rally could result in losses for investors.

Heed Cramer’s Advice: Don’t Chase Soaring Stocks

As the host of “Mad Money,” Cramer recommended that investors refrain from buying stocks that have already experienced substantial gains. Instead, he suggested waiting for more favorable opportunities, noting that chasing stocks that have already increased by 30% or 40% within a year is often a recipe for disappointment.

He described this approach as “an invitation to lose money.”

Cramer also pointed out that the banking sector may face short-term challenges as earnings season approaches. While he acknowledged that many banks are currently undervalued, he warned that even industry leaders like JPMorgan Chase could see their stock prices dip temporarily, especially if CEO Jamie Dimon makes cautious remarks during strong market periods.

“It’s wise to hold some overlooked technology stocks, but make sure to leave room in your portfolio for high-quality consumer companies,” Cramer advised.

Growing Concerns Amid Market Uncertainty

Cramer’s latest warning follows a period of heightened market activity. Just a week earlier, he cautioned against pursuing oil stocks in response to the situation in Venezuela. Despite these warnings, Cramer has previously expressed a positive outlook on the banking industry, highlighting the potential for certain bank stocks to deliver strong returns.

Adding to the caution, Goldman Sachs recently noted that elevated stock valuations could trigger greater volatility if corporate earnings fail to meet expectations. This makes Cramer’s recommendation to wait for better entry points even more relevant. Similarly, Tom Lee of Fundstrat has predicted the possibility of a 15-20% market correction later in the year.

Recent Performance of Major ETFs

- Over the past year, the Invesco QQQ Trust (NASDAQ: QQQ) has risen by 22.33%.

- The Vanguard S&P 500 ETF (NYSE: VOO) has gained 18.76% in the same period, according to Benzinga Pro data.

Image via Shutterstock

Stock Snapshot

- JPMorgan Chase & Co (JPM): $330.43 (+0.19%)

- Invesco QQQ Trust, Series 1 (QQQ): $622.08 (+0.26%)

- Vanguard S&P 500 ETF (VOO): $634.84 (+0.12%)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

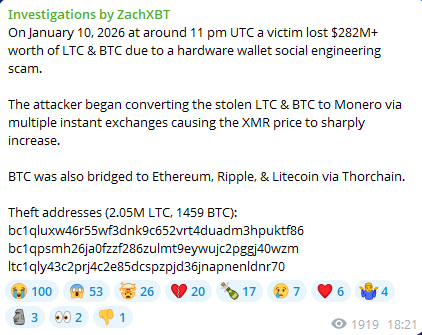

Weekly Crypto Gainers – Dash Up 129%, Monero and ICP Post Double-Digit Rallies

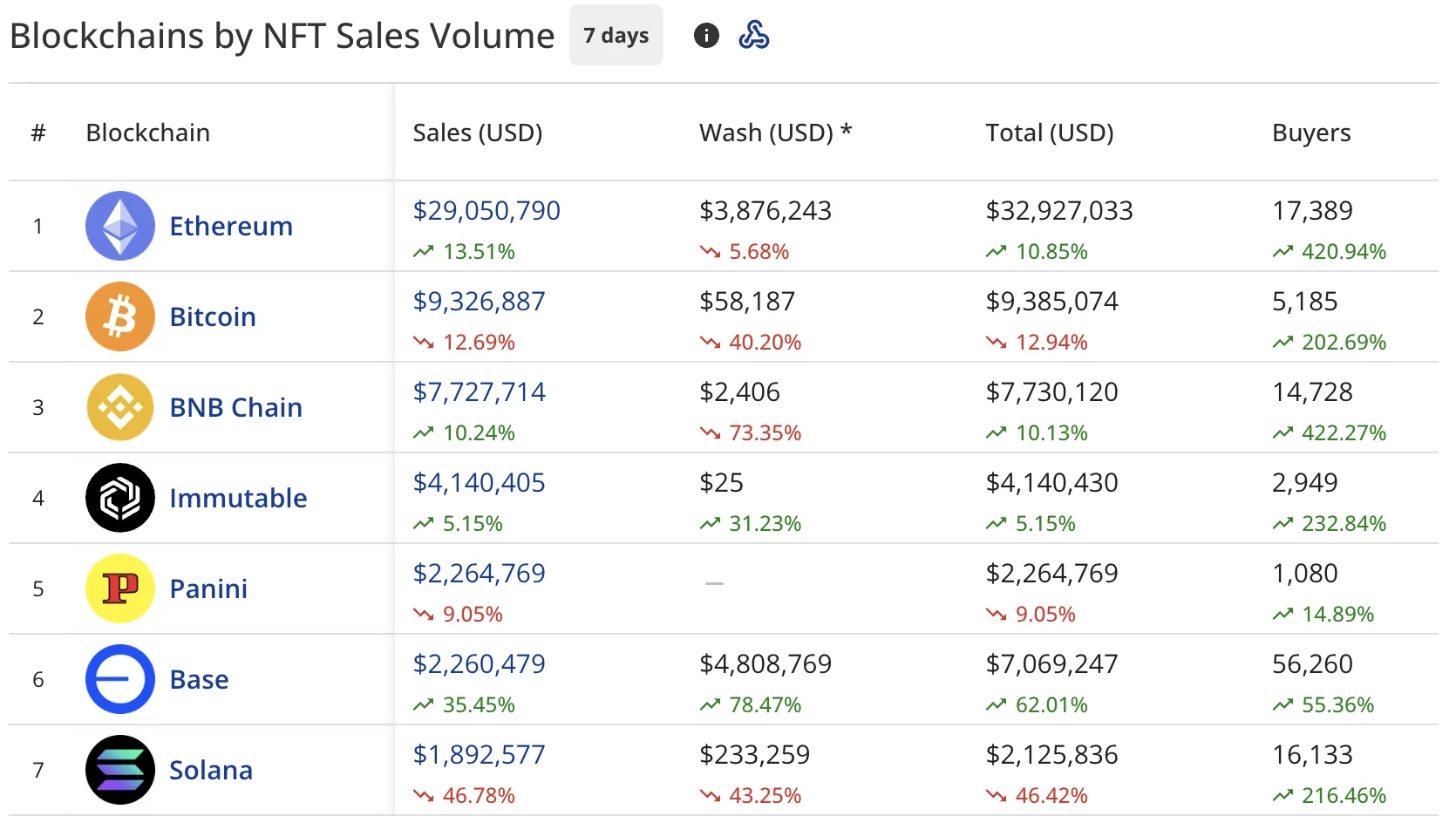

NFT buyers rise 120% despite sales staying flat at $61.5 million

Was Monero’s (XMR) Surge Fueled by a $282M Theft Swap? Chart Says No!

Trump’s renewed attacks on the Fed evoke 1970s inflation fears and global market backlash