Top 3 Utility Stocks That Could Plummet in January

Utilities Stocks Showing Overbought Signals as of January 9, 2026

Investors who prioritize momentum in their trading strategies may want to pay close attention to several utilities stocks currently exhibiting potential warning signs.

The Relative Strength Index (RSI) is a popular momentum tool that evaluates a stock’s performance by comparing the magnitude of recent gains to recent losses. This indicator helps traders gauge short-term trends. Typically, when a stock’s RSI exceeds 70, it is considered to be in overbought territory.

Below are some of the most notable utilities stocks recently identified as overbought:

Enlight Renewable Energy Ltd (NASDAQ: ENLT)

- On December 8, JP Morgan’s Mark Strouse shifted his rating for Enlight Renewable Energy from Neutral to Underweight, while maintaining a $35 price target. Over the last month, the stock has surged approximately 27% and reached a 52-week high of $51.50.

- RSI: 71.9

- Recent Performance: Enlight Renewable Energy shares rose 1.6%, closing at $50.35 on Thursday.

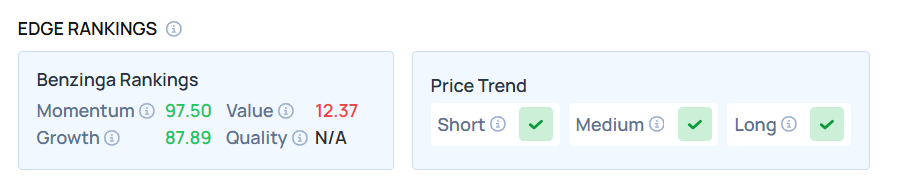

- Edge Stock Ratings: Momentum score stands at 97.50, with a Value score of 12.37.

Hawaiian Electric Industries Inc (NYSE: HE)

- On January 6, Reuters reported that Hawaiian Electric agreed to a $47.75 million settlement with shareholders related to the Maui wildfires. The stock has climbed about 11% over the past week and reached a 52-week high of $13.91.

- RSI: 71.1

- Recent Performance: Shares of Hawaiian Electric increased by 2%, closing at $13.66 on Thursday.

Ellomay Capital Ltd (NYSE: ELLO)

- On December 30, Ellomay Capital reported third-quarter earnings of $0.93 per share, up from $0.52 per share a year earlier. The stock has jumped around 27% in the last month and set a 52-week high of $28.49.

- RSI: 75.5

- Recent Performance: Ellomay Capital shares advanced 4.9%, closing at $28.40 on Thursday.

Image credit: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After ATOM’s 2-month high, is $3.3 next for the altcoin’s price?

Unstable Global Climate Signals New Phase for Defense Stock Surge

Bitcoin (BTC) Holds Strong Amid Institutional Buying Signals Renewed Market Confidence

Walmart Set to Enter Nasdaq 100 on January 20, Replacing AstraZeneca