USD gains momentum on favorable data before payroll release – BBH

US Dollar Strengthens Amid Upward Shift in Rate Expectations

The US Dollar (USD) has been gaining ground against other major currencies, supported by a slight increase in expectations for US interest rates. According to BBH FX analysts, a series of balanced US economic reports has reinforced the outlook in favor of the dollar.

Supreme Court Tariff Decision Introduces Uncertainty for USD

The upcoming December non-farm payrolls (NFP) release is poised to influence the Federal Reserve's short-term policy direction, with the data scheduled for 1:30pm London (8:30am New York). Later, the January University of Michigan sentiment survey will also be released, though it is expected to have less impact. Market consensus anticipates an increase of 70,000 jobs in the NFP, compared to 64,000 in November and a decline of 105,000 in October, the latter affected by the government shutdown. Private sector job growth, considered a more accurate measure of labor market health, is projected at 75,000, up from 69,000 in November. However, the focus is less on the headline numbers and more on which sectors are driving employment gains.

In November, nearly all NFP growth was concentrated in the non-cyclical health care and social assistance sectors—a trend that often precedes a slowdown in the labor market. Analysts expect this pattern to persist in December. Data from ADP showed private payrolls rising by 41,000 in December, with education and health services contributing 39,000 of those jobs. Similarly, Revelio Labs reported a 71,000 increase in nonfarm payrolls, with 31,400 jobs coming from education and health services. Should the anticipated weakening in US labor demand materialize, the USD could lose some of its recent strength as the narrative around interest rate differentials shifts. Conversely, evidence of a steady labor market may support further USD gains, especially if expectations for Fed rate cuts are scaled back.

The US Supreme Court is expected to rule soon on President Donald Trump's use of emergency tariff powers. Betting markets currently assign less than a 30% probability that the court will uphold these tariffs. If the court rules against the emergency tariff authority, risk assets could rally as the administration would lose a significant economic tool. On the other hand, a decision supporting Trump's tariff powers would likely be negative for risk sentiment but could provide marginal support to the USD by reaffirming tariffs as a potent unilateral policy instrument. The most probable outcome is a nuanced decision, granting only limited emergency tariff powers and requiring partial repayment, which would increase policy uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

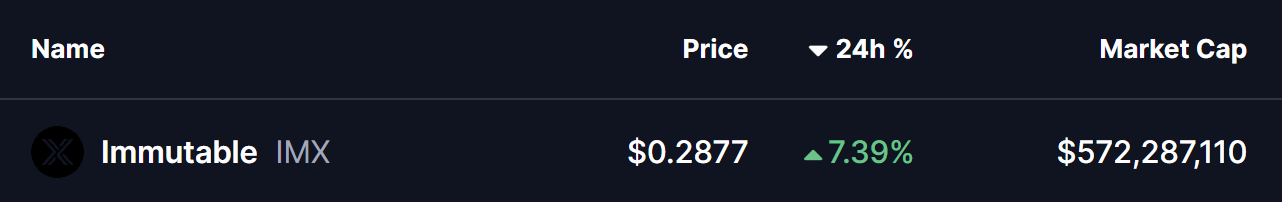

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside