SMPL Q4 CY2025 In-Depth Analysis: Quest and OWYN Drive Power Expansion Amid Ongoing Margin Challenges

Simply Good Foods (SMPL) Q4 CY2025 Earnings Overview

Simply Good Foods (NASDAQ:SMPL), a leading packaged food company, posted its Q4 CY2025 financial results, surpassing Wall Street’s revenue projections. The company reported sales of $340.2 million, matching last year’s performance, and delivered a non-GAAP earnings per share of $0.39—an 8.2% increase over analyst expectations.

Curious whether SMPL is a smart investment right now?

Highlights from Q4 CY2025

- Revenue: $340.2 million, beating the $336.1 million analyst consensus (flat year-over-year, 1.2% above expectations)

- Adjusted EPS: $0.39, topping the $0.36 forecast (8.2% beat)

- Adjusted EBITDA: $55.62 million, closely aligned with the $55.72 million estimate (16.4% margin)

- Operating Margin: 12.8%, down from 16% in the prior year’s quarter

- Market Cap: $1.96 billion

Analysis and Market Reaction

Simply Good Foods’ latest quarter featured stable sales and stronger-than-expected profitability, which was met with a positive response from investors. Leadership credited the performance to robust growth in the Quest and OWYN brands, which together made up the bulk of net sales. CEO Geoff Tanner highlighted “double-digit growth” in both brands and emphasized ongoing productivity improvements to counteract higher input costs and tariffs. While the Atkins brand faced headwinds, innovation and expanded distribution helped support overall results.

Looking ahead, the company’s outlook depends on continued strength in its high-protein, low-sugar snack lines, while managing challenges from commodity inflation and tariffs. Management is focused on launching new products, expanding distribution, and driving productivity to fuel a rebound in revenue and earnings in the second half of the year. CFO Chris Bealer noted that improved supply coverage and expected declines in cocoa costs and tariffs should provide relief, though rising whey prices and the pace of Atkins’ recovery remain concerns.

Management Commentary: Key Takeaways

Leadership attributed the quarter’s results to effective execution in Quest and OWYN, offset by ongoing difficulties for Atkins and increased input costs. The company’s main priorities included innovation, distribution expansion, and operational efficiency.

- Quest Brand Growth: Quest saw a 12% increase in consumption, driven by new product launches and broader distribution, especially in salty snacks. Salty snack consumption rose by 40%, and household penetration continued to climb, supported by new flavors and packaging tailored to specific channels.

- OWYN’s Comeback: OWYN consumption jumped 18%, fueled by greater distribution and improved product quality. Increased marketing spend aimed to boost brand awareness and household reach, with progress made in addressing past quality concerns.

- Atkins Under Pressure: Atkins experienced a 19% drop in consumption, mainly due to lost distribution at club stores. The company has started modernizing the brand with updated packaging, a more affordable 4-pack, and refreshed marketing, with early signs of improved trial and repeat purchases.

- Cost and Tariff Challenges: Margins were squeezed by higher cocoa prices, new tariffs, and inflation in key ingredients. Management secured supply contracts at better prices, particularly for cocoa, with benefits expected to show later in the year.

- Efficiency Initiatives: The productivity program launched 18 months ago has delivered cost savings and is expected to support margin recovery. Investments in supply chain and operational improvements remain a priority.

Looking Ahead: Growth Drivers

Simply Good Foods anticipates that continued momentum in Quest and OWYN, along with productivity improvements and easing input costs, will help counteract ongoing pressures from tariffs and commodity inflation.

- Innovation and Distribution: The company plans to introduce new products and increase shelf presence, especially in Quest’s salty snacks and OWYN’s plant-based offerings. CEO Geoff Tanner pointed to a strong innovation pipeline and new distribution wins as key to accelerating growth in the second half.

- Margin Recovery: CFO Chris Bealer expects relief from cocoa costs and tariffs later in the year, in addition to ongoing productivity efforts. However, higher whey prices remain a challenge, and gross margins are projected to stabilize before improving gradually.

- Atkins Turnaround: Efforts to modernize Atkins with updated packaging, lower-priced options, and targeted marketing are underway to stem distribution losses and boost repeat purchases. Management believes early results from a clinical study on GLP-1 weight loss drugs could help reposition Atkins for future growth.

Upcoming Catalysts

In the next few quarters, analysts will be monitoring:

- Signs of renewed momentum in Quest Bars and further expansion in salty snack distribution

- Stabilization in Atkins consumption and progress in brand modernization

- Margin improvement as lower cocoa costs and tariff relief take effect

- The impact of new product launches and growth in OWYN’s household penetration

Simply Good Foods shares are currently trading at $20.63, up from $19.37 before the earnings announcement. Is this a buying opportunity?

Top Stock Picks Right Now

Building a successful portfolio means looking ahead, not relying on yesterday’s winners. The risks of investing in overcrowded stocks are increasing.

Discover the next generation of high-growth companies in our Top 6 Stocks for this week. This carefully selected list of High Quality stocks has outperformed the market with a 244% return over the past five years (as of June 30, 2025).

Our picks include well-known names like Nvidia (up 1,326% from June 2020 to June 2025) and lesser-known companies such as Exlservice, which delivered a 354% five-year return. Start your search for the next big winner with StockStory today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jinping wants to curb price wars between China’s tech groups

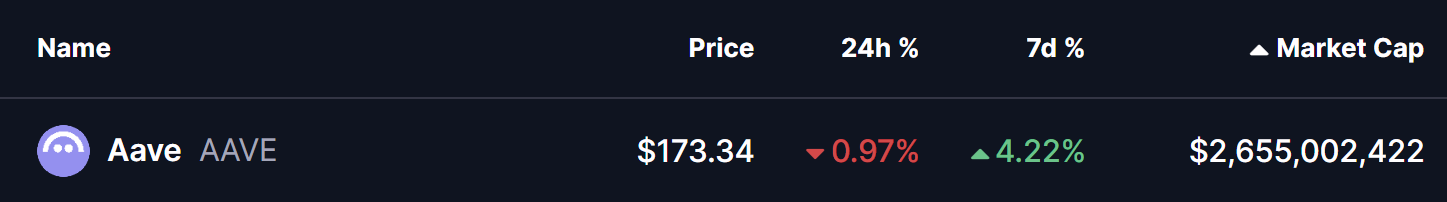

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports