AUD/USD extends its decline toward 0.6680 as the US Dollar strengthens, with attention turning to upcoming US NFP data

AUD/USD Continues Downward Trend Amid Strong US Dollar

The AUD/USD currency pair extended its decline for a third consecutive session on Friday, slipping to approximately 0.6676 in late European trading. The pair is under pressure as the US Dollar (USD) gains momentum ahead of the release of December’s US Nonfarm Payrolls (NFP) report, scheduled for 13:30 GMT.

US Dollar Index Hits Four-Week High

Currently, the US Dollar Index (DXY)—which measures the Greenback’s performance against a basket of six major currencies—hovers near 99.10, marking its highest point in the past month.

Market Focus on US Jobs Data and Fed Policy

Traders are keeping a close eye on the upcoming NFP figures for insights into the Federal Reserve’s (Fed) future policy direction. Recent statements from Fed officials suggest that concerns over a weakening labor market have taken precedence over worries about inflation remaining above the 2% target.

Expectations for December Employment Data

- Economists forecast that US employers added 60,000 new jobs in December, a slight decrease from November’s 64,000.

- The Unemployment Rate is anticipated to fall to 4.5%, down from 4.6% previously.

- Average Hourly Earnings are projected to rise at an annual rate of 3.6%, up from 3.5% in November.

- On a monthly basis, wage growth is expected to accelerate to 0.3%, compared to 0.1% in the prior month.

Australian Dollar Weakens on Dovish RBA Outlook

Beyond the robust US Dollar, the Australian Dollar (AUD) is also facing headwinds. Investor sentiment toward the AUD has soured as expectations for a hawkish move by the Reserve Bank of Australia (RBA) at its February meeting have diminished, following softer-than-expected Consumer Price Index (CPI) data for November.

According to Reuters, the likelihood of a February rate hike by the RBA has dropped to just 24%. Annual inflation in November eased to 3.4%, below both the forecasted 3.7% and October’s 3.8% reading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP and ETH Price Prediction As White House Threatens to Pull Back Clarity Act Bill

A new US bill says writing Bitcoin software isn’t a financial crime

SUI Price Prediction After Resolving the January 14 Mainnet Outage

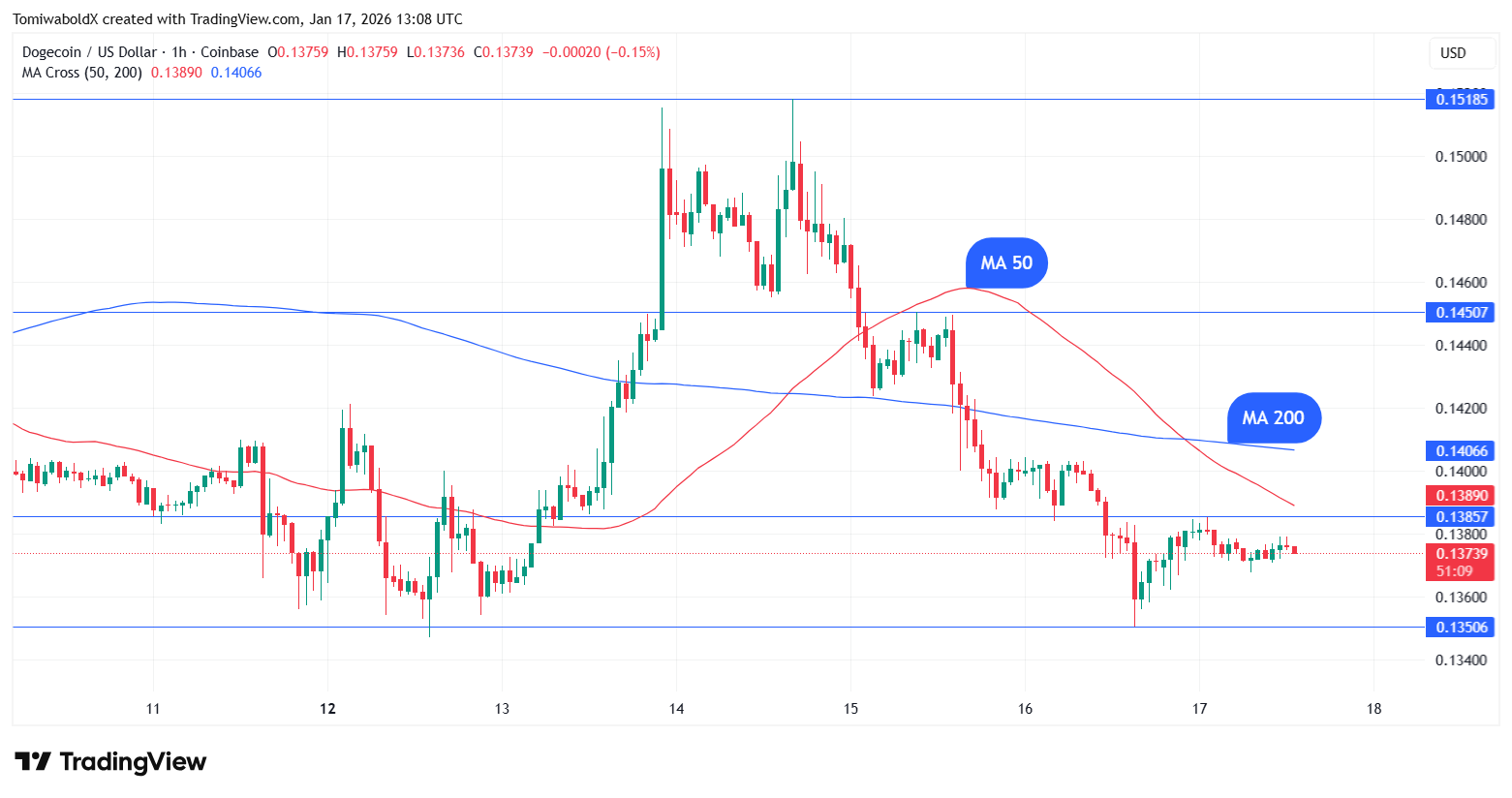

Dogecoin (DOGE) Oversold? Death Cross Sends Mixed Signals