Wall Street no longer expects a Fed rate cut this month as it looks ahead to two key market events happening today

Market Outlook Shifts as Fed Rate Cut Expectations Fade

Last October, over half of traders in Fed Funds futures anticipated that the Federal Reserve would lower interest rates this month, potentially reducing the benchmark rate to 3.25%. Fast forward to today, and a striking 90% now predict the Fed will maintain rates at 3.5% when it convenes in 19 days.

Simply put, Wall Street no longer expects another rate cut from the Fed in the near term.

Two major developments have contributed to this change in sentiment, and both are set to make headlines today:

-

The Bureau of Labor Statistics is scheduled to release the latest nonfarm payroll data. Analysts are forecasting an increase of 70,000 jobs, with the unemployment rate expected to dip slightly to 4.5%. The report will be published at 8:30 a.m. Eastern.

-

The U.S. Supreme Court is poised to issue a decision on the legality of President Trump’s trade tariffs. The prevailing view is that the court may rule the administration cannot impose new tariffs without Congressional approval. Such a decision could require the government to reimburse companies approximately $179 billion in tariffs collected since last April. The ruling is anticipated after 10 a.m. Eastern.

Until these key updates are released, Wall Street remains in a holding pattern: S&P 500 futures were unchanged this morning, following a flat close just below the index’s all-time high yesterday. Meanwhile, European and Asian markets mostly opened higher.

Last night, President Trump made a final appeal to the Supreme Court justices via Truth Social, stating, “Our Nation’s Gross Domestic Product (GDP) is predicted to come in at over 5% … a direct result of TARIFFS, which have rescued our Economy and National Security. I hope the Supreme Court is aware of these Historic, Country saving achievements prior to the issuance of their most important (ever!) Decision. Thank you for your attention to this matter!”

However, Trump did not provide a source for his 5% GDP projection. According to a Bloomberg analyst survey, the consensus expects 2% growth this year, while Goldman Sachs offers a slightly higher forecast of 2.6%.

UBS economist Paul Donovan commented to clients that the Supreme Court is reviewing over 70% of the tariffs in question. If these are deemed unlawful and refunds are issued, it would effectively act as a fiscal stimulus for the U.S.—even if new tariffs are later introduced, potentially tightening future trade conditions.

Should the labor market show improvement and the Supreme Court mandate tariff refunds, the Federal Reserve would have little reason to introduce further monetary stimulus through additional rate cuts.

Expert Perspectives and Market Snapshot

Francesco Pesole of ING believes that a Fed rate cut is unlikely before March. He noted, “The unemployment rate may be watched even more closely than payroll figures, reflecting the Fed’s emphasis on joblessness. If unemployment eases back to 4.5% from 4.6%, and payrolls grow by 50,000 to 100,000, that would be enough to rule out a January cut and keep the odds of a March cut below 50%.”

Pre-Market Overview

- S&P 500 futures: Unchanged this morning, following a flat session just below record highs.

- STOXX Europe 600: Up 0.42% in early trading.

- FTSE 100 (UK): Gained 0.39% in early trading.

- Nikkei 225 (Japan): Rose 1.61%.

- CSI 300 (China): Increased by 0.45%.

- KOSPI (South Korea): Up 0.75%.

- NIFTY 50 (India): Down 0.75%.

- Bitcoin: Climbed to $90,300.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

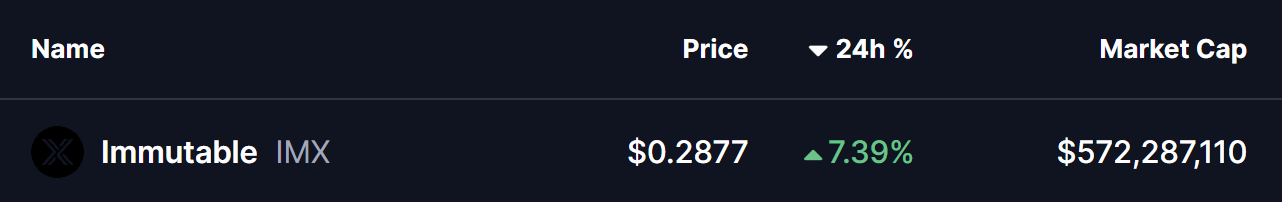

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside