Airbnb receives an upgrade, while Zillow is downgraded: Leading analyst recommendations from Wall Street

Today's Key Analyst Ratings and Market Insights

Stay informed with a roundup of the most influential analyst calls and research updates making waves on Wall Street. Below are the latest upgrades, downgrades, and new coverage initiations that investors should be aware of, as summarized by The Fly.

Top 5 Analyst Upgrades

- Airbnb (ABNB): Wells Fargo has raised its rating to Equal Weight from Underweight, increasing the price target to $128 from $118. The upgrade is attributed to Airbnb’s lagging share performance over the past two years, a variety of growth opportunities—particularly in hotel supply and sponsored listings—and its relative protection from AI-related risks. Barclays has also moved Airbnb to Equal Weight from Underweight, setting a new price target of $120, up from $107.

- American Airlines (AAL): Susquehanna has upgraded the airline to Positive from Neutral, with the price target raised to $20 from $14. The firm points to a favorable industry outlook through 2026 and expects American’s revenue strategies and network adjustments to drive margin gains into 2027.

- Southwest Airlines (LUV): JPMorgan has issued a double upgrade, moving Southwest to Overweight from Underweight and boosting the price target to $60 from $36. The firm sees a strong likelihood that Southwest could achieve $5 earnings per share by 2026.

- CrowdStrike (CRWD): Berenberg has lifted its rating to Buy from Hold, maintaining a $600 price target. The decision is based on the stock’s recent underperformance, making its valuation more attractive.

- FedEx (FDX): Bank of America has upgraded FedEx to Buy from Neutral, assigning a $365 price target. The firm anticipates that demand will benefit from bonus depreciation incentives, leading to significant infrastructure spending, including $1.4 trillion projected for data centers and power supply over the next three years, along with lower interest rates and a potential positive impact on the housing sector.

Top 5 Analyst Downgrades

- Zillow Group (ZG): Mizuho has lowered its rating to Neutral from Outperform and reduced the price target to $70 from $100. The downgrade reflects growing uncertainty regarding the company’s real estate listings distribution, ongoing litigation, and the possible effects on Zillow’s business model.

- Adobe (ADBE): BMO Capital has downgraded Adobe to Market Perform from Outperform, with the price target cut to $375 from $400. Despite a reasonable valuation, BMO sees a lack of positive catalysts and expects the stock to trade within a range.

- Qualcomm (QCOM): Mizuho has shifted its rating to Neutral from Outperform, lowering the price target to $175 from $200. The firm’s projections are now below consensus, citing challenges in handset shipments and iPhone content for 2026.

- GE Vernova (GEV): Baird has downgraded the company to Neutral from Outperform, reducing the price target to $649 from $816. The firm believes that concerns about oversupply may outweigh GE Vernova’s potential to surpass near-term expectations.

- Mattel (MAT): Goldman Sachs has moved Mattel to Neutral from Buy, maintaining a $21 price target. The firm now sees a more balanced risk/reward profile at current share prices.

Top 5 New Analyst Coverages

- Chipotle (CMG): Telsey Advisory has initiated coverage with an Outperform rating and a $50 price target. While the restaurant sector saw slower consumer spending in 2025, the firm expects a moderate rebound in 2026 as consumers benefit from larger tax refunds and lower interest rates.

- DraftKings (DKNG): Texas Capital has started coverage with a Hold rating and a $39 price target. Although DraftKings is considered a leading online gaming stock, the firm notes heightened volatility due to its pure-play status, recent expansion in prediction markets, investor concerns over hold and win rates, and the possibility of increased gaming taxes in some states. The outlook is described as neutral but not negative.

- Autodesk (ADSK): Rothschild & Co Redburn has initiated coverage with a Buy rating and a $375 price target. The firm expects Autodesk to outperform its industry peers, projecting annual growth of 5.0%-5.5% between 2024 and 2027, which is higher than consensus estimates.

- Casey's General Stores (CASY): Bank of America has begun coverage with a Buy rating and a $700 price target. The firm’s premium valuation reflects Casey’s emphasis on higher-margin foodservice and steady EBITDA growth, which BofA believes justifies the higher multiple compared to other convenience stores.

- Doximity (DOCS): RBC Capital has initiated coverage with an Outperform rating and a $59 price target. Doximity is highlighted as a top-tier healthcare technology company, recognized for its consistent double-digit growth and robust 50% margins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

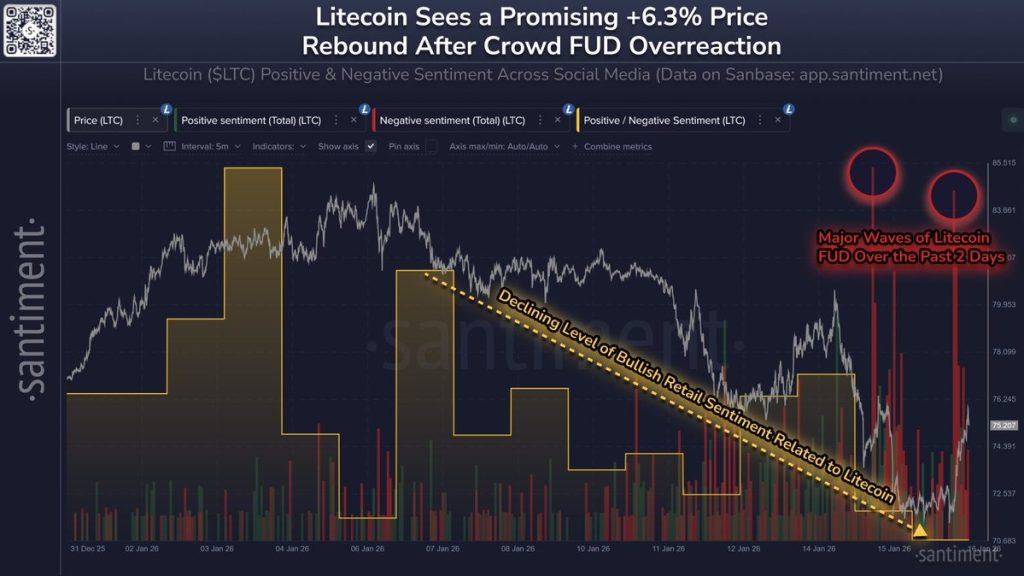

Are Traders Leaving Litecoin (LTC)? What It Means for This OG Crypto

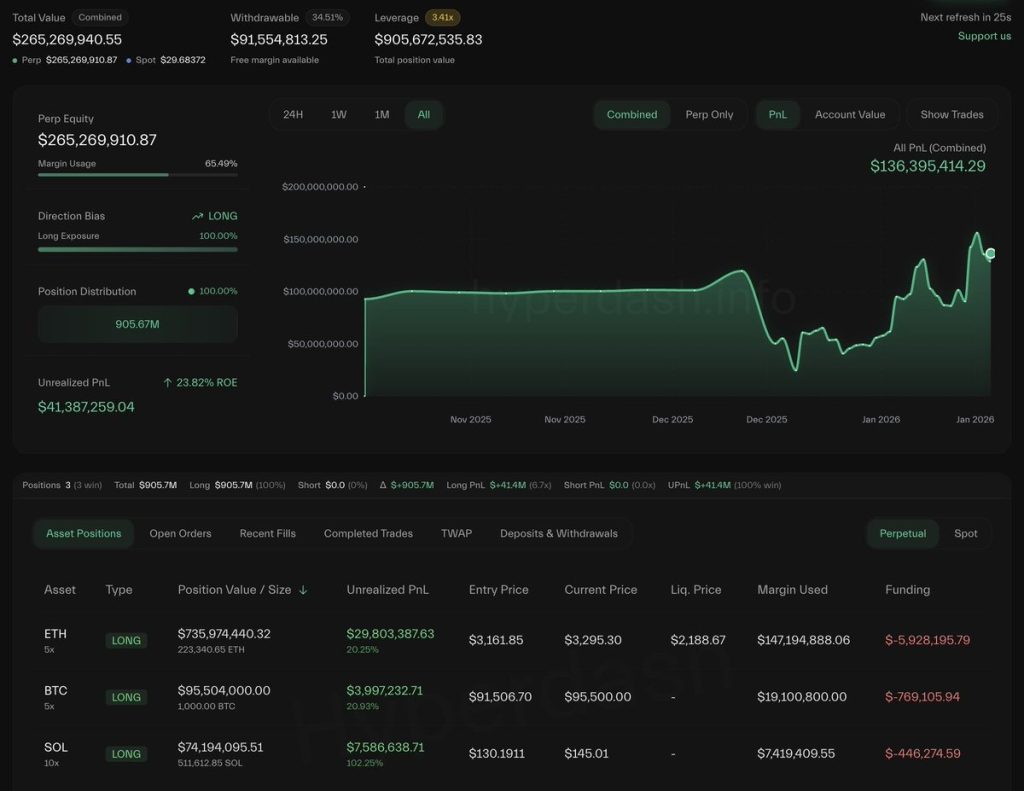

Solana (SOL) Price Eyes $150 as Active Addresses Rebound and ETF Volumes Hit $6B

Top Crypto to Watch This Weekend: BTC, ETH and SOL as Open Interest Rises

Polygon (POL) Price Pulls Back on Layoff News: But the Chart Signals a Different Story