Equifax Quarterly Earnings Outlook: Key Information You Should Be Aware Of

Equifax Inc.: Company Overview and Earnings Outlook

Equifax Inc. (EFX), with a market capitalization of $26.1 billion, is a leading provider of data, analytics, and technology solutions. Based in Atlanta, Georgia, the company operates in over 20 countries, delivering services that help assess credit risk, prevent fraud, and verify employment for a diverse range of clients, including banks, employers, government bodies, and businesses of all sizes.

Upcoming Earnings Report

Equifax is preparing to release its financial results for the fourth quarter. Analysts are forecasting diluted earnings per share of $2.04, which would represent a 3.8% decrease compared to the $2.12 per share reported in the same quarter last year. Notably, the company has outperformed Wall Street’s EPS projections for the past four quarters.

Analyst Projections for Future Earnings

Looking ahead to fiscal 2025, analysts anticipate Equifax will achieve earnings per share of $7.61, a 4.4% increase from the $7.29 expected for fiscal 2024. For fiscal 2026, EPS is projected to climb 15.5% year-over-year, reaching $8.79.

Image source: www.barchart.com

Stock Performance Comparison

In the past twelve months, Equifax shares have declined by 12.1%. This performance lags behind the S&P 500 Index, which gained 17%, and the Industrial Select Sector SPDR Fund (XLI), which rose 20.6% during the same period.

Image source: www.barchart.com

Recent Developments and Market Sentiment

On January 6, Equifax’s stock dropped over 3% following remarks from FHFA Director Bill Pulte, who questioned the pricing strategies of credit bureaus. His comments sparked concerns about increased regulatory attention, particularly regarding Equifax’s pricing power in its U.S. Information Solutions division and mortgage-related credit report fees. These worries weighed on the stock, especially given the already challenging housing market conditions.

Analyst Ratings and Price Targets

Analysts maintain a generally positive outlook on Equifax, assigning it a “Moderate Buy” consensus rating. Of the 24 analysts covering the stock, 11 recommend a “Strong Buy,” three suggest a “Moderate Buy,” and 10 rate it as a “Hold.” The average price target stands at $262.38, implying a potential upside of 20.3% from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA

Tesla’s AI team creates a patent that addresses AI “drift” in positional encoding

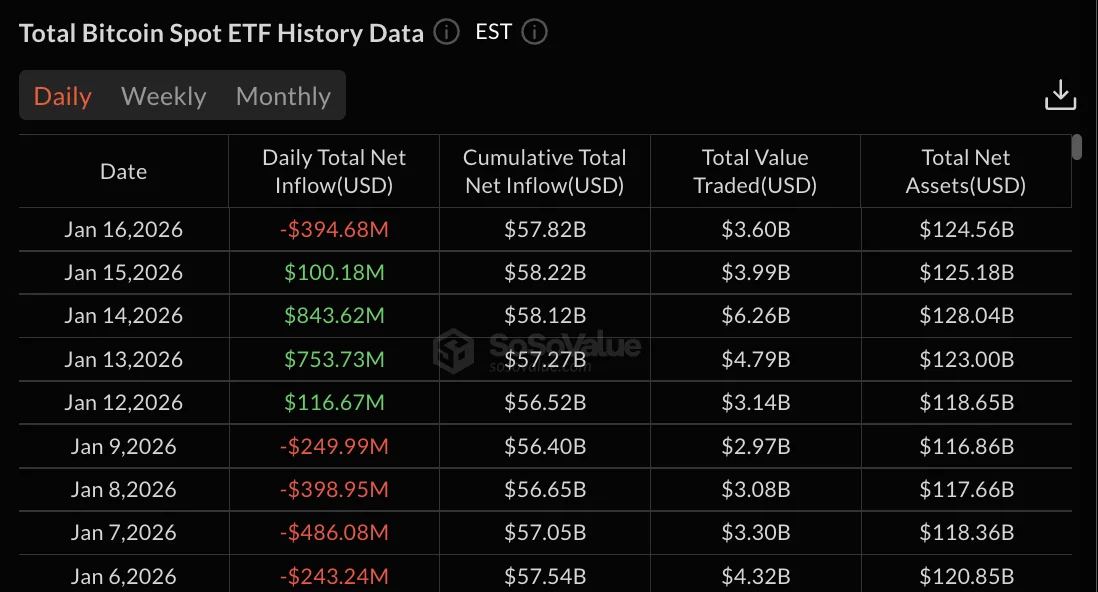

Bitcoin ETFs turn red after four days of inflows, post $394.68M outflow

Critical minerals ETFs hit new all-time high market cap above $750 billion