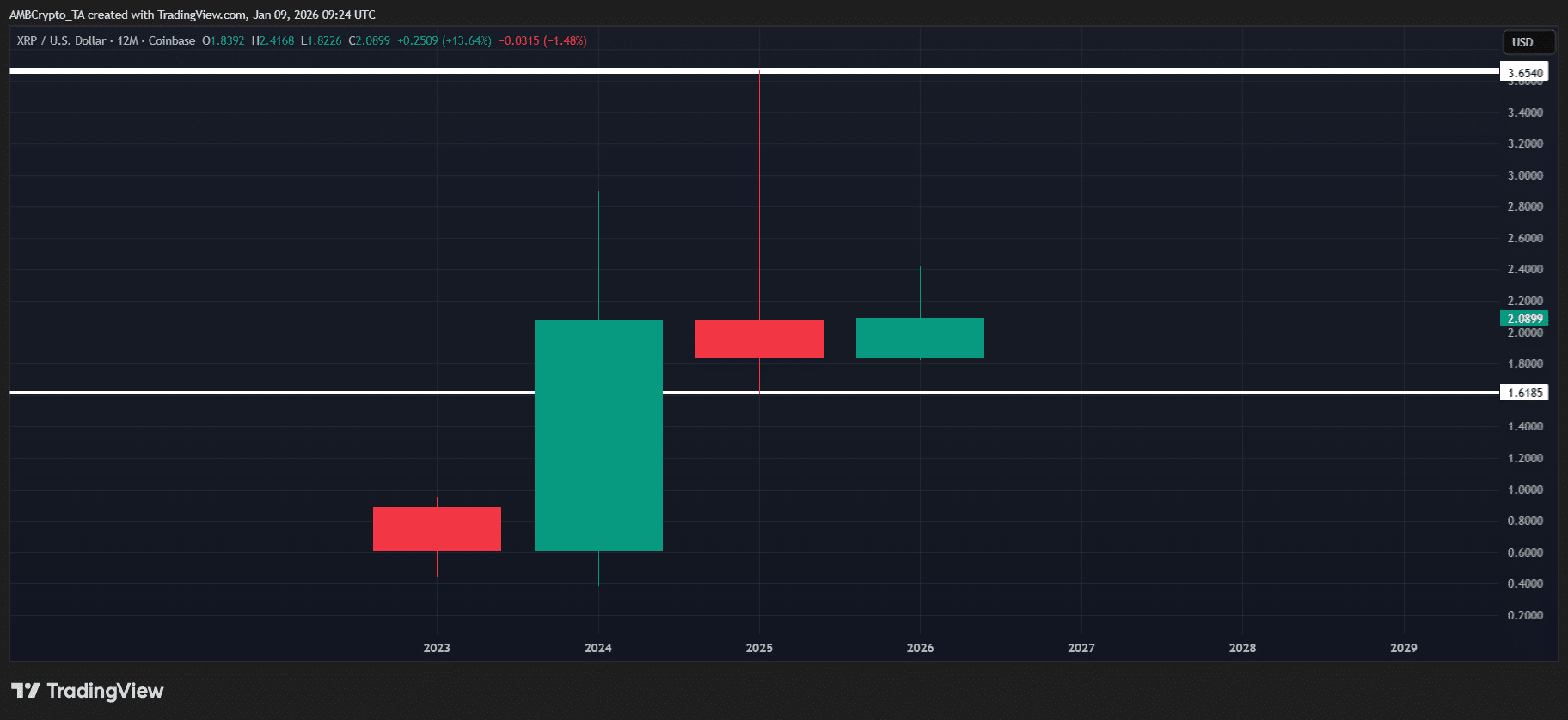

The impact of the 2025 cycle has kicked off earlier than expected this year.

Back in that cycle, FUD pushed risk assets below key levels, dragging prices back toward early-year lows into year-end. However, this pullback has delivered more than just a liquidity sweep that caught bears offside.

Instead, it has put real-use-case blockchains back in focus. In that sense, Ripple [XRP] fits the narrative perfectly, ripping nearly 15% in under 10 days during the early stages of the 2026 rally and firmly grabbing the spotlight.

That said, on-chain data suggests this thesis is now being tested.

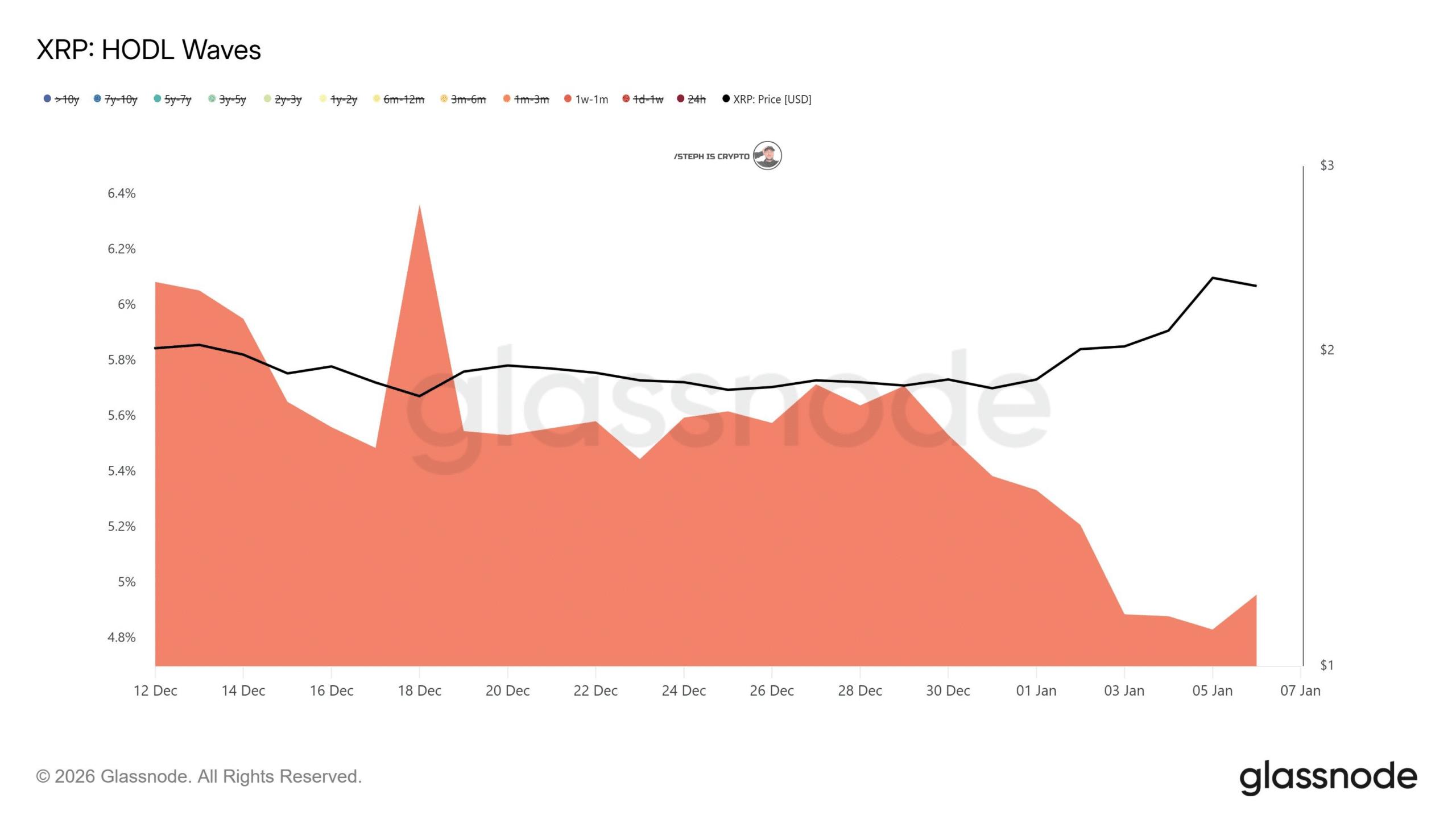

From the chart, short-term XRP HODLers (1 week–1 month) have trimmed exposure, with their supply share sliding from 5.7% to 4.9% in just seven days, mirroring XRP’s almost 13% pullback from the $2.4 high.

Put simply, STHs are taking profits, pressuring supply. The result? Roughly $400 million was flushed from Open Interest (OI), while XRP ETFs saw their first-ever outflows, with $17.72 million exiting.

In short, XRP’s rally is cooling off, confirming that its 12% pullback isn’t a random blip. That said, the move raises the classic question: Is this just a temporary shakeout of weak hands, or the start of an extended correction?

On-chain data dips, but XRPL deals could turn XRP around

A key divergence is building under XRP, hinting at underlying strength.

Looking back at the 2025 cycle, XRP closed the year down 12%, but Ripple didn’t pause. Instead, it kept moving, locking in strategic partnerships aimed at capturing a slice of the trillion-dollar payments market.

Building on that momentum, Ripple has acquired Slovexia to automate payments, with around 50,000 daily transactions projected. Put simply, XRP will now be a payment option in their gateway for these transactions.

And it doesn’t stop there.

Amazon’s AWS is looking to partner with Ripple to integrate XRPL into its ecosystem. Consequently, XRP could become a payment option across a wide range of services, tapping into the big leagues of the tech industry.

In this context, XRP’s 15% “New Year” rally doesn’t look speculative.

Instead, with DeFi TVL up 30% in the first week of 2026, it’s an early sign that real adoption and capital inflows are driving momentum, making Ripple’s pullback feel like just a “blip” as fundamentals take center stage.

Final Thoughts

- Ripple’s short-term holders are taking profits, trimming exposure, and causing minor supply pressure.

- Strategic partnerships, along with a 30% DeFi TVL surge, signal real-world use and capital inflows, making the 12–13% pullback feel like just a blip.