US Supreme Court Ruling to Decide Bitcoin’s Next Move — Here’s Where Bulls and Bears Are Waiting

By:BeInCrypto

Bitcoin is trading at a critical inflection point as markets brace for a rare convergence of legal and macroeconomic catalysts. Today, the US Supreme Court is set to rule on the legality of Trump-era tariffs, a decision that could ripple across global markets just hours after the release of US unemployment data. Together, the two events have created a compressed, high-risk window for risk assets, including cryptocurrencies. Bitcoin Bears and Bulls Hold Breath Ahead of a Supreme Court Decision At the time of writing, Bitcoin is trading for $90,383 (UTC+8), confined within a narrow trading range that reflects growing uncertainty rather than conviction. Bitcoin (BTC) Price Performance. Source: BeInCrypto Price action has stalled between clearly defined support held by bulls and overhead resistance defended by bears. However, technical and on-chain data indicate that both sides are entrenched, waiting for clarity. This isnt a routine legal updateWhether broad tariffs imposed under emergency powers were lawful, ~$130B+ in annual tariff revenue potentially challengeda ruling on authority and structure, not a technical tweakEven if some tariffs fall, others remain under different statutes. Any rollback would likely be partial, slow, and messytoday doesnt end tariffs. It defines how much of the current trade regime holds and how uncertain revenue, inflation, and global trade policy become from here, said analyst Kyle Doops. Markets Brace for a Binary Macro Shock The Supreme Court ruling, expected at 10:00 a.m. (UTC+8), will determine whether tariffs imposed during the Trump administration are legally valid. The outcome could act as a macro switch for sentiment. Many market participants have been operating under the assumption that tariffs remain in place, an environment that has shaped inflation expectations, earnings outlooks, and trade-sensitive growth forecasts. Some traders argue that striking down the tariffs could ultimately be constructive for risk assets. If the Supreme Court strikes down Trumps tariffs today, the local bottom is most likely in for Bitcoin and crypto. Tariffs will be invalidated, markets get clarity, cost pressure eases, corporate earnings outlook improves, and risk-on flows return, said analyst Fefe Demeny. However, sentiment is far from uniform. Polymarket data shows a 26% chance of the Court ruling in favor of the tariffs. This highlights how skewed expectations have become, and how violent any repricing could be if markets are caught off guard. Odds of Supreme Court Ruling in Favor of Trump Tariffs. Source:Polymarket The legal decision follows closely on the heels of the US unemployment report, due at 8:30 a.m. (UTC+8). According to Crypto Rover, the sequencing alone is enough to elevate risk. Bitcoin drops back below $90,000 (UTC+8) as markets brace for todays US unemployment report and the Supreme Court ruling on tariffs, he wrote, warning that the next 24 hours could be extremely volatile. Bulls Defend Below, Bears Cap Above: Heres Where Buyers and Sellers Could Act On-chain data from Glassnode shows that bulls are firmly positioned at $87,094 (UTC+8), where a large volume of Bitcoin last changed hands. Holders at this level are sitting comfortably in profit, reducing their incentive to sell and making the zone a natural support area rather than an aggressive buying level. Bitcoin Realized Price Distribution for Bulls. Source: Glassnode. If price pulls back, this is the first region expected to absorb selling pressure. Below that, $84,459 (UTC+8) represents a secondary bull fallback, where deeper cost-basis support exists if the higher level fails. On the upside, resistance begins at $90,880 (UTC+8). Here, many holders are sitting near breakeven, creating conditions for distribution as price rallies into the zone. Glassnode data shows even heavier resistance clustered around $92,143 (UTC+8), backed by a large concentration of underwater supply that could intensify selling pressure. Bitcoin Realized Price Distribution for Bears. Source: Glassnode. Until bulls can reclaim $90,880 (UTC+8) decisively, bears retain tactical control of the upside. Volume Profile Confirms the Standoff TradingViews Volume Profile mirrors the same picture. Aggressive buying is concentrated between roughly $89,800 (UTC+8) and $90,300 (UTC+8), marking bulls short-term line of defense (shown with green horizontal bars). In contrast, repeated selling pressure emerges between $91,200 (UTC+8) and $92,000 (UTC+8), where bears have consistently capped upside attempts (red horizontal bars). Bitcoin (BTC) Price Performance. Source: TradingView The result is a textbook compression structure, where price is squeezed between demand below and supply above, with volatility suppressed not by calm, but by balance. With Bitcoin wedged between bull-held support and bear-controlled resistance, the market is effectively waiting for permission to move. A clean break above $92,000 (UTC+8) could force bears to cover and trigger momentum expansion. A loss of the $89,500 (UTC+8)$90,000 (UTC+8) region, however, would expose the market to a deeper retracement toward the high-$80,000s. The Supreme Court ruling stands as the most immediate catalyst capable of breaking the deadlock, with bulls and bears remaining locked in place, waiting to see which side the macro winds will favor. Read the article at BeInCrypto

0

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Are war bonds the solution to Britain’s defense challenges?

101 finance•2026/01/17 12:06

Zero Knowledge Proof Introduces $500,000 Rewards for Early Adopters! XRP Holds at $2 & Stellar Eyes $0.33

Coinomedia•2026/01/17 12:06

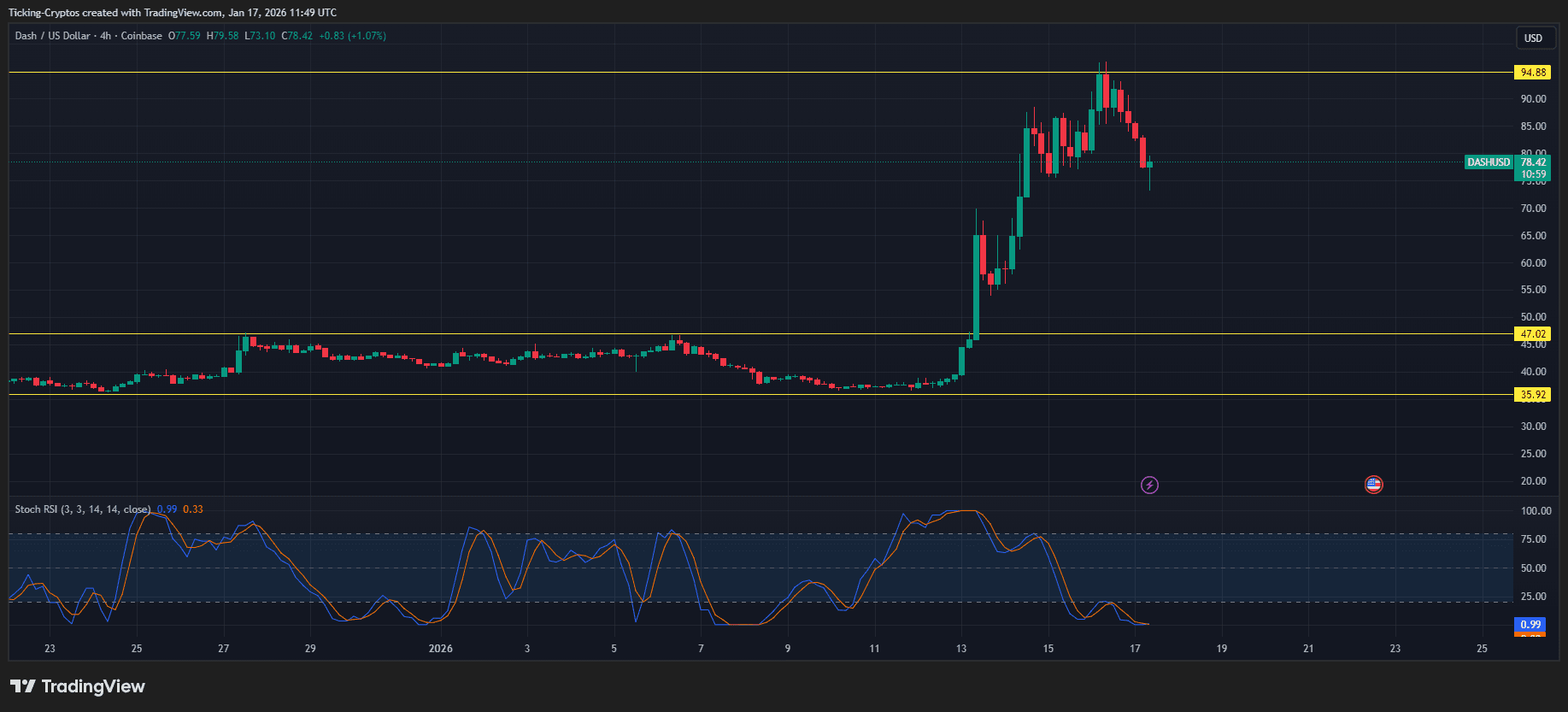

Why is Dash Coin Up 90%? DASH Price Prediction for 2026

Cryptoticker•2026/01/17 12:03

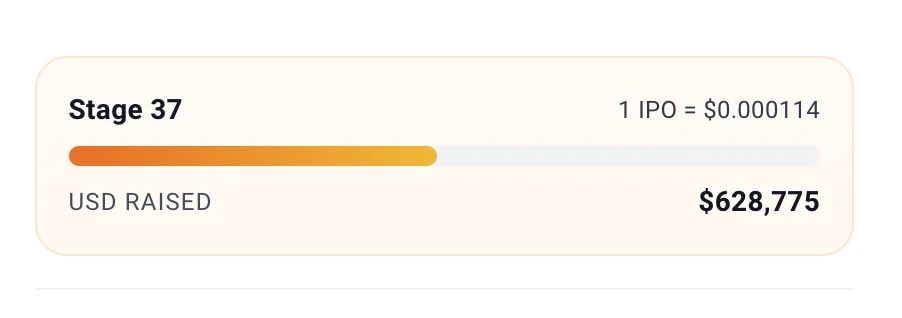

Banking Crypto Presale Crushes $4M Raised: Digitap ($TAP) vs. BlockDAG ($BDAG) vs. IPO Genie ($IPO)

BlockchainReporter•2026/01/17 12:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,261.8

-0.18%

Ethereum

ETH

$3,301.75

+0.00%

Tether USDt

USDT

$0.9995

-0.00%

BNB

BNB

$942.63

+0.78%

XRP

XRP

$2.06

-0.15%

Solana

SOL

$143.89

+0.40%

USDC

USDC

$0.9997

-0.02%

TRON

TRX

$0.3128

+1.45%

Dogecoin

DOGE

$0.1376

+0.01%

Cardano

ADA

$0.3951

+0.78%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now