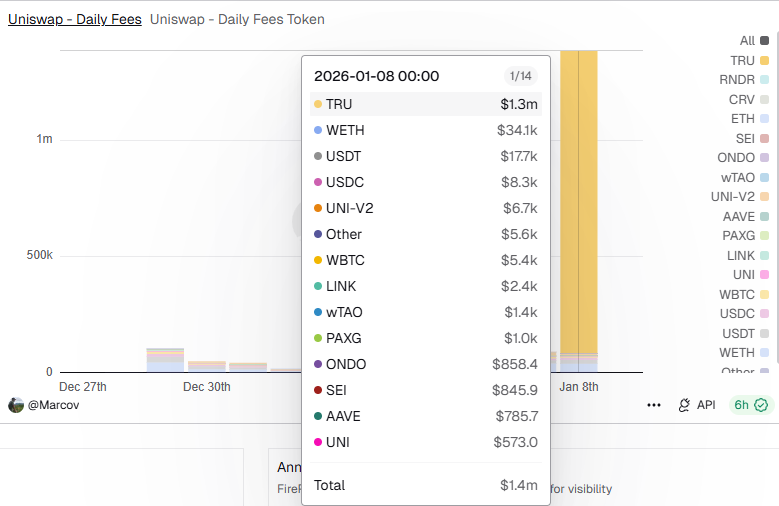

The Uniswap (UNI) daily fee revenue surged to a record $1.4 million, catalyzed by the Truebit Protocol (TRU) hack. The daily average trading activity for TRU surged by over 43% to $83k, according to market data from , thus contributing nearly 90% of Uniswap’s record fee revenue.

According to onchain sleuths led by PerkShield, Truebit Protocol was attacked and 8.5K Ethereum (ETH), valued at around $26.6 million, was stolen from its liquidity pool. Following the attack, investors’ confidence in the Truebit Protocol crashed, leading to a 100% dump in the TRU price over the past 24 hours.

With the TRU token heavily traded on Uniswap across multiple pairs, the DEX benefited significantly from investors’ stampedes to sell this altcoin. According to market data analysis from Dune Analytics, Uniswap collected about $1.3 million in daily fees from the TRU token, even higher than Wrapped ETH (WETH) and Tether USDT.

Source:

Source:

Currently, the Truebit Protocol team is still investigating the attack in collaboration with law enforcement, as the attacker holds the stolen funds in two different wallets.

(adsbygoogle = window.adsbygoogle || []).push({});The Uniswap Protocol has significantly benefited from the rising adoption of digital assets. Last year, the Uniswap DEX reported around $1 trillion in trading volume, an exponential gain from below $250 billion during Q1 2025. The Uniswap protocol is well-positioned for 2026, with rising altcoin adoption and anticipated U.S. regulatory clarity via the CLARITY Act set to boost trading and revenue.

The Truebit attack highlights ongoing risks in DeFi protocols. While Uniswap saw a notable increase in fee revenue due to high TRU trading volume, investors in TRU experienced significant losses. Both retail and institutional participants should continue to monitor protocol security and adopt risk management practices.

Related: Uniswap Burns 100 Million UNI Tokens as Fee-Burning Upgrade Goes Live