Healthcare dealmakers head to San Francisco hoping for megamergers in 2026

By Sabrina Valle

NEW YORK, Jan 9 (Reuters) - Healthcare dealmakers are heading to San Francisco this weekend betting on a new wave of mega-mergers in 2026 that could eclipse the industry’s standout years of 2019 and 2021 when such tie-ups approached half a trillion dollars, according to more than a dozen top bankers and lawyers.

Ahead of the week-long 43rd annual J.P. Morgan Healthcare Conference, dealmakers said more forgiving antitrust scrutiny under U.S. President Donald Trump has given large pharmaceutical companies confidence to consider acquisitions worth $30 billion or even merging with equally big companies.

Fresh industry agreements with the White House on tariffs and drug prices are also helping, they said.

"Across a number of different industries, we have seen deals get approved in the last year that could have had more regulatory risk in the past," said Jeremy Meilman, global co-head of healthcare investment banking at JPMorgan. "So that has made people dust off the playbook on the art of the possible."

That is a sharp contrast in sentiment to 2024 when there wasn't a single biopharma deal worth more than $5 billion, and marks a rise in activity from last year, when several transactions exceeded $10 billion, according to LSEG.

SETTING THE TONE FOR DEALMAKING

The run-up to the annual gathering, which pulls thousands of investors, bankers, lawyers and companies into San Francisco, often sets the tone for healthcare dealmaking for the year with deals getting announced at and around the meetings.

Eli Lilly announced plans Wednesday to buy Ventyx Biosciences for $1.2 billion.

Speculation that AbbVie was close to buying Revolution Medicines ahead of the conference and that Merck was also interested, lifted the cancer‑drug developer’s market value by 34% to about $20 billion — even though AbbVie denied the talks and the company remains six months away from clinical trial results that are key for its valuation.

CEOs are running models to test how their portfolios would look under transformational deals, anticipating a potential window to win regulatory approval through 2026, before the U.S. midterm elections could reshape Washington.

Several transformational deals are being considered and should be discussed in side meetings, and even some merger-of-equals scenarios are being explored—if only to conclude they are not the best move and let discussions drop, people said.

The administration's "interventionist tendencies may provide an incentive for speed in M&A," PwC said in its 2026 outlook, with the first companies to reach agreements having an edge to get deals approved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero Knowledge Proof Secures AI and Enables Safe Decentralized Marketplaces for Monetizing Sensitive Data

Altcoin Market Sets Up for a Possible $1T Rotation — 5 Tokens Positioned for a 60% Breakout This Month

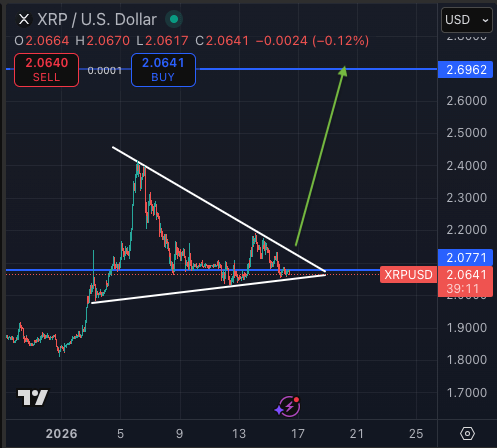

XRP Breakout Possible Before The Weekend, Expert Says

Crypto Market Review: Fake Bitcoin (BTC) Breakthrough; Shiba Inu (SHIB): Third Time's a Charm; XRP: 3 Price Waves