Nonfarm payrolls "soften" but the market remains calm—Is a "strange" divergence taking place?

Huitong Network, January 9th—— On Friday (January 9th), the U.S. Department of Labor released the December 2025 Nonfarm Payrolls Report. The data showed that 50,000 new jobs were created during the month, lower than the Wall Street economists’ consensus estimate of 73,000. Due to previous federal government shutdowns interrupting data collection, this is the first relatively complete labor market report in several months and has therefore attracted significant market attention.

On Friday (January 9th), the U.S. Department of Labor released the December 2025 Nonfarm Payrolls Report. The data showed that 50,000 new jobs were created during the month, below the Wall Street consensus of 73,000 and also weaker than the revised 56,000 for November. This marks a further slowdown in the U.S. labor market at the end of 2025, with a significant weakening in hiring demand throughout the year. However, the unemployment rate unexpectedly dropped to 4.4%, better than the expected 4.5%, providing some support for the market. Average hourly earnings increased by 0.3% month-on-month, in line with expectations; manufacturing employment fell by 8,000 while government employment increased by 13,000; the average weekly working hours stood at 34.2, slightly below expectations. Due to previous federal government shutdowns disrupting data collection, this is the first relatively complete labor market report in several months and thus has garnered high market attention.

Contrasts Between Market Expectations and Actual Data

Before the data release, market expectations were generally cautiously optimistic. Most analysts predicted December job growth would be between 60,000 and 70,000, partly based on the ADP private sector employment report showing 41,000 new jobs and initial jobless claims falling from an average of 227,000 in November to 217,000 in December, suggesting a possible mild recovery in labor demand. Institutional interpretations believed that the later Thanksgiving date may have dragged down November retail hiring but had a boosting effect of about 15,000 for December; weather factors might have had a slight negative impact on certain sectors. The market generally believed that if the data were strong, it would reinforce expectations for the Fed to pause rate cuts in January—prior to the data release, traders had already assessed the probability of a January rate cut as nearly zero.

However, the actual number of new jobs fell short of expectations, highlighting a “low hiring, low firing” pattern in the labor market, which was in contrast to the anticipated mild recovery and led to a quick adjustment in sentiment.

Immediate Reaction and Interpretation in Financial Markets

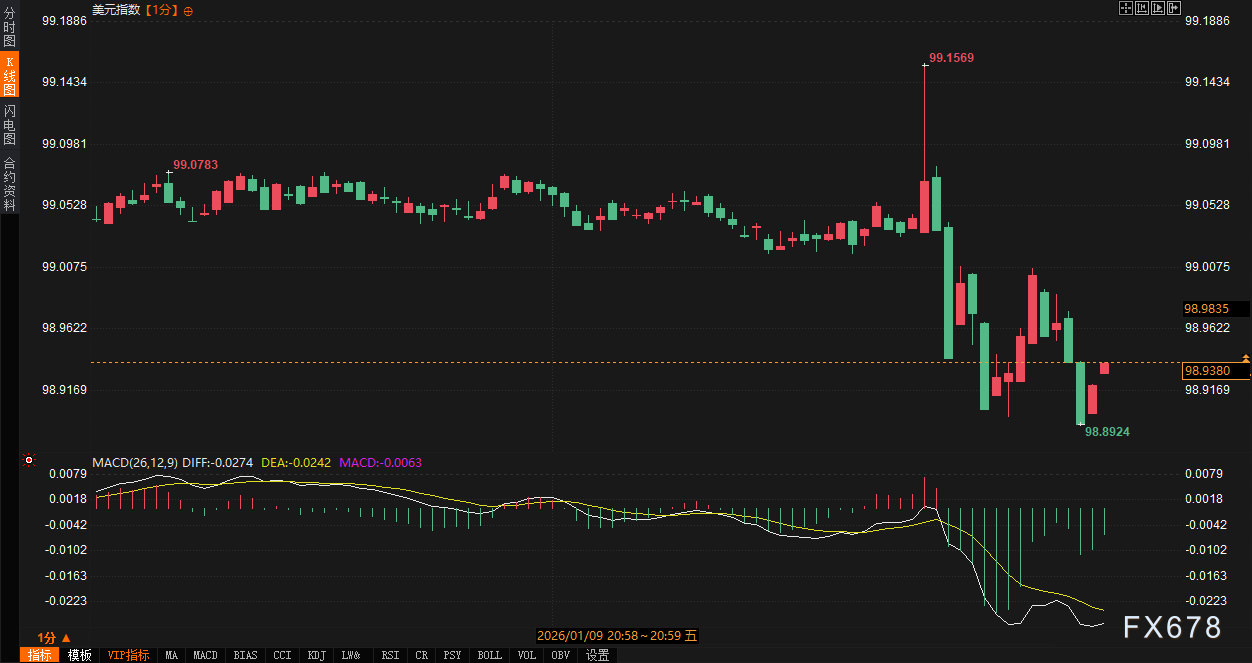

After the data release, financial markets reacted mildly but with divergent directions. The U.S. Dollar Index rose by 12 points in the short term before quickly retreating about 26 points. Spot gold dropped $14 before quickly rebounding about $30, reaching a peak of $4,491.46/oz. U.S. Treasury yields continued to rise, with the 10-year yield up 1.6 basis points to 4.195% and the 2-year yield up 3.6 basis points to 3.524%. The yield curve between the 2-year and 10-year Treasuries remained positive, indicating that market concerns about recession had eased and the yield curve was normalizing.

This trend contrasts with the background for all of 2025: last year, job growth continued to slow, with average monthly job gains far below the 2024 level, prompting the Fed to cut rates at its last three meetings, lowering rates to a three-year low of 3.5%-3.75%. After this data release, the market, while digesting weak employment, also found support from the low unemployment rate, thus avoiding drastic volatility.

Focus on Institutional and Retail Views

After the data release, institutions and retail investors quickly offered their interpretations, and sentiment was mixed.

Institutional analysis generally emphasized the structural contradictions in the data. One view pointed out, “Nonfarm added 50,000, below expectations, but the unemployment rate dropped to 4.4%, better than expected, indicating the labor market hasn’t collapsed but is stuck in a ‘no hiring, no firing’ mode.” Another institutional view stated, “The private sector only added 37,000, far below the expected 64,000, showing that companies are cautious about hiring, possibly affected by tariff rhetoric and increased AI investment,” but also noted that the low unemployment rate might prompt the Fed to keep rates unchanged at the January meeting.

Retail traders’ views were more varied. Some users expressed disappointment, saying “New job growth slammed on the brakes, far below expectations, and the signal of a hiring slowdown is clear”; others were relatively optimistic, noting “The 4.4% unemployment rate is a highlight, labor force participation rate remains stable at 62.4%, and economic resilience persists.” Some retail investors also noted, “The ADP report already hinted at weakness before the data release, but the actual improvement in the unemployment rate helped the market avoid a steep drop; focus should be on AI-driven productivity gains.” Overall, platform interpretations, after contrasting with the earlier optimistic expectations, highlighted both the shock of the data missing expectations and the cushioning effect brought by the improved unemployment rate, with market sentiment shifting from hopes of mild growth to a focus on structural issues.

Policy Expectations and Future Outlook

From the perspective of Fed policy, this report further reinforced the market’s judgment of short-term policy stability. Before and after the data release, traders’ expectations for a January rate cut remained extremely low. Although job growth was weak, the drop in unemployment and expected wage growth indicated mild inflation pressure and that the labor market had not deteriorated sharply. Institutional economists pointed out, “Labor market challenges are more structural than cyclical; tariff rhetoric and AI investment have suppressed hiring, but productivity grew at its fastest pace in two years in Q3, supporting jobless economic expansion.” This is consistent with the 2025 trend: the job market slowdown was once the main reason for Fed rate cuts, but the latest data does not provide enough evidence for further easing.

Looking ahead, the labor market in 2026 may gradually recover with support from low borrowing costs and potential tax cuts, but uncertainties remain. Job growth in 2025 was concentrated in education and healthcare, with overall demand slowing, but Q3 GDP grew at its fastest pace in two years, mainly due to resilient consumption and AI investment, laying a certain foundation for 2026. However, tariff rhetoric, geopolitical turmoil, and the substitution effect of AI on some jobs may intensify structural challenges. Consumer confidence has recently declined due to concerns about inflation and the employment outlook, but accelerated productivity growth suggests the economy has long-term health potential. The Fed may continue to assess cautiously, seeking a balance between growth and inflation.

Overall, the trend points to a moderate recovery, but close attention should be paid to whether hiring activity can break out of the “low hiring, low firing” pattern. In the short term, market sentiment has shifted from cautious optimism before the data release to neutral-to-cautious, and subsequent market trends will depend on the evolution of consumer spending, business investment, and inflation data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple and UC Berkeley Unveil UDAX to Scale XRP Ledger Startups

Nobody is truly interested in electric vehicles, asserts the executive from Vauxhall's parent company