Could your children become millionaires thanks to 'Trump accounts'? It's possible — if you use this approach.

New Government-Funded Investment Accounts for Children Launching Soon

Starting in July, parents will have the opportunity to open newly established, government-backed investment accounts for their children.

These so-called "Trump accounts," introduced as part of the One Big Beautiful Bill Act, are designed to help families build significant wealth for their children’s futures—especially if the funds are set aside for retirement decades down the line.

Key Details About the Accounts

Beginning July 5, families with children born between January 1, 2025, and December 31, 2028, can access these accounts, which come with an initial $1,000 government contribution. Parents or legal guardians will manage the accounts until the child turns 18. Annual contributions are initially limited to $5,000.

Trending on MarketWatch

How the Accounts Work

While further details are forthcoming—such as which financial institutions will oversee the accounts and what investment options will be available—experts are already discussing strategies to maximize long-term growth for children.

Christopher Gandy, president of the National Association of Insurance and Financial Advisors and founder of Legacy Wealth Group, described the initiative as a "gold rush for children’s futures."

Addressing Retirement Savings Gaps

Many Americans are not financially prepared for retirement, with Generation X workers holding a median of $107,000 in household retirement savings, according to a Transamerica Center for Retirement Studies report from December.

Unique Features of the New Accounts

These children’s accounts are similar to individual retirement accounts (IRAs) but come with notable differences: lower annual contribution limits, no requirement for contributions to come from earned income, and the option for employers or other private parties to contribute as well.

One powerful strategy involves converting the account to a Roth IRA when the child turns 18, allowing for tax-free withdrawals and no required minimum distributions later in life. Gandy believes that, if managed wisely, this could result in an unprecedented number of young millionaires.

Potential Growth Over Time

Consider this: With only the initial $1,000 government deposit and an average annual return of 8% (adjusted for inflation), the account could reach $4,000 in 18 years, $10,000 in 30 years, and $149,000 in 65 years.

Using a compound savings calculator, if an additional $500 is contributed each year for 65 years at the same rate of return, the account could surpass $1 million.

Not a Substitute for Other Savings Options

Experts caution that while these accounts can be a valuable part of a child’s long-term financial plan, they shouldn’t necessarily replace other savings vehicles.

For example, 529 plans offer tax advantages for education-related expenses, including college and K-12 tuition, and unused funds can be transferred to a Roth IRA (with a $35,000 lifetime cap and other restrictions).

“This isn’t a universal solution,” said Stephen Kates, a financial analyst at Bankrate. “It’s one tool among many for achieving your financial goals.”

Kates recommends that parents clarify their objectives before deciding where to allocate funds—whether to a Trump account, 529 plan, custodial account, or traditional savings account. “Think about your priorities and where your next dollar will have the greatest impact,” he advised.

If saving for college is the main goal, a 529 plan may be preferable due to higher contribution limits and tax-free withdrawals for qualified expenses. For those aiming to help with a child’s first car or home purchase, custodial accounts might be more suitable.

Additional Benefits and Considerations

The new accounts add flexibility to family investment strategies, functioning like retirement accounts without requiring earned income and allowing for eventual transfer to a Roth IRA for decades of tax-free growth. According to Ed Slott and Company, a financial firm specializing in IRAs, a Roth conversion at age 18 could enable substantial tax-free growth, with up to $5,000 per year (indexed from 2028) contributed by parents, grandparents, or others, even if the child has no earned income.

The IRS has released Notice 2025-68, providing preliminary guidance on these accounts. The special rules will expire when the child turns 18, after which standard IRA regulations—including contribution limits, Roth conversions, and early withdrawal penalties—will apply.

Experts note that more detailed rules and procedures are still forthcoming, including which institutions will manage the accounts, how investments will be selected, and how contributions from various sources will be handled.

Nonetheless, the program holds promise for young savers, offering the potential for lifelong, compounded, tax-free growth. As Gandy put it, “This could open up new opportunities for tax-free wealth accumulation for the next generation.”

Trending on MarketWatch

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

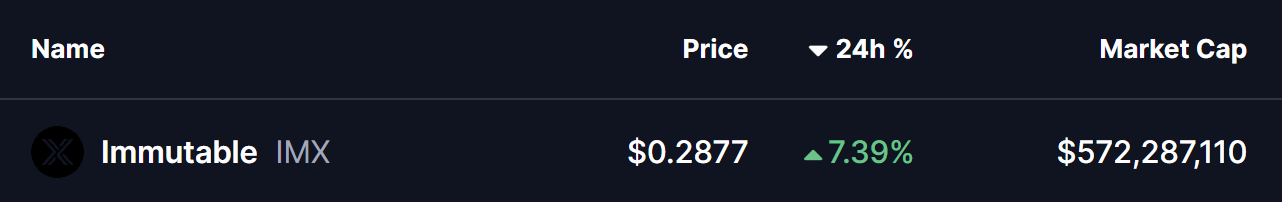

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside