Crypto Venture Capital Powerhouse Andreessen Horowitz Secures $15 Billion to Support America’s Success in the Technology Competition

Andreessen Horowitz Secures Over $15 Billion to Boost U.S. Tech Innovation

Andreessen Horowitz, also known as a16z and recognized as a leading venture capital firm in the United States, revealed on Friday that it has raised more than $15 billion through five distinct venture funds. This significant capital is aimed at advancing American technological progress.

According to co-founder Ben Horowitz, this fundraising effort accounts for over 18% of all venture capital raised in the U.S. for 2025.

Horowitz emphasized the firm's pivotal role in shaping the future of technology in America, stating, "As the nation's top venture capital firm, we share responsibility for the direction of new technologies in the U.S. Our goal is to ensure America leads the next century of innovation."

He further explained that this vision begins with dominating emerging fields such as artificial intelligence and cryptocurrency, and extends to applying these advancements in crucial sectors like healthcare, biology, defense, public safety, education, and entertainment to enhance human well-being.

The newly raised funds will be allocated to support American innovation, application development, health and biological sciences, infrastructure, growth initiatives, and other strategic ventures.

While the announcement did not specify a dedicated crypto fund, a16z crypto—the firm's digital asset division—has played a major role in some of the largest investments within the cryptocurrency industry in recent years. Their portfolio includes prominent names such as Coinbase, Solana, Uniswap, OpenSea, and Phantom, among others.

Over the past year, Andreessen Horowitz has participated in a $300 million fundraising round for prediction market Kalshi, invested $70 million in the Ethereum restaking platform EigenLayer, and supported the Solana-based DeFi protocol Jito through a token investment.

The firm's involvement in the crypto sector began in 2018, when it launched its first dedicated crypto fund with $350 million. Since then, a16z has established at least three additional crypto-focused funds, amassing over $7 billion for the industry.

This latest fundraising effort more than doubles the total amount previously raised for crypto, underscoring the firm's belief in the critical importance of American leadership in technology for the benefit of humanity.

Horowitz concluded, "No other nation offers the same opportunities for innovation and growth. Should America fall behind in technology, it risks losing its economic, military, geopolitical, and cultural standing—and the global community would suffer as a result."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

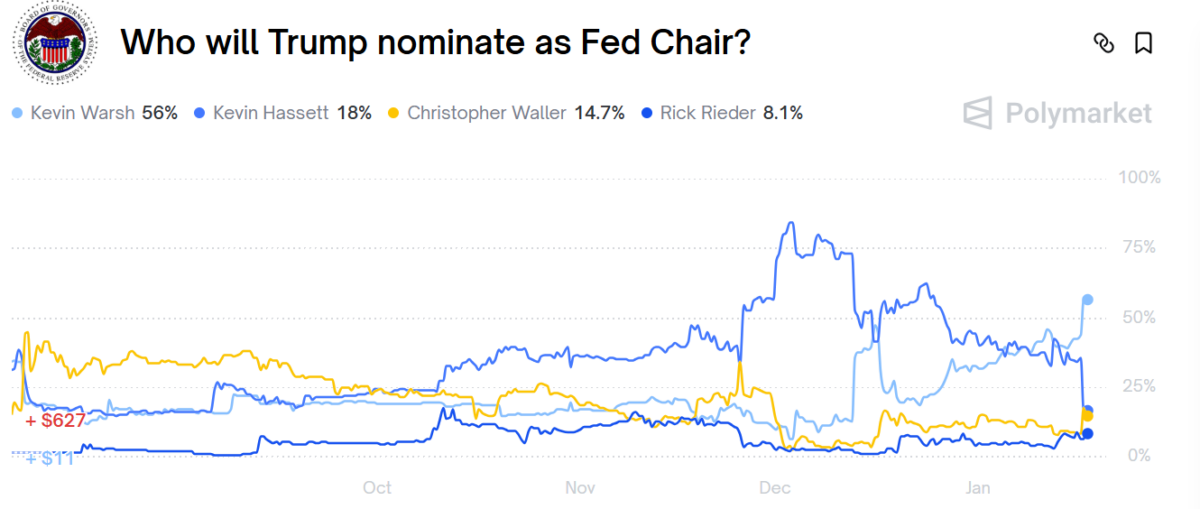

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA