Trump to Take Over Fed's Role in Managing Mortgage Rates? Bessent States: "Trump QE" Aims to Match Fed's "Quantitative Tightening"

In the face of persistently high housing costs, the Trump administration has bypassed the Federal Reserve and leveraged executive power to intervene in the mortgage market, attempting to "hedge" the Fed's balance sheet reduction by pushing down mortgage rates.

On January 9 local time, U.S. Treasury Secretary Bessent clarified the core logic of the Trump administration's latest round of financial intervention policy in an interview in Minnesota. He stated that the U.S. government has directed Fannie Mae and Freddie Mac to purchase mortgage-backed securities (MBS) with the goal of roughly matching the pace at which these bonds are flowing off the Fed's balance sheet.

Bessent pointed out that currently, about $15 billion in MBS mature each month at the Fed and are not reinvested (i.e., "balance sheet reduction"), causing the Fed's vast $6.3 trillion bond portfolio to hold progressively fewer MBS. He believes the Fed's operations are in fact exerting reverse pressure on the market, hindering further declines in mortgage rates. Therefore, the Trump administration's strategy is to use the purchasing power of the "GSEs" to fill the demand gap left by the central bank.

So I think,our idea is to roughly keep pace with the Fed, because the Fed has been moving in the opposite direction.

Previously, President Trump officially ordered the Federal Housing Finance Agency (FHFA), which regulates the "GSEs," to purchase $200 billion in MBS on Thursday. FHFA Director William Pulte confirmed on Friday that they had initiated the first round of $3 billion in purchases. The market interpreted this directive as an aggressive move by the White House to address the housing affordability crisis, while also markinga rare intervention of executive power in a financial market area traditionally dominated by the central bank.

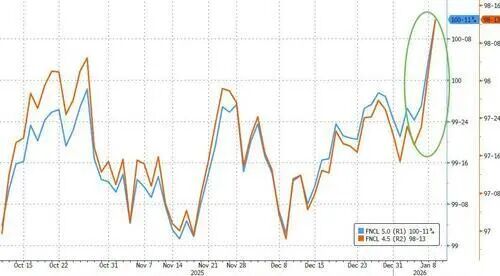

MBS Prices Surge, Mortgage Rates Expected to Drop by 0.25 Percentage Points

Since Trump announced the directive, the market has reacted sharply.

Trump's quantitative easing policy has caused mortgage-backed securities (MBS) prices to surge, with the market repricing rapidly.

The risk premium (spread) of MBS relative to U.S. Treasuries narrowed sharply by about 0.18 percentage points compared to Thursday's close. In the interview, Bessent acknowledged that although purchases funded by the GSEs' balance sheets are unlikely to directly pull down mortgage rates significantly, they can have an indirect effect by compressing the yield spread between MBS and Treasuries.

Analysts point out thatwhile the $200 billion purchase size seems modest compared to the Fed's multi-trillion dollar quantitative easing (QE) programs, it is still sufficient to exert substantial pressure on the market.According to analysts cited by Bloomberg,this move could lower mortgage rates by as much as 0.25 percentage points.Currently, the average 30-year fixed mortgage rate in the U.S. has dropped from nearly 8% in 2024 to around 6.2%, still well above the 3% seen during the pandemic.

Rob Zimmer, director of external affairs at the Community Home Lenders of America, said the policy will benefit first-time homebuyers, as young buyers have long been penalized by the high spread between mortgage funding costs and 10-year Treasury prices.

Executive Intervention Raises Concerns Over "Fed Independence"

Although the injection of liquidity is welcomed by the market, there are divisions within the investment community on the long-term impact of this policy, with debate over the Fed's role becoming increasingly heated.

Generally, regulating interest rates across the broader economy has always been the Fed's responsibility.The Fed's design was precisely to shield it from political interference.Besides setting short-term borrowing costs, the central bank sometimes intervenes by making large purchases of Treasuries and mortgage-backed securities (MBS), but this is usually limited to specific circumstances such as restoring liquidity to stressed markets or providing stimulus during severe economic downturns.

Baird & Co. strategist Kirill Krylov warned in a report to clients that Trump's directive blurs the line between market-driven utility and political manipulation. He argued that purchasing assets explicitly to manipulate mortgage rates reintroduces political risk into a market that has strived to avoid such practices for more than a decade.

Jeffrey Gordon, co-director of the Center for Global Markets and Corporate Ownership at Columbia Law School, pointed out that while these purchases may be justified under the guise of "housing affordability," which is technically outside the Fed's mandate, the mortgage market is closely linked to overall interest rate policy. Such executive actions, equivalent to disguised monetary policy, set a new precedent and are undermining the Fed's independence.

In fact, the Fed currently holds a little over $2 trillion in MBS, a legacy from past crises used to stimulate the economy. However, this holding has been shrinking at a pace of $15 billion to $17 billion a month for more than two years. The Trump administration's move is seen as a new front after public pressure on the Fed to cut rates failed, suggesting that if monetary policy does not quickly align with executive goals, the White House is willing to act unilaterally.

Privatization Prospects for the "GSEs" Become More Uncertain

This policy also makes the future direction of Fannie Mae and Freddie Mac more uncertain. The Trump team had previously discussed re-privatizing these two companies, which were taken over by the government during the 2008 financial crisis. Bessent insisted the purchase action would not harm the financial condition of the "GSEs," claiming both companies have ample cash and the move might even increase their earnings.

However, Vitaliy Liberman, portfolio manager at DoubleLine Capital, pointed out that the market previously thought an IPO would mean the government would fully return them to the public through a public offering, but now the signal suggests this may not occur. The government has realized that the "GSEs" are important policy tools; once fully released to the free market, the government would lose this control.

Strategists at J.P. Morgan also believe that the government's desire to use government-sponsored enterprises (GSEs) as policy levers fundamentally conflicts with the traditional expectations of private investors. Clearly, there is an irreconcilable contradiction between current target interest rates and the future profitability of the "GSEs."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wing plans to introduce drone delivery services at an additional 150 Walmart locations

Google unveils new agentic commerce protocol for retailers

Magnificent 7’s Grip on the Stock Market Begins to Weaken

Best Crypto to Buy Now: Bitcoin Slips After Jobless Claims Surprise as Tapzi and SUI Draw Investor Attention