Adult offspring are eager to receive their inheritance immediately. However, they might need to be patient.

Generational Divide Over Inheritance Conversations

Many American adults believe they are prepared to handle their future inheritance, but their parents often see things differently.

Recent findings from Fidelity Investments highlight a significant disconnect between generations when it comes to estate planning. Older parents frequently hesitate to disclose details about the assets their children will one day receive, doubting whether their heirs are ready to take on such responsibilities.

The financial sector is closely watching what’s being called the Great Wealth Transfer, with projections that $84 trillion will move from older Americans to their descendants by 2045.

Despite this massive transfer of wealth, many affluent seniors are reluctant to discuss their estate plans with their children. Some feel their families are not prepared for such discussions, while others simply find the subject uncomfortable.

“Discussing finances and mortality is inherently awkward,” explained Cody Molacek, a financial planner at Freedom Wealth Advisors. “People keep waiting for the right time to bring it up, but that moment rarely comes.”

According to Fidelity’s 2025 Family and Finance Study, which surveyed families with at least $500,000 in investable assets, nearly all Americans agree that estate planning discussions are important. Yet, these conversations are often avoided.

There is frequent disagreement between older and younger generations regarding inheritance matters.

Parents Keep Inheritance Details Under Wraps

About two-thirds of parents have not informed their adult children about any inheritance they may receive, nor have they disclosed the potential amounts. Half of parents have never shared their net worth with their children.

In contrast, over half of adult children express a desire to know what they might inherit.

While 95% of adult children claim they are ready to manage inherited wealth, a quarter of parents remain unconvinced of their readiness.

Experts suggest that baby boomer parents’ reluctance to discuss finances may be a pattern inherited from their own parents.

“Many in the older generation lived through the Great Depression, so they tend to be secretive about their finances,” noted Ryan Viktorin, a vice president and financial consultant at Fidelity.

Parents often worry about their children’s financial skills. The Fidelity report found that two out of five parents lack confidence in their children’s ability to handle debt, and a similar number doubt their children can maintain a budget.

Letting Children Learn Financial Responsibility

Some wealthy families prefer that their children develop financial independence before managing inherited assets.

“They hope their children and grandchildren will forge their own paths, overcome challenges, and learn to handle money wisely,” Molacek added.

The timing of inheritance discussions is a point of contention between generations.

Different Views on Passing Down Wealth

Other studies echo this generational split. In the 2025 Planning & Progress Study by Northwestern Mutual, 74% of millennials believe it’s crucial to leave something for the next generation, compared to just 47% of baby boomers.

A 2024 Charles Schwab survey found that many younger wealthy Americans want to transfer assets to their heirs while still alive, whereas most boomers prefer to wait until after their passing.

In that survey, 53% of millennials said they want their heirs to benefit from their wealth during their lifetime, but only 21% of boomers agreed.

Discussing estate plans with adult children can help ensure everything is organized and clear.

Why Estate Planning Talks Shouldn’t Be Delayed

Although many older parents hesitate to discuss finances and mortality with their children, financial planners warn that avoiding these conversations can leave heirs struggling to sort out assets and debts after a parent’s death.

“It’s wise for parents to at least provide an overview of their estate plan,” advised Zaneilia Harris, a financial planner based in Washington, D.C. “Awareness is key.”

Sharing your estate plan doesn’t require revealing every account balance. Instead, it’s an opportunity to explain your assets, investment choices, and your intentions for them—offering a chance to communicate your values.

“This isn’t a conversation you have just once,” Harris said. “Ideally, as parents age, these discussions should happen every year.”

Viktorin added that talking about your estate plan can also prompt you to get your financial affairs in order before involving your heirs.

Harris recommends including a financial advisor in these discussions. An advisor can act as a neutral party and help keep the conversation focused, rather than letting it devolve into disputes over inheritance details.

“Arrange the discussion in a way that feels comfortable for everyone,” Harris suggested. “Having an impartial third party is always beneficial.”

Originally published by USA TODAY: 'Where's my inheritance?' Boomer parents aren't telling.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto makes inroads into US real estate as Megatel, Newrez clear hurdles for payments, rewards token

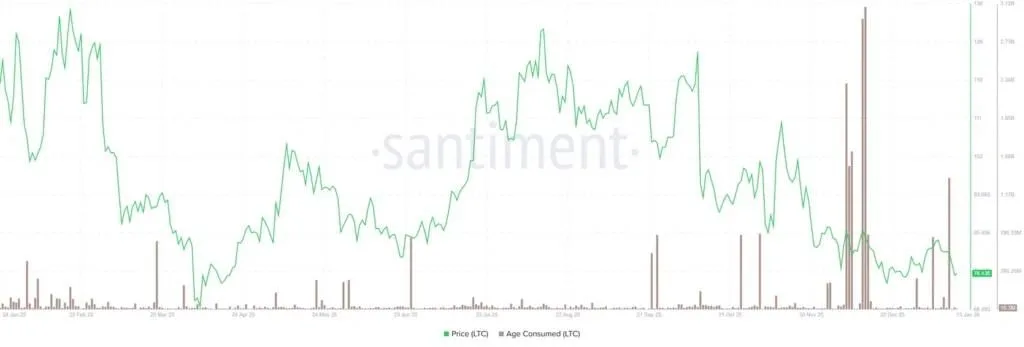

Litecoin Price Prediction: Will LTC Hold Key $72 Support?

Analysts Bullish On BlockDAG Hitting $1 in 2026 – Why It’s The Best Crypto To Buy Before Launch

FAA de EEUU advierte a aerolíneas sobre posibles acciones militares en Centroamérica y Sudamérica