HELOC and home equity loan interest rates for Saturday, January 10, 2026: See how your top offer stacks up against these rates

Current Trends in HELOC and Home Equity Loan Rates

Across the nation, average rates for both HELOCs and lump-sum home equity loans have edged closer to 7%. Rates for second mortgages are now at their lowest point in recent years.

Latest HELOC and Home Equity Loan Rates (as of Saturday, January 10, 2026)

Data from Curinos shows that the average HELOC rate has dropped to 7.25%, a decrease of 19 basis points over the past month. Meanwhile, the average rate for a home equity loan stands at 7.56%, down by three basis points.

These averages are calculated for borrowers with a credit score of at least 780 and a combined loan-to-value ratio (CLTV) below 70%.

The Federal Reserve estimates that homeowners collectively have $36 trillion in home equity. With mortgage rates remaining high, many homeowners with favorable primary mortgage rates may feel unable to tap into their increasing equity. In such cases, a second mortgage—such as a HELOC or home equity loan—can offer a practical way to access those funds.

Understanding HELOC and Home Equity Loan Interest Rates

Rates for home equity products differ from those for primary mortgages. Second mortgage rates are typically calculated by adding a margin to an index rate, most often the prime rate, which recently dropped to 6.75%. For example, if a lender adds a 0.75% margin, the resulting HELOC rate would be 7.50%.

Home equity loans, on the other hand, usually have a fixed interest rate and may feature a different margin than HELOCs.

Lenders have considerable discretion in setting rates for second mortgages like HELOCs and home equity loans. Your rate will be influenced by your credit score, existing debt, and the ratio of your credit line to your home's value. Comparing offers from multiple lenders is essential.

It's important to note that average HELOC rates may include introductory offers that last only six to twelve months. After this period, the rate typically becomes variable and may increase.

In contrast, fixed-rate home equity loans rarely feature temporary "teaser" rates.

Introductory Rates: What to Know

The top HELOC providers typically offer competitive fees, options for fixed rates, and sizable credit lines. With a HELOC, you can access your home equity as needed, up to your approved limit—borrow, repay, and borrow again as your needs change.

Seek out lenders with attractive introductory rates. For instance, FourLeaf Credit Union currently advertises a 5.99% APR for the first 12 months on lines up to $500,000, after which the rate becomes variable. Be sure to review both the introductory and ongoing rates when comparing lenders.

Also, check the minimum draw requirement, which is the smallest amount you must initially borrow from your HELOC.

Finding the best home equity loan lenders may be simpler, as the fixed rate remains unchanged throughout the repayment period. With a lump-sum loan, you don't need to worry about minimum draws.

Always compare lender fees and carefully review the repayment terms before committing.

Frequently Asked Questions About HELOC Rates

What is considered a competitive HELOC rate right now?

Interest rates can differ widely depending on the lender and your location, ranging from about 6% up to 18%. Your personal credit profile and how thoroughly you compare offers will impact your rate. The current national averages are 7.25% for HELOCs and 7.56% for home equity loans.

Is now a good time to apply for a HELOC?

If you have a low-rate primary mortgage and substantial home equity, this could be an ideal time to consider a HELOC or home equity loan. This allows you to keep your favorable mortgage rate while accessing funds for renovations, repairs, or other expenses.

How much would the monthly payment be on a $50,000 HELOC?

Withdrawing $50,000 at a 7.50% interest rate would result in a monthly payment of approximately $313 during the 10-year draw period. However, keep in mind that HELOC rates are usually variable, so your payment could rise during the 20-year repayment phase. In total, a HELOC can function as a 30-year loan, but it's generally best to pay off the balance sooner if possible.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

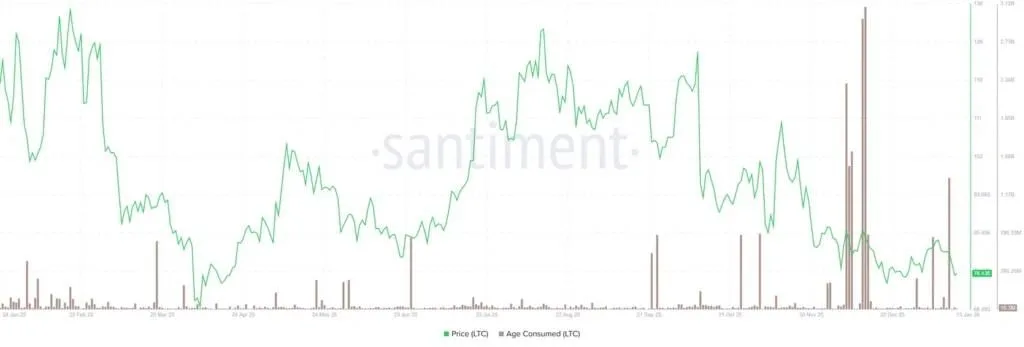

Litecoin Price Prediction: Will LTC Hold Key $72 Support?

Analysts Bullish On BlockDAG Hitting $1 in 2026 – Why It’s The Best Crypto To Buy Before Launch

FAA de EEUU advierte a aerolíneas sobre posibles acciones militares en Centroamérica y Sudamérica

Trump administration urges tech firms to purchase $15 billion in power plants they might never operate